Hello and welcome back. In this month’s update, I will reflect on my two years as a blogger and tell you about some changes to my investment strategy and my monthly returns. Also, I celebrate a huge milestone.

The UK has been steadily improving in terms of Covid. With our world-leading vaccination programme, we can smell the freedom returning. The weather is getting better, and we are all excited for our release on parole.

Scotland beat France in a thrilling finale to the Six nations. Now let’s see if Warren Gatland can recognise the quality in our team for the Lions selections. I live in hope. But I digress…

Two Years of Blogging

When I started blogging two years ago, it felt new and fresh. I was full of excitement for FIRE, and I duly proceeded to write about my experiences. I’m still excited about FIRE and still like writing on this blog.

I would get ever so excited about the five people a month that visited my site in the beginning. It started mainly about paying down my ridiculous debts. I’d think, “Wow!, five people wanted to read this”. Now I’m at around 5000 people a month. I can hardly believe it. I still don’t make a penny from this site. I’ve just signed up to Google Adsense so lets see how that goes. However, I do view the money I save as being directly correlated to the blog. That’s because I maintain discipline in my finances due to blogging. So it’s been very positive, and I’ve met many like-minded people in the process.

Investment strategy change

I have made several investment changes this month. You can check out my thoughts in this blog post.

However, the long and short of it is I’ve sold most of my VUKE and replaced it with VWRL.

And I bought some Bitcoin. £1000 worth (or £956 with the fee Coinbase charge – ouch!). Luckily I’m already in the green. I’m expecting a rollercoaster, though.

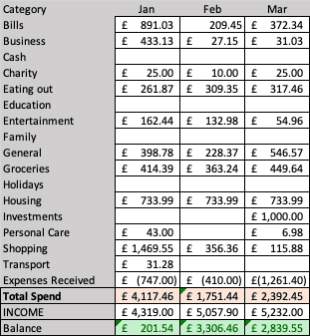

Spending

Spending this month has been down MASSIVELY. That’s because there was nothing to do and nothing to spend on. I also gave up booze for the month, so that reduced spending too.

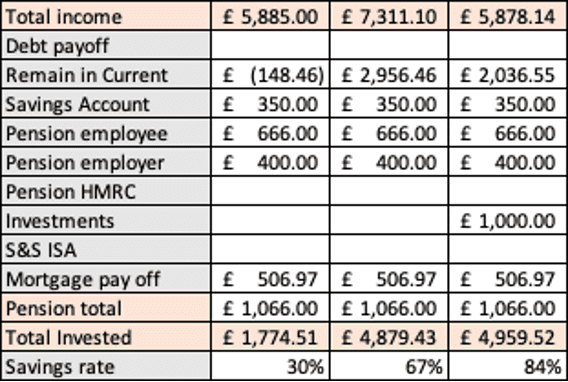

In addition to the dull month, add some repayment of incurred business expenses to the mix, and my savings rate went up to 84%. Yes, I couldn’t believe it either. But that is the case.

Savings

Savings rate is a crazy 84% this month. That is down to me doing nothing all month.

It’s a lovely position in which I find myself.

Car

I’m still saving for a car as I miss having mobility, and post covid, I don’t want to use public transport if possible.

My current thinking is to save 50% of the cars price and borrow the rest on a 0% finance deal with a credit card. Then smash the debt payments for that. That way, I get to keep more in the markets, which will keep compounding. Yes, I would save less, but I’m at the point where I have my emergency fund, and I’m doing ok.

Yes, it will put my FIRE journey behind slightly, but I want to live a little, and after one year of not living, I now value this much more. I will also not accept driving the stereotypical dull and old car. It must be fast and/or fun to drive. It won’t be brand new, but it will probably have to be post-2015 as I live in London and the pollution charge is coming in later this year.

Investment update

So the BIG NEWS!

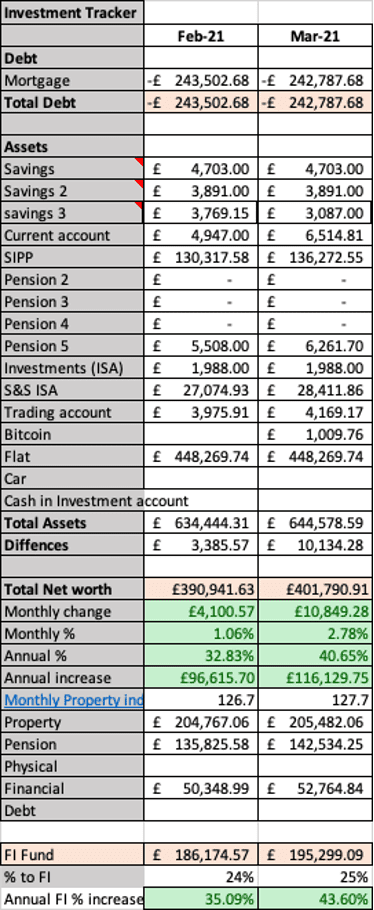

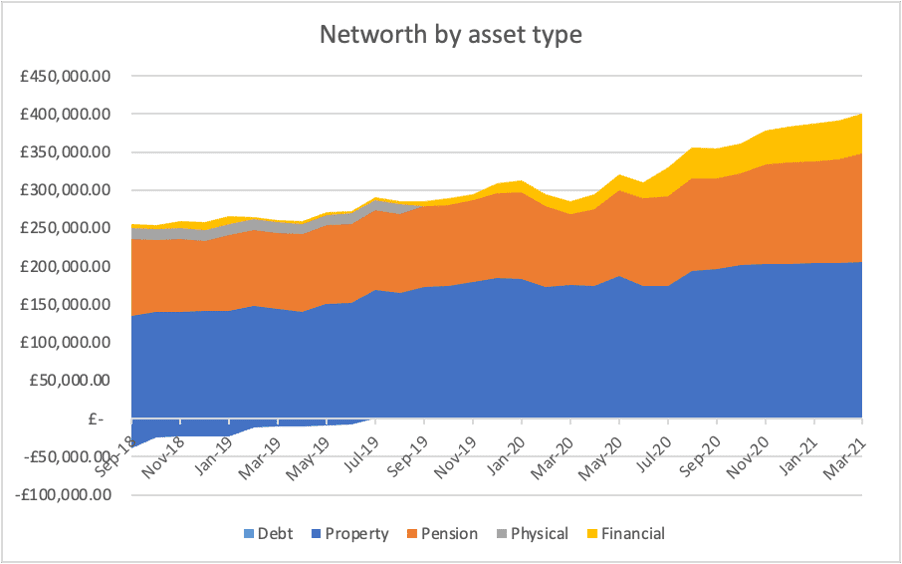

I have passed £400,000 net-worth!!

I’m surprised and pleased at the same time. I’ve been close for a while, but now it’s official. I crossed that boundary.

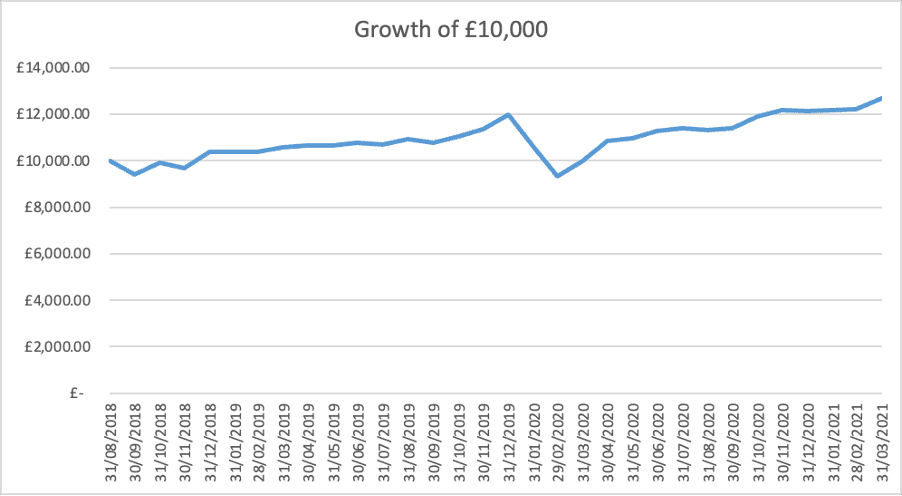

A good month in the markets and also ditching my sluggish VUKE has powered me through that goal. I’m up £10,849.28 for the month. And an insane £116,129 since this time last year.

The annual gain is basically because the markets were at their low point following the lockdowns. If I’d had any spare cash back then, it would be worth about 30% more (I didn’t because I was made redundant!). It’s also because I’ve been socking away a large portion of my income consistently ever since. Lockdown has helped, but it’s the discipline that makes it possible.

You need the capital in the first place to get any growth from it. A high savings rate gives you the money to invest. Rinse repeat. My increases are now greater than my annual salary for the year. I’m hoping it will accelerate from here.

Here is the pure investment growth of my portfolio. You can see the significant dip around one year ago.

My Tesla shares crashed big time this month. Currently, they are down about 8%. It’s disappointing, but I’m going to hold for the long term. I bought with a 5-year valuation in mind. I like hearing the valuation from Ark fund, although this could be totally over-egged.

I’ve been holding cash until the new ISA opening deadline passed as I’ve maxed mine for the 2020-21 tax year. I am also saving money for the car.

That brings me to the end of this months update… thanks for reading!

If you live in central London, why do you want to own a car? Buy yourself a really nice e-bike instead, and hire a car when you want to use one. The e-bike will probably get you around faster most of the time (and be better for your health, I recommend reading Peter Walker’s _The Miracle Pill: Why a sedentary world is getting it all wrong_ on this) and you’ll be able to drive a nicer car.