Investing a Lump Sum Redundancy Payout. Make the best of a bad lot.

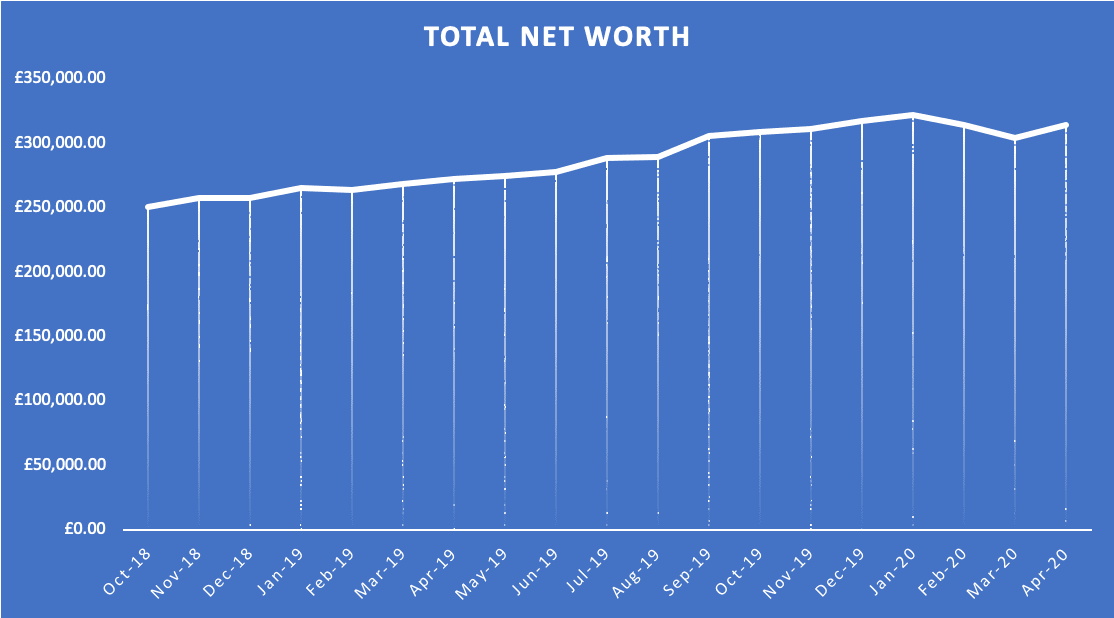

In my article, I detail my decision process on investing a lump sum redundancy payout. I was fortunate to get a new job shortly after getting the payout, so I didn’t technically need the money. With a full emergency fund … Continue reading Investing a Lump Sum Redundancy Payout. Make the best of a bad lot.