2024 seemed to be gone in a flash. Here is my annual review.

Highlights

2024 was a year filled with highlights. I shall list them below:

- Travelling to Australia, Spain (Valencia & Barcelona), Scotland, Ireland, New York, Vietnam.

- Remaining sober for two years.

- New job.

- Record increase in investment returns.

We’ve had a great year, and we have been busy doing other fun things too. Work has been great but very busy. I’m progressing quite rapidly, and this can only be down to not drinking and performing much better than before. Big trips to Australia, the USA, and Vietnam made the year extra special. Spending time with friends and family is great.

We also went on some more local adventures to the Lake District which were fantastic ways to spend a weekend.

In terms of finances, we have the following wins:

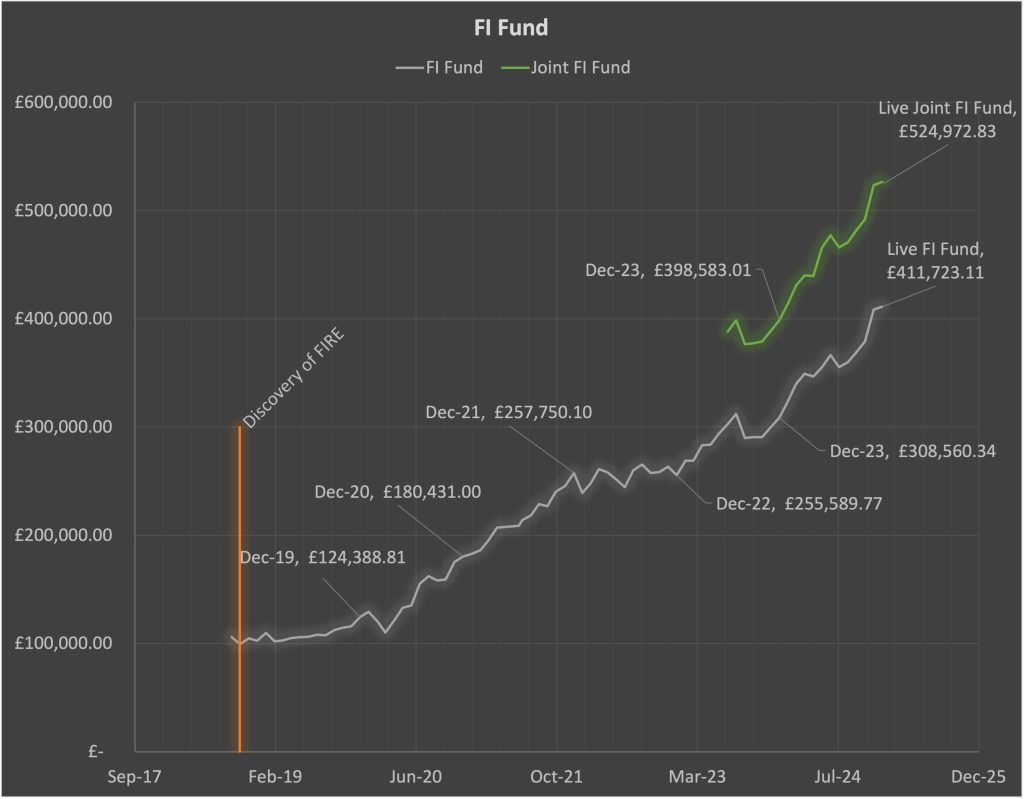

FI fund growing from £398k to £526K, an increase of £128K (+32%). Note there has been a slight drop in the markets until today (live value).

Our net worth grew from £626K to £759K, an increase of £133k (+21.2%). This is a record for me by a country mile. I am very pleased about this.

The total returns for the year were 25.3%. This is thanks to the massive growth of the S&P500 and NASDAQ. I’m beyond happy with this if not slightly wary that we could be in a bubble. It’s too easy to think “What if I’d gone all in on NVIDIA?” and other mad thoughts. Of course, I’d have a much better return, but this is still a record high increase for me.

| Portfolio return as of | 31 Dec 2024 |

| 1 month | 0.0% |

| 3 months | 8.4% |

| 6 months | 8.6% |

| YTD | 25.3% |

| 1 year | 25.3% |

| 3 years* | 8.9% |

| 5 years* | 9.6% |

Lowlights

As in all years, 2024 wasn’t all holidays and fun but I felt it was pretty good on average with no really bad things happening. Especially compared to 2023 which was very depressing for us in some ways.

I am very unhappy about the amount I have invested into my ISA this year. Even though I have saved 41% of my income, this was not into the ISA. Since May we seem to have had expense after expense. Some expected and others not.

Spending

Spending this year was significantly higher than 2023. I have been able to put this down to a few things. Firstly, my increased mortgage costs thanks to the higher interest rates. This was £4,800. Literally money for nothing.

I also had to make some payments to my building’s service charge after not paying for a few years. These charges were in dispute in court and although we didn’t win on all accounts, we got some charges lifted. I had to pay £3,200 at the end of the year. This was technically including my heating and hot water as the building has a communal system. So I effectively deferred paying this due to the other unlawful charges on the service charge. So this artificially reduced my spending in previous years by a few thousand pounds. I guess I benefitted from investing that money and they didn’t charge us interest on what I owed for some reason.

I have also taken to renting a garage at my building. This is a bit of a luxury, but it has given us more space and lets me easily run my car as I can store stuff there. Not sure if its good value but it’s another £2,000 per year of spending. I think the well being from having a less cluttered flat is good and it also reduces the desire to try and move to a bigger place which would cost significantly more than £2000/yr.

My car is also a major expense that I have chosen to take on. I am fine with that. It’s costing about £12k per year including payments, insurance, fuel, tax and servicing. It’s also my dream car so this is very much a heart over head mid life crisis thing that I don’t regret. We have gotten good use of it this year and the plan is to use it for adventure and holidays. So could I move some of this cost to my holiday budget? LOL.

Our travel habit got a bit out of hand this year too. We spent quite a bit more than I feel comfortable with. £14,000 between us. I’m kind of shocked by this figure. It does include a trip next year so I probably shouldn’t include it in the 2024 figures but I spent the money in 2024 so I think it should be. Having said that I have visited 4 continents this year and had some top life experiences. I won’t remember the price of the holiday next year but I will remember the time spent with friends and family in a cool location.

We also jointly spent about £10,000 on renovating the flat with new floors and redecoration. We also had to buy a new washer/dryer (£800). This was well worth the money and I’m also fine with that.

I’m slightly concerned that spending has risen so much this year but I’m also aware that some of these costs were one-offs. I did deliberately decide to increase my spending because I wanted to seize the day and do things I want to do like regular hiking trips and trips abroad. However, I may have gone too far. Thankfully my pay rise has really made this not a huge issue except that I haven’t invested as much as I wanted.

2024 strong suggestions

In 2022 I said I didn’t want to set goals as I was feeling rather disheartened when I didn’t make them. I instead set some “strong suggestions” for 2023 which were basically goals, but not.

Here are the 2023 strong suggestions

- Savings rate of 40% – Achieved (41%)

- Increase pay (either from promotion or job move). – Achieved +31% increase to income.

- Remain alcohol free – Achieved.

- Go on an adventure with the car. Partially achieved.

I’ve exceeded my target savings rate somehow, and to my surprise. My spending has been quite high this year and I haven’t been investing as much as I would like. However, I have been saving into my savings account and into my pension. Somehow this has reached 41% over the whole year. Well done us. I think it can be explained by the fact that I’m earning significantly more now and therefore spending more will not necessarily result in a reduced savings rate.

I think hitting the £750k net worth mark is quite symbolic as this was my original FIRE number. However, this was a few years ago and now I am married, this has effectively doubled. Not there yet. I think we are CoastFIRE if that means anything to you.

My pay increased over 30% thanks to a promotion and then because I jumped ship to a new company.

My lack of drinking has been great. I have gone further than I ever imagined and am feeling healthier than ever. I am finding myself thinking fondly of drinking and wondering if I could restart with a new relationship with alcohol. I always go through the mental gymnastics of this and always conclude that I should not. So it will remain so.

This year, again, my goals will be more like strong suggestions as they seemed to work very well last year!!

2025 strong suggestions

- Savings rate of 40%

- Max out ISA.

- Remain alcohol free

- Get promoted at work

- Start winning business under my own name at the new company

- Improve fitness levels by working out minimum 4 times a week.

I’m quite motivated at work at the moment and want to progress. I feel like the company is growing and management is encouraging me (and others at my level) to bring in work. The rewards of doing so could be very lucrative. My boss told me that he earned over £1million last year and that other senior people are on £2m+. I feel like it is totally achievable to get to that level in a few years. So this is now a big longer term goal of mine.

What are your goals for 2025, assuming you dared to set any?

Congrats on the amazing year!

You hit a big financial milestone, and managed to do a lot of travel and spending. Best to spend when the stock market is high, right?

£1m-£2m income, WOW, sales? Are you worried that if you start earning that much, there would have been no point in saving in your earlier years and you may as well have had more experiences (like they suggest in the book Die With Zero?)

Good job with keeping sober. I wouldn’t bother going back. I went fully sober while my wife was pregnant for 9 months, we both felt we could stay like that, but slowly after the birth we started having some glasses of wine again, which we didn’t like at the start, now it’s normalized and part of our daily habit again, it’s addictive, and our bodies have became reliant on it again as a method to relax.

Thank you Saving Ninja! Yes I think you are right regarding the spending when it’s high. Certainly doesn’t feel as much of a missed opportunity to invest when my pot has grown 25%.

Also yes the opportunity to earn a lot more is also maybe making me lax. I work in a very niche legal dispute consulting firm. Bosses basically bring in the work and keep a large part of the fees generated by staff. Just need to hang in there a bit longer and it might happen.

The thing about me is I was a total idiot with money in my youth for various reasons and only really started saving properly at age 35. So I managed to get a good amount of experiences in. I liked the booze and was a bit of a party animal. Going sober has helped calm me down. I’d love to be able to have one drink but I always end up having 3-4+. Funny that you say you’ve slipped back into old habits. I worry I’d do the same if I started again!