Life update

June was much better than May.

Last month, things with Mum reached a crisis point which ended up with her being in hospital for about a week. When she returned the care regime increased to four times a day. This took a lot of pressure off me and my sister. It will take time for things to settle down following her house move and to get better, but light is at the end of the tunnel.

Our fertility treatment started but then stopped for a month as we were advised to wait a month. Now It’s started again and things are going OK. Fingers crossed all is well.

Other than that, work was busy and interspersed with slow days as I waited for responses from the client. It reduced stress levels at least.

Just at the end of May we went for a nice walk in Herfordshire near Luton. It was a lovely countryside walk with a pub lunch half way.

We had a nice day out in Hackney in East London walking along the canal with friends and enjoying visiting a pub or two (non-alcoholic beer only!!). Mid month we treated ourselves to a meal at Hawksmoor for our wedding anniversary. It was ace. We also went to Holland Park and enjoyed the lovely weather and visited the Design Museum and the Japan House. It’s good to have a day out in your home city to remind you how awesome it is.

We also had a trip to Scotland to do the final unpacking of boxes at my Mum’s house. The house is now totally liveable and that is a relief. I’m still appalled at how much the flights cost to go up, but I felt we had no choice, so they have you over a barrel so to speak.

Investments

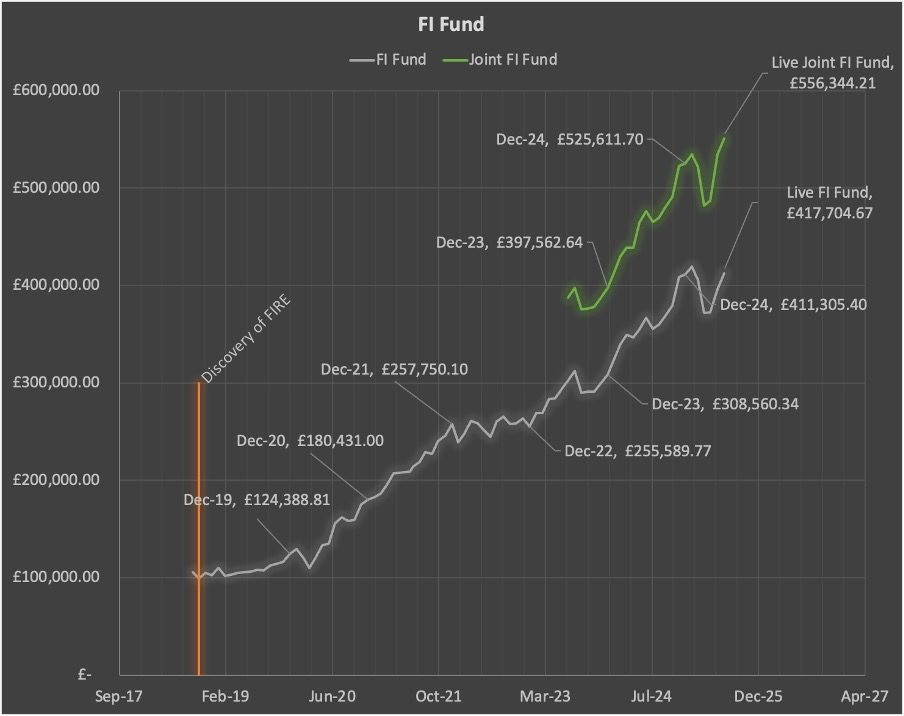

After the surge in May, growth in the markets continued.

Net worth was up from £769k at the end of May to £783k (+£14k) at the end of June.

This was due to the stock market doing rather well. We are now above our all-time high which we hit in Jan 2025.

The joint FI fund has reached £551k, up (£16k). This has created a sharp gradient on my FI fund graph, but I am glad it had returned to “normal”.

I have also slowly been rebuilding my emergency fund and this month I reached 3 months expenses. This was my goal, so I am happy about that. Investing (outside of pension) will remain on hold until we have paid for the fertility treatment and building works.

Spending

As mentioned above we spent another £8k on fertility treatment this month. I used my interest free Monzo flex card for £4500 and the rest on my AMEX. I will pay from my savings. So having reached my emergency fund goal I quickly eviscerated it. It is for a very valid and good cause.

General spending was lower than normal even with the trip to Scotland. I’m pleased things are coming under control again.

My savings rate was 39% with no withdrawals from the ISA this month.

Best of luck, fertility stuff isnt easy but at least prioritising having some cash means you can afford it.

I appreciate that. Thanks