April has vanished before my eyes. Highlights included a trip to Somerset with some friends over Easter, a trip to the Harry Potter theatre show, catching up with friends many times, a walk around Guildford, and progressing plans for the big day.

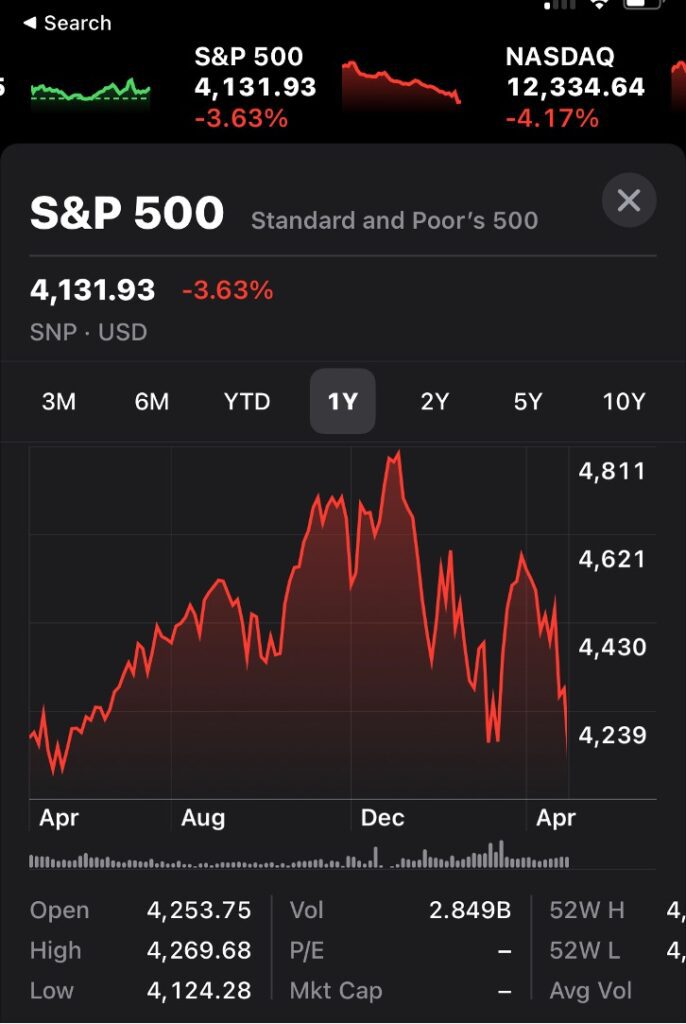

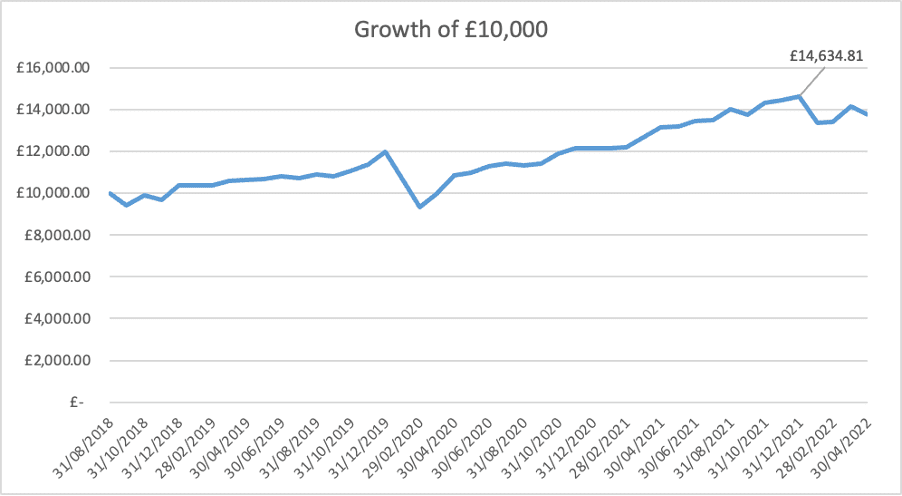

It’s a good thing that we were so busy because it has been pretty depressing on the stock market front. It appears that the markets have continued their plunge that began earlier in the years. I believe we are now down about 13% YTD and as far as the SP500 is concerned, my stocks app 1-year view is now red. It’s been the worst 4-month start to a year since 1939. That means all the gains in the past year have been wiped out. It’s very possible that there is further pain to come. Rising inflation will surely mean rising interest rates which will squeeze consumers further with increased mortgage payments. That will knock on to the rest of the economy. Add this to the strains caused by war in Ukraine and the looming energy, trade, and food crises that could result, and it is not looking great.

What will happen? I don’t know but it feels pretty gloomy right now. I’m expecting at least a 20% reduction in the markets.

Luckily, I am taking a very long term view so am not paying a great deal of attention to the market and am trying to increase spending/happiness in the real world.

It’s also been a very hard month for other more personal reasons. My mother’s health has been deteriorating to the point where she is becoming increasingly confused and is unable to carry out basic day-to-day tasks. I have spent a great deal of time on the phone with her and also contacting doctors and arranging for tests etc. I’ve also been trying to arrange for a cleaner to replace the one she fell out with. I have contacted the local Council who offered some advice (if not any actual assistance) for places where I can order ready meals for my Mum. This has been extremely stressful for me. However, at times like these, it’s great to know I have the support of my fiancé. I just have to think that these things will pass one way or another and try to adjust my expectations of what is possible.

Savings

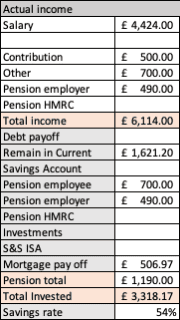

My savings rate has been much improved this month and is now at 54% compared to last month’s derisory 33%. I have achieved this by simply not spend so much and also getting repaid for some expenses that I was owed.

Spending

Spending has been reasonable. People have been asking me if I’ve noticed an increase in prices lately, and to be honest I haven’t been able to pin point why, but they are increasing. However, this month I have noticed my groceries expenses increase significantly whilst I know, that quantity wise, it has been relatively flat in terms of what I’ve been buying.

Big spends this month included a Playstation 5 which Ms Wealthster and I promised each other as a Christmas present but were unable to get hold of one. I started following a PS5 stock alert twitter account and was able to get one from Game within a few days. I’m very pleased with it but fear it will lead to me having to upgrade my 12 year old TV which I don’t think does the PS5 justice.

I also had to buy a new suit for work as I had an important presentation to give this month and my existing suits were looking shabby. I got one from Hawes and Curtis and it is very nice quality. It’s sort of a higher end mid range suit. Someday I will get a Saville Row suit but for now this is pretty good and much better than the usual M&S suits I usually get for work.

We have also booked our wedding venue which is hugely exciting. Looking forward to this a lot. I’m not tracking those expenses on here though.

Investing

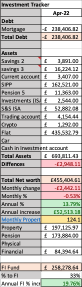

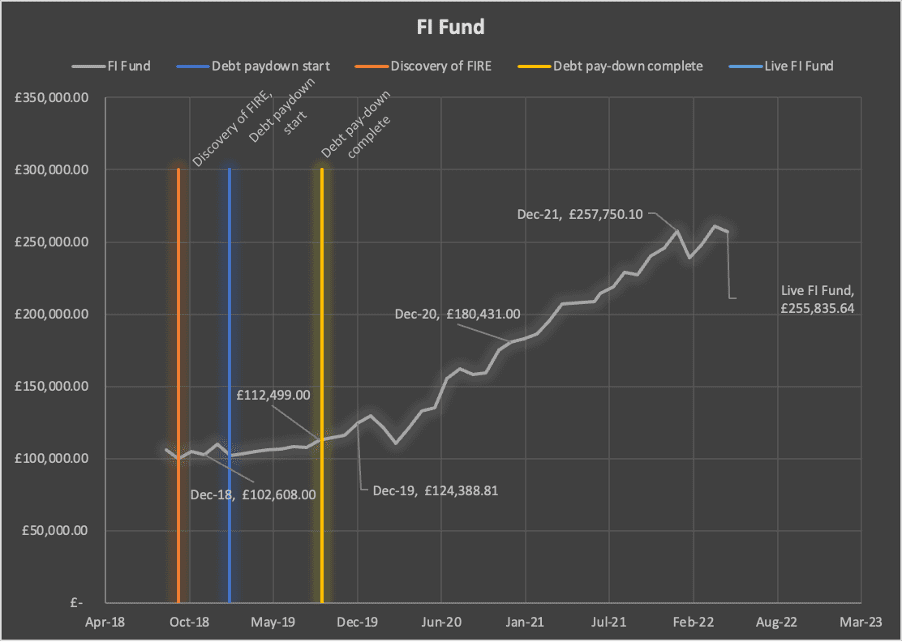

Investing is rather gloomy this month. Despite boosting my ISA last month it has all been but wiped out by the markets this month. I am down about £4000 in my FI fund. Also my SIPP has taken a similar hit. This was offset by the non-spending that I did this month which remains in cash as I nervously decide whether to proceed with investing it or put it towards something else (like a wedding or car).

My return on investment for April is -2.7%. Slightly sad really but it is no surprise that some months will not provide a positive return.

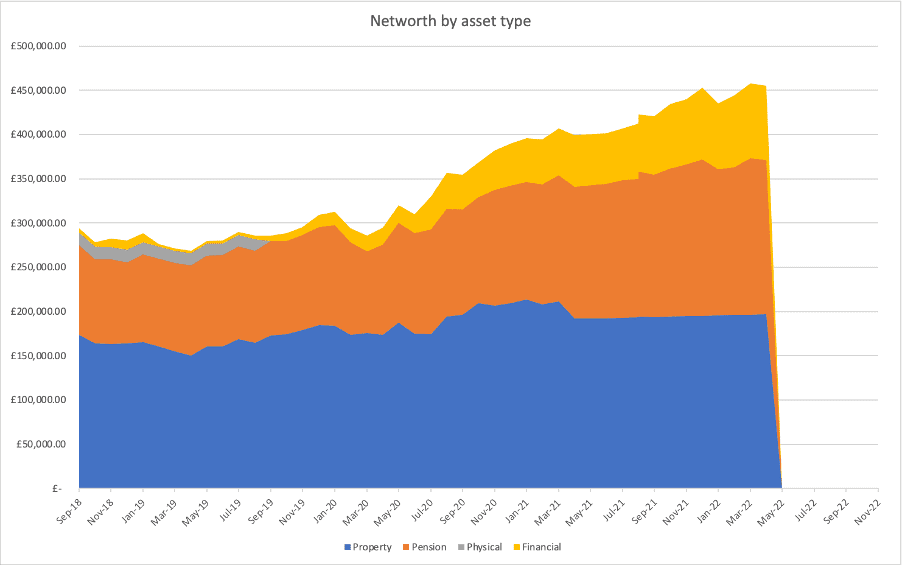

Networth is also slightly down: