April has been one the strangest months of my life. As with everybody, I have been confined to my flat. I’ve found it to be both exhausting and stressful. To top it off, I’ve been made redundant despite working harder than ever in my job. The company’s revenue has shrunk by 15% and because I’m one of the higher paid members of staff and relatively new, I’ve gotten the chop.

I’m weirdly non-plussed. It’s not to say being given this news didn’t hurt. My consultation meeting was downright insulting as my boss picked up what would be rather trivial matters in normal times as reasons as to why I had been selected ahead of my colleagues when in truth it is I’m the cheapest to ditch and other employees have been there longer and have statutory protections.

I’m not going to fight it as I haven’t been enjoying working there. I think it’s time for a change of direction. This may affect my FIRE trajectory, but I really do think I can’t keep doing the same thing over and expecting to be happy or satisfied with my life.

I have no clue what that may be at this point, but I’ll have some time to think about it. I may go back into the industry too in a better company. Who knows?

The numbers

My expenses for April 2020 are massively down which is great. I’ve managed to achieve 79% savings rate which is crazy good. Perhaps the only way I can achieve this is by being locked down? I don’t think it’s sustainable.

** Correction – I noticed I had made a slight error which my previously stated savings rate of 85% was in fact only 79%. That has been corrected!

My total cash (savings and current) as of today is £13,343 which is frigging amazing. I haven’t had that amount of cash since before I bought my flat in 2011. It works out at 7 months expenses at April’s rate of expenditure, or 4.5 months at £3000/month.

My company is being fairly generous. I have three months notice, however, and they want to furlough me on 11 May on the £2500/month until the end of June incase some work comes in. And why not? Then I would get 3 months pay, and 1 month tax-free upon ending of my employment. That’s due to my 3 months notice period.

I should be fine even if the economy is in the doldrums for a while. As I say, I’m not sure what job I want to do. I’d like to earn even more money than I do now of course but if I change industry or job, I will likely have to take a lower salary as I retrain.

I have tried to retrain before but with mixed success. I took a year out to study and did well. It was for a legal qualification, but I just haven’t found the type of job I want, or been accepted in a very competitive jobs market.

Any ideas on what a project manager of civil engineering projects with an additional legal qualification could do? I’m really open to ideas.

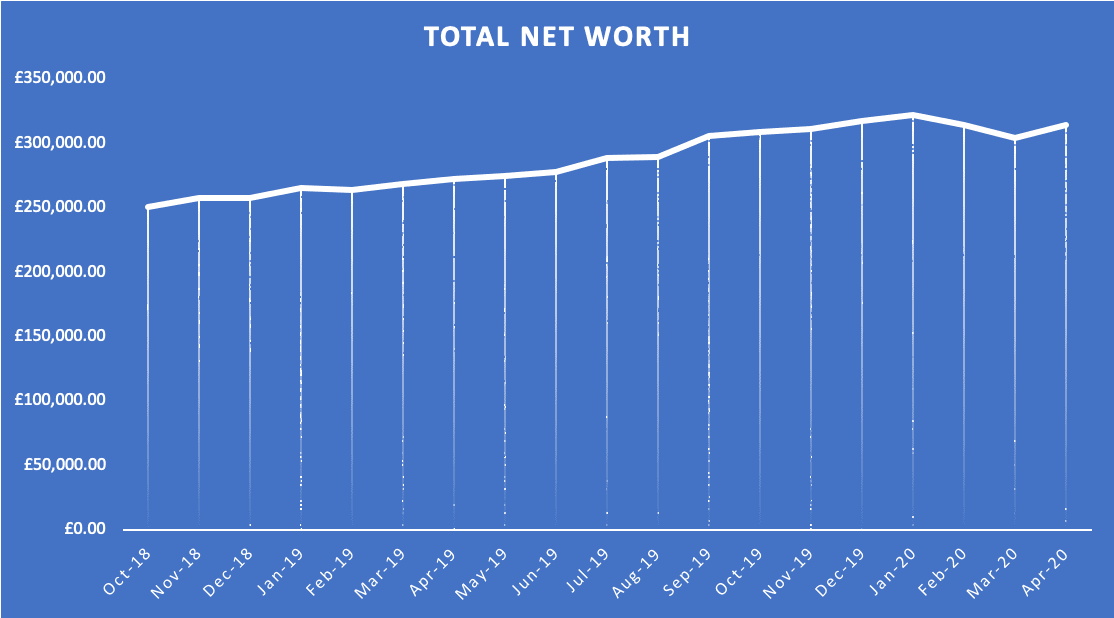

Networth

This month I have started to include the cash sitting in my current account in the networth. I don’t know why I did not do this before. I think it’s a psychological thing where I always assume I’m in the overdraft, or its close to zero and didn’t bother. That hasn’t been the case for over a year and cash is building up in there so I’m putting it up here.

The rally in the stock markets has really bumped up my pensions. Not to pre crisis levels, but certainly in a much better place than before. The peak was £113k in and now its at £101k, up from £92k last month.

Conclusion

Its been a shitty month, I’m feeling a bit lost with my career. However, I’m optimistic everything will get better and I’ll be fine. I am genuinely glad to have ‘found’ FIRE and if i hadn’t, I’d be in deep dog shit now. I’d be scrambling for a new job in the same field and hating it. I may still end up in the same field, but the point is I don’t need to rush and can find the right place.

My FIRE journey may need to pause while this blows over, but that’s what emergency funds are for.

Have you ever considered maintenance project management? I used to run a petrochemical complex and we had huge maintenance outages, as do power plants, refineries, paper mills, etc. where there are a number of contract project managers running the outage repairs? It pays comparable, maybe better than construction management and the skill sets are very close. You do have to travel a good bit. But the people I knew who did the work seemed to enjoy it quite a bit, though it is a little intense when the projects go over budget and miss the schedule, but you’ve got that in construction management too.

I suspect you’re not alone in having a huge savings rate this month! 85% is something else though.

Regarding your career, I have no idea about your area (I’m in a completely different field), but I have seen a number of career related questions on the r/ukpersonalfinance subreddit (https://www.reddit.com/r/UKPersonalFinance/) so they may be able to give you some ideas about how you can proceed next.

Sad to hear that April has overall been a crappy month, but hopefully it is just a one-off, and that May will be better!

Sorry to hear you have been made redundant, though it sounds like you are taking it very well. I’m hopeful that it won’t be long before most businesses are back to somewhat normal- and in fact growing again. All this money that people are saving- they are going to want to spend it once they are allowed out again! I mean, that’s most people, not including us few that want to FIRE and all.