Life update

It is apparently too easy to let things slip. I haven’t done an update for nearly 5 months now which is unfortunate as it has been a very eventful 5 months.

Let’s go back and have a look at what happened.

July 2025

The biggest thing was the fertility treatment. The good news is that it was a success, and we are expecting a baby in April 2026. We used an egg donor after many years without success. I am both nervous and so happy this worked out. We are also grateful to the egg donor who provided these eggs without any monetary incentive (as it is illegal in the UK to get paid for donating eggs). We had our treatment in what we think was the best fertility clinic in London, perhaps even Europe, so our fees were not cheap, but it has all been worth it and we could not be happier.

August 2025

We were on cloud nice in August following the news about the baby. The month seems like a long time ago now. We were taking it easy and not putting any strain on Mrs Wealthster at this delicate stage of the pregnancy. Luckily, she is in the small proportion of women who did not get any morning sickness at all. However, she did have other quirks like extreme hunger at odd times throughout the day. I was happy to keep her fed, and it meant adjusting my routine to suit. Something I think will start prepping up for the arrival of the baby and the changes that will come.

We also had a trip to Scotland to sort out my mum’s house. She was unwell and confused and had done zero unpacking. We must have taken about 20 carloads of junk to the recycling centre. My sister helped which was good as she was in denial about the need to step up and help Mum.

September 2025

This month seemed like a slog, and I remember being utterly exhausted. We had not had a summer holiday due to the need to be in London for the fertility treatment and I was suffering. Also, all the stuff ongoing with my mum who was also unwell and was seemingly rapidly declining. We were trying to get power of attorney for her medical affairs implemented which required getting letters from her doctor. Phone calls to Mum were making little sense and she was utterly detached from reality. She could not understand that she was in her own house that she herself had bought. She was in Australia, Perth, Glasgow, or some random institution. Also, she believed other people lived in the house with her. She also believed my dad lived with her (he died in 2016). So, it was not a great month to be honest.

October 2025

We took a week off for a complete relaxation in Devon, staying in a cottage across the water from Salcombe. It was a beautiful location, and we were able to fully unwind. We didn’t want to go on a plane with the pregnancy so stayed in the UK. It was a good decision I think, and the weather was kind to us. It was great to go there at that time of year because it was practically deserted. Our Airbnb host slightly ruined it by trying to get building works done on the cottage while we were there. I feel like that was ridiculous and has made me think hotels might be the way forward lol.

This month was also expensive as I began my treatment for gum disease. This involved getting laser treatment to heal the gum disease. This was not cheap but now writing a few months on, I think worth it. It cost around £3,500 in total which was upsetting. However, the benefits are potentially greatly improving my health and relieving my body from constant immune response which can lead to Alzheimer’s disease amongst other things. I chose a clinic near my work for convenience and time saving. It was a good idea as they were next level compared to my general dentist. If I am going to have to pay for this treatment, then I should get the best I can afford. Is this not what emergency funds are for?

November 2025

Mrs Wealthster’s parents arrived from Australia for the month. They stayed in an Air bnb near our house in a dry run for when they return to help with the baby. We did a lot of sight-seeing around London. Also, we drove to Scotland where we spent a week visiting my family and in the Highlands near Fort William. We visited Crieff, Mallaig, Luss, Loch Lomond and stayed in the Lake District on the way back to London. It was very relaxing.

Unfortunately, Mum fell and broke her collar bone and was in hospital when we were visiting. It was a real shame. We did get some news about the cause of her confusion. She takes a lot of medication and one of the medications was way too high. This had shown up in a blood test in August but was missed by the GP. Now the medication was adjusted, and she was getting less confused. To say I was annoyed with the GP would be an understatement.

December 2025

My return to work after a week off meant I just had to work a lot to catch up with the work I didn’t do while on holiday. One week was spent working until 10pm each day and I had to work the whole weekend and the following week. Mental really but it’s over. We then went to Scotland again where we stayed in Angus and visited my family for Christmas. I cooked a good roast lamb for the big day.

Mum’s confusion levels improved significantly. I’d say she was 10% confused and 90% lucid. Back in September she was 90% confused. I had a great phone call with her which was almost like old times.

The family trouble didn’t stop there. I got an email from my Aunties asking for money. They are rather hopeless and have lived an odd life. They live in the family home and although had moved out at some point, both moved back in their 30s and 40s. They both rely on low paid businesses for their income which have not been going well. As a result, they have not maintained the house, and it had reached a crisis point where the chimney looked like it might collapse.

I decided that I would help by paying for the urgent repairs to the chimney however, I am not willing to fund them further than that. I am helping them find jobs by updating CVs and coaching them. This might seem harsh, but I can’t enable this lifestyle any further.

Investments

Over the past 5 months things have gone well. I really haven’t been able to spare money this year to invest beyond my pension, and this feels bad. However, it is hopefully just temporary and next year I’ll get back on the ISA investment path.

The good thing which I did not notice until recently is that our net worth is now over $1m USD ($1.14m). In pounds it’s another matter and we are at £850k, but it is a huge achievement. To think that when I started this journey I was in massive debt to now where we have a joint net worth of over £850K.

| Year | Return |

| 2019 | 15.6% |

| 2020 | 1.4% |

| 2021 | 20.9% |

| 2022 | -10.9% |

| 2023 | 15.8% |

| 2024 | 25.3% |

| 2025 | 11.0% |

As you can see the annual return this year was 11%. I am satisfied with this as it there was a massive crash during the year and back then I was expecting it to be a negative return. We have recovered somewhat since then so I can’t complain.

| Portfolio return as of | 31/12/2025 |

| 1 month | -0.7% |

| 3 months | 3.2% |

| 6 months | 12.6% |

| YTD | 11.0% |

| 1 year | 11.0% |

| 3 years* | 17.2% |

| 5 years* | 11.7% |

It is slightly below the 5-year average return which was 11.7%. I’m fine with it.

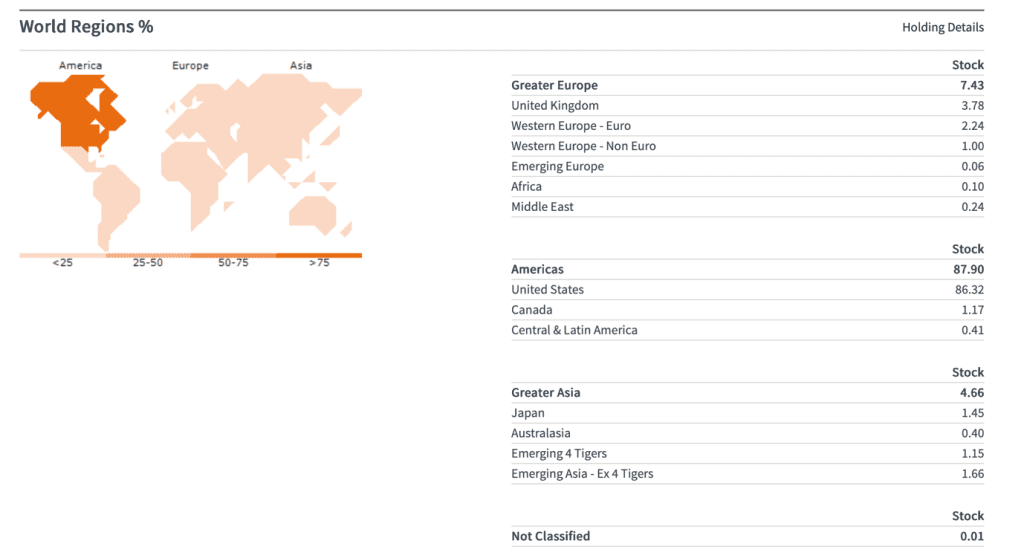

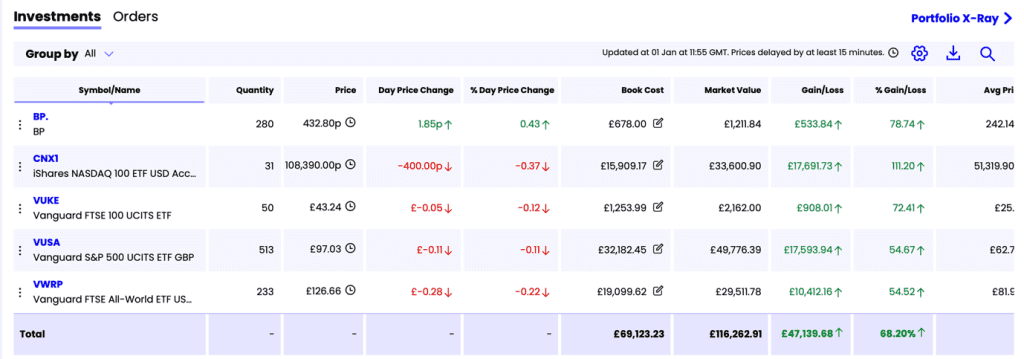

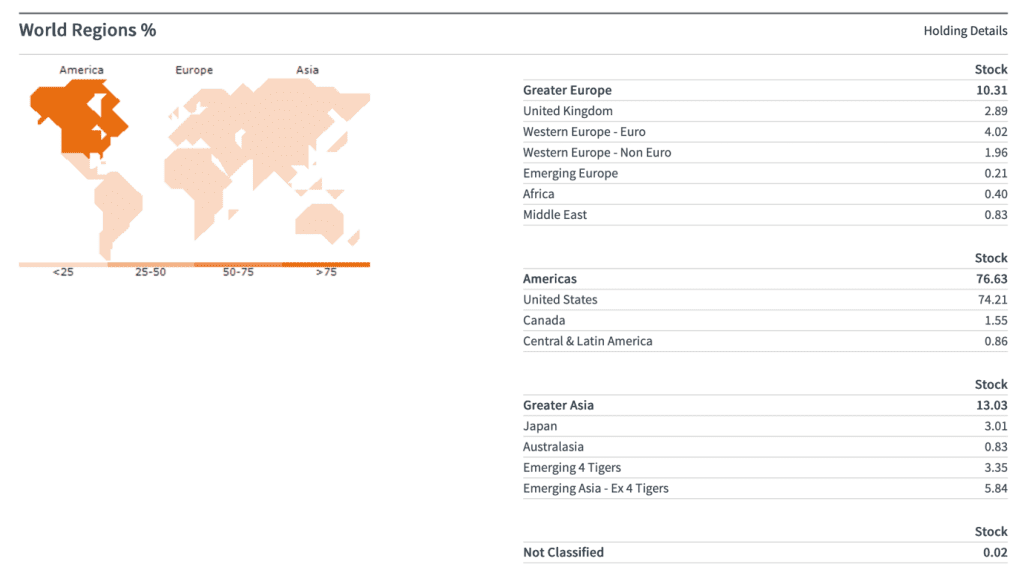

My investments have remained mainly in index funds and is heavily US based.

My ISA is as follows:

My SIPP breakdown is as follows:

This year the UK stock market did very well and I do feel a tinge of regret but changing to the US was really the best thing I could have done many years back. I’m happy with my allocation for now. If this blows up due to an AI bubble then so be it. Never bet against America.

Spending

Over the past five months I seem to have had some very high spending months, perhaps some of the highest since I started tracking.

This was because of the need for expensive dental treatment, paying off the fertility treatment on my credit card (which was paid off in September, service charge demands for work to the building and helping my Aunties out with repairs on their house. I had a service charge demand for £1,500 to carry out works on the heating system in the building. We are expecting a further £7k of charges in the coming year. So far, I have put aside about £2.5k to cover this so it won’t be that bad. The beatings to my savings rate continue.

Conclusion

While this year has been poor for investing, there have been exceptionally good reasons for it. We are so excited about having the baby and it will transform our lives, I’m sure in ways we don’t even know. At the start of the year, we knew these costs would come up and that this would be the case. None of this was a surprise and we were able to plan accordingly. Still, we are technically millionaires now and 2025 was the year we became so. Just got to reach GBP millionaire status!

From a financial point of view I feel like the next year will be about getting control of my savings again and investing again. Let’s see how that plan withstands having a baby!!

Happy New Year!

Congratulations, its funny how similar some of our journey is. We welcomed our son 4 days ago and he is going well. The NHS delivery system is brutally (in)efficiency compared to private IVF – my advice is to monitor everything yourselves (medication timings etc) so you can chase the midwives as its a situation where the loudest gets the best service.

I am also in London, with a tedious leasehold situation (leaking roof, sadly we are the top floor!).

Reading your posts I am very thankful my parents (in Australia for another parallel) are doing well.

Ha! Yes some strong parallels indeed! I hope everything is going well with the new arrival. We are now on the final stretch and Mrs Wealthster can’t wait (as can I).

Thinking about getting a Doula to help things too.

Let’s see how it goes!