This update is covering January and February as I missed my January update. Oops. I hope you weren’t worried about me.

I can barely remember what happened in January now as everything is blurring into one day. Living and working in the same space for months on end, with no outside distractions, has been tough on everyone. I must admit that having had Covid 19; I found it OK in comparison. However, there is a mental toll.

Six Nations

The biggest thing to happen was Scotland beating England at Twickenham for the first time in 38 years. I’m a massive rugby fan and ex-player. I’m also a die-hard Scotland fan and have travelled Europe watching us get a good spanking over the years. However, this game was amazing. Never in my lifetime have Scotland won at Twickenham. The celebration was via Zoom with some of my long-suffering fellow Scotland fans. A game for the ages.

(We won’t talk about the Welsh game other than to say we threw it away due to indiscipline. Well done, Wales.)

Post-Covid struggle

Me and Ms PWF were both struggling to recover for Covid 19. For a few weeks afterwards, we would both be exhausted after a day at work. Luckily Ms PWF’s work allowed her to work reduced hours. I was able to work my base hours and not a minute more. I went to bed at 8pm one night, which I haven’t done since I was seven years old. Thankfully, we have both recovered fully. No one seems to talk about the ongoing effects of Covid 19. I genuinely hope there will be no other effects. My biggest fear is that my taste will change, and everything will start smelling like sewage. I’ve heard this can come up months after having Covid.

We found that taking Vitamin D and a Berocca tablet every day and not doing a great deal seemed to help.

By February, I was back to reasonable strength and was immediately thrust into 15-hour workdays to meet a deadline. I know this would happen at some point, but it didn’t make it any more pleasant.

We were both relieved to have taken this week off. I’m missing my annual ski trip, but next year…. When covid is over…

London is empty

I was able to take a cycle into Central London and take some photos of the empty streets. Quite eerie. I doubt I’ll see it this quiet again in my life.

We also had some snow. It was fun but also fairly bleak.

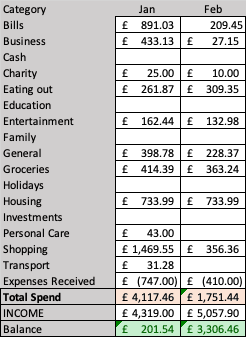

Spending

Due to feeling somewhat blue in the past few months, I feel like my spending has gone up. I made a few big-ticket item purchases, including a new MacBook Pro (M1) and some new Nike running shoes.

MacBook Pro M1

I maximised the MacBook purchase by getting it from John Lewis, who was selling it for 8% less than Apple direct. I also collected my points on my AMEX and BA shopping portal, so I got a cool 2100-ish point. I did try and collect my £175 return from the AMEX offer, but I think it is only valid on food purchases as I did not get anything back. Finally, I traded in my old MacBook (2015). It had served me well, but it was time to upgrade as it became increasingly slow.

I manage to trade my old Macbook in for £380. By the time the old Mac arrived at the trade-in place and the company picked it up, the cable was broken, and the battery was naff. Weirdly, there was no way to state that something was wrong, so you had no chance to negotiate with them until they had your laptop. I did expect them to knock something off the price but was surprised by how much! They wanted to give me £120 for it, so I got my haggling hat on and said no, I wanted more. I pointed out that a new cable was £19 and that a new battery fitted by Apple was £199, so they had no business cutting so much from the price. They came back and gave me £162. I was pleased with that. The moral of the story, everything is negotiable.

Apart from that, I am thrilled with the new machine. It is excellent, and I don’t think I’ve used a laptop as fast as this. It feels like a big step forward and is worth upgrading.

I’ve always had Macs since my Dad got a Mac Classic in the 90s. I had an iBook (2001), MacBook Pro (2007), MacBook (2015), and now the Apple Silicon MacBook Pro (2021). You will notice that they tend to last about 6-7 years, so I’m happy paying a premium for a reliable and high-quality product.

Other Spending

I found that General spending is down for both January and February, but the overall spending is higher thanks to the more expensive purchases. Groceries have been going up as I’ve been purchasing some quality meat from local butchers and cooking some excellent steak and chicken dinners. I also had some Haggis for Burn’s night.

We’ve also had a few takeaway meals (purely due to boredom), and I ordered a meal kit from one of my favourite restaurants. The idea is to keep them in business! It was also delicious. Maison Patron – check it out. I think it’s important to keep places like that afloat, even if it means paying a little over the odd for a meal that you have to cook yourself. It’s easy to do and worth it if they get through the pandemic.

Avios

I’m tracking these in the vain hope we can go to Australia and upgrade to a better cabin. I think its 20,000 each way, so one of us can upgrade now!

Total Avio: 8748.

Total AMEX points: 32,880.

Total points: 41,628.

Savings and investments

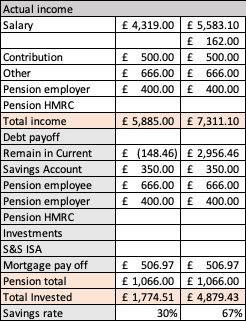

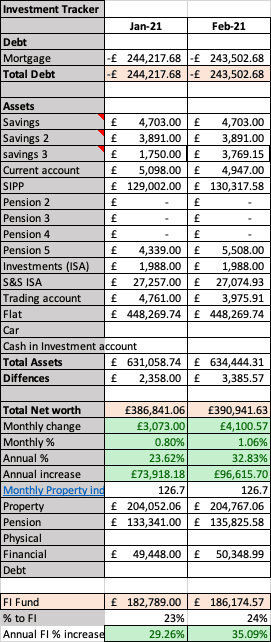

The savings rate for January was only 30%, but back up to 67% in February. I have to remember that even saving 30% is way more than I used to save, so it’s not a problem to be down every now and again.

Total invested is the sum of Remaining in Current + Savings account + pension total + investments + S&S Isa + mortgage payoff.

Investments

I was able to slam away a fair amount of money into my investment account at Xmas, but have not really submitted much more and have the money in my savings account to pay for things like my new Macbook. I have a vague goal of buying a car which seems a long way off, so I’m keeping it as cash for now.

In January, I bought my first Tesla shares. I bought in at $720, which was a gamble. It was as closed to a YOLO moment I’ll ever have. The stocks went up to $900 and now are down to $684. I’m down 5%. I’m not selling and won’t panic about this.

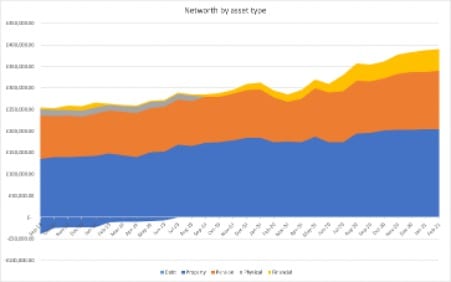

I’m still growing month on month. I’m at 24% of my FI number. I’m up a staggering £96k since this time last year. Even if the stock market tanks, I’ve got a long way to fall before I will be upset.

I have a separate column in my spreadsheet linked to live figures, and my FI Fund was up at £192k last week. It’s now at £186k. I’m so near to the £200k mark.

I also decided to put these numbers into dollars. It made me feel better, too, as I have about $1.14million of assets and a net worth of $702k.

I’m getting so close to that £400k net worth. Fingers crossed, I’ll get there soon.

Rebrand

Last but not least, I have decided to rebrand my blog. When I started Playing with FIRE, I was obsessed with retiring early. However, now, I’m in a job I like, and it isn’t a so much of a priority for me anymore. Financial Independence remains very high on the agenda. If I can get there and retire if I feel like it then all the better.

So without further ado – I introduce you to my new identity:

“The Wealthster“

It’s a combination of ‘wealth’, and my actual name and better reflects my goals. A rebrand was in the offing for a while. I couldn’t decide whether to reveal my identity or change the brand, but I wanted to keep giving in-depth updates, which I feel are better without my identity revealed. I, therefore, settled for changing the brand, which I’m happy with, as it allows me to blog about a broader range of topics and removes the limitations I felt that calling myself Playing with FIRE put on me.