January has been a month of sobriety except for the 1 January when I had a drink on new years day. You may have read about my recent foray into sobriety in my last post.

It’s also been very quiet in terms of going places and doing things. We’ve kept it local and stayed in London the whole month. Work was also busy with meetings and workshops, so it’s been stressful. I also have done some training related to my job and attended a conference. It’s good to be getting back to normality (when will we feel able to stop saying this I wonder?).

I must admit that the first week of sobriety was bad. Although I was not in what you might categorise as a serious alcoholic, I did apparently have enough dependency to notice that I had stopped drinking. Day 5 was the worst, and I was an emotional wreck after a bad day at work. Thankfully I resisted the urge to drink. As they say, take it one day at a time. Now, on day 35, I am feeling more relaxed, less stressed, sharper, better at my job, and healthier than I’ve felt in ages. Long may it continue.

We have been meeting up with friends during the month and had various birthdays and events. We visited a horror exhibition at Somerset House which was interesting. We also went out for lunches here and there with friends.

One of the other less exciting things that I have done this month is sort out my email nightmare (10,000+ unread emails) in my gmail account. It was getting absurd so I have used Apple’s mail app and smart inboxes to sort this out. I unsubscribed from hundreds of mailing lists, which took ages, but now my email is functional again.

I also decided to move away from using Chrome as a browser as I feel it gathers too much information. The problem with that was I had all my passwords on there so I had to spend some time sorting out that mess too. I’ve changed my password manager to Bitwarden which as far as I can tell is the best option. I paid the $10 fee to go premium. This however meant spending a lot of time sorting through websites where my details had been leaked and changing the password where I hadn’t bothered to sort previously. I mean at least I’m way less likely to be hacked now, but I didn’t enjoy spending so much time on it.

Not a January update, but Scotland winning in Twickenham yesterday was also a highlight. I celebrated with a non-alcoholic beer.

Spending

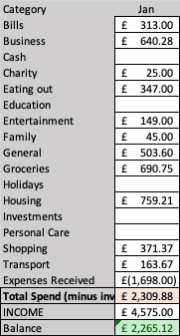

With my sobriety and a lack of travelling, my spending was down massively compared to last month. I had a few business expenses included here which have not been expensed yet but for the purposes of this I have balanced this up. I only spent £2399. I have no clue whether this is due to not drinking. I really didn’t think I spent that much in the pub, but I suppose it’s possible that all these rounds add up. I decided to do a little further investigation.

My average spending in my “Eating out” category in 2022, which is where I stash my pub spending, was £493 per month. This month it was £347. That’s a big saving of £146. So that doesn’t really explain it. I didn’t go anywhere on holiday which really has been a habit the last few months so that’s probably what did it.

My groceries seem to have skyrocketed this month too which I can’t explain. Maybe eating at home more often? I didn’t think I ate out that much anyway so this must be inflation taking effect. Eggs and meat are way more expensive than previously, and I eat a lot of them. Even so, I’m still massively down on spending so it made no difference.

We bought a new rug for our living room which cost £280 from Ruggable. It’s nice actually and in the words of the Dude, from the Big Lebowski, “It really pulls the room together”.

So anyway, a big success for January on the spending front.

Savings

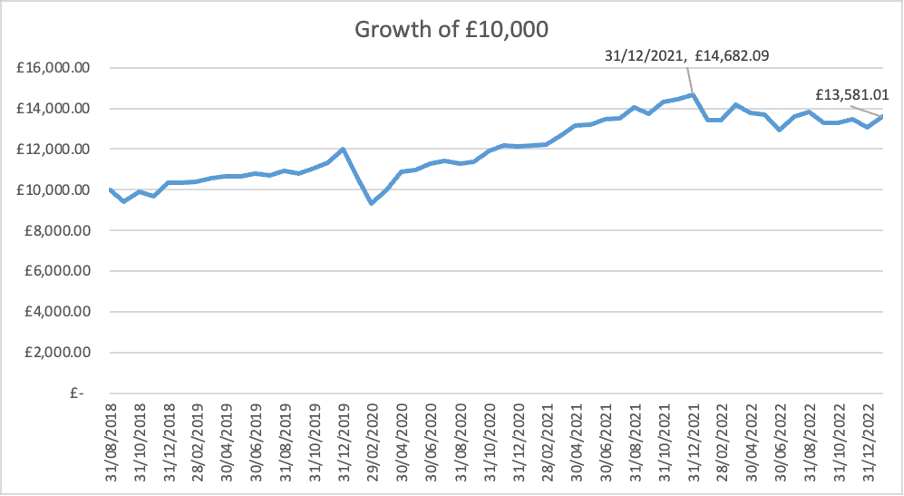

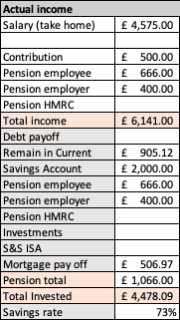

Savings are a very healthy 71% savings rate this month. This is simply due to my lack of spending. I have yet to top up my ISA for this month, but I did replenish my cash savings by £2000 after raiding it last month to buy plane tickets to Australia and to California.

I think I will add £1200 to the ISA.

Investing

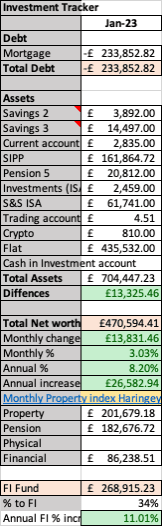

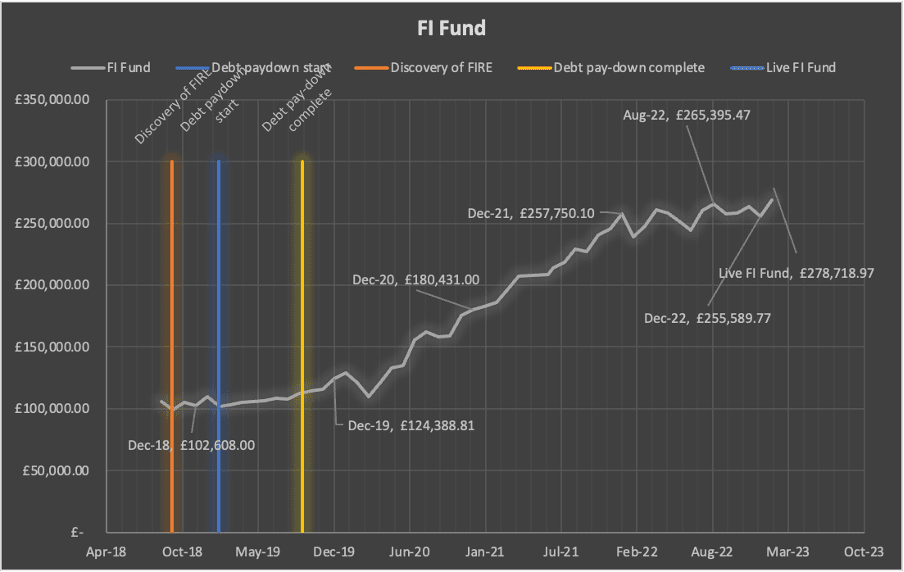

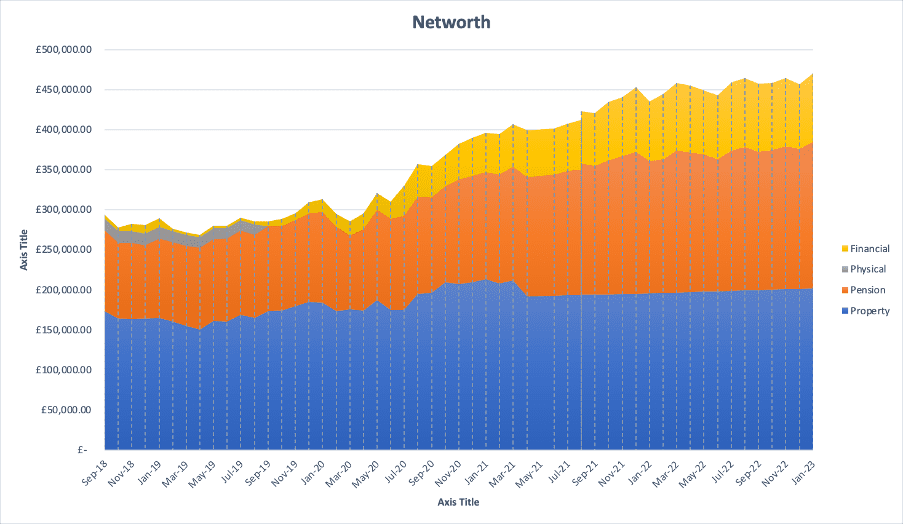

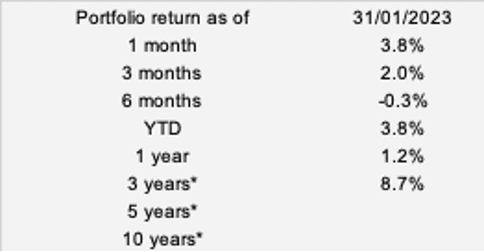

As you may have noticed the stock market has been on fire this month. After the lacklustre year we had in 2022 it’s starting off 2023 with a bang. The results recorded below are as they were on 31 January 2023, but I can report that my FI fund has now hit £279k which is an all-time high and up £24k from £255k at the end of December 2022!!

Is this the big break that I’ve been looking for? Or is it a bull trap which will have me sobbing next month? I don’t know but I’m going to enjoy it while it lasts. Returns for the year to date are 3.8% which for the first month of the year is excellent.

Good news on the cash savings side to as interest rates are increasing to around 2%. My NS&I is at 2.6%. Paltry returns compared to inflation, but at least they are increasing as the base rate goes up.

That’s all for this month. Catch up soon. Let me know how your January went in the comments below.