General stuff

I have spent the last couple of months getting started and settling into my new job. It’s been a change to be going in four days a week but one that I have, to my surprise, found to be good. I’m now into the habit and really enjoy my Fridays at home. Sure, the laundry bin gets a bit full as I have less opportunity to get household chores done but I think it forces me to be more efficient with my time.

That brings me to my break from X. With the dramatic riots taking place in the UK, I found X to be an intense cesspit of hate and faux logic about immigration espoused by “Concerned citizens” which is far-right code for being a racist f*ck.

I also didn’t enjoy Elon Musk trying to interfere directly in problems that don’t concern him. It made me really question whether I wanted to be part of X anymore as almost all enjoyment I previously got interacting with people on personal finance had disappeared and been replace with racist bile.

Anyway, I may return when things settle down, but for now the app is deleted.

July brought some London visits from friends from my Scottish hometown. It was fun showing them around London and taking their kids to Hampstead Heath. We did a nice walk in Hertfordshire around the Wheathampstead area. I was also lucky to get to go to Goodwood Festival of Speed with work to take out some clients.

We also managed a weekend trip to the Lake District. We left at 6pm on Friday and got to our Air BNB around 11pm. The next day we hiked up Scafell Pike which allowed me to tick off all the three peaks in the UK. Drove back on Sunday afternoon. This is why I got the car and we both loved the weekend away.

We also went to visit our friends in Cambridgeshire who stay in a small village. It was great to get out of London again.

Investing

Investing has been an odd one. I have not contributed anything to my ISA for these two months. This is because I was in what felt like a financial crisis. My work did not pay me in June which wouldn’t have been a problem had we not decided to renovate the flat. We spent as good as £10,000 on a new floor and getting the flat decorated. I have to say, it has transformed the flat and made us feel very happy with the results. I’m super pleased we did it, but it was still a financial challenge to do.

In fact, because of the credit crunch on my personal finances I had to dip into my ISA to pay the tradesmen and put money on my Monzo flex card. This felt like breaking a sacred rule of never take money out the ISA, but what else is it for? This was to pay for a project that has improved our living standards so what better thing is there to sell for?

Anyway, I’m confident that with our higher incomes (Mrs Wealthster received a pay rise too) that we will get back on the investing horse soon enough.

I have also set up a new pension at my work. I need to do some calculations so that I can avoid the 60% tax trap between £100k and £120k. If I increase my pension contributions, I should be able to bring my income below £100k and therefore save money on tax. It’s an interesting position to be in and one I am thankful to be, but I haven’t quite got to grips with it yet.

The markets suffered a flash crash at the start of August, but this seems to have been long forgotten and my investments have recovered nicely. This crash was something to do with hedge funds borrowing money in Japan due to its low interest rates, and then shitting the bed when that money supply was turned off. There are games being played that I have no hope of understanding, so I try not to get worried or concerned by these things. So, I did nothing, and it was fine.

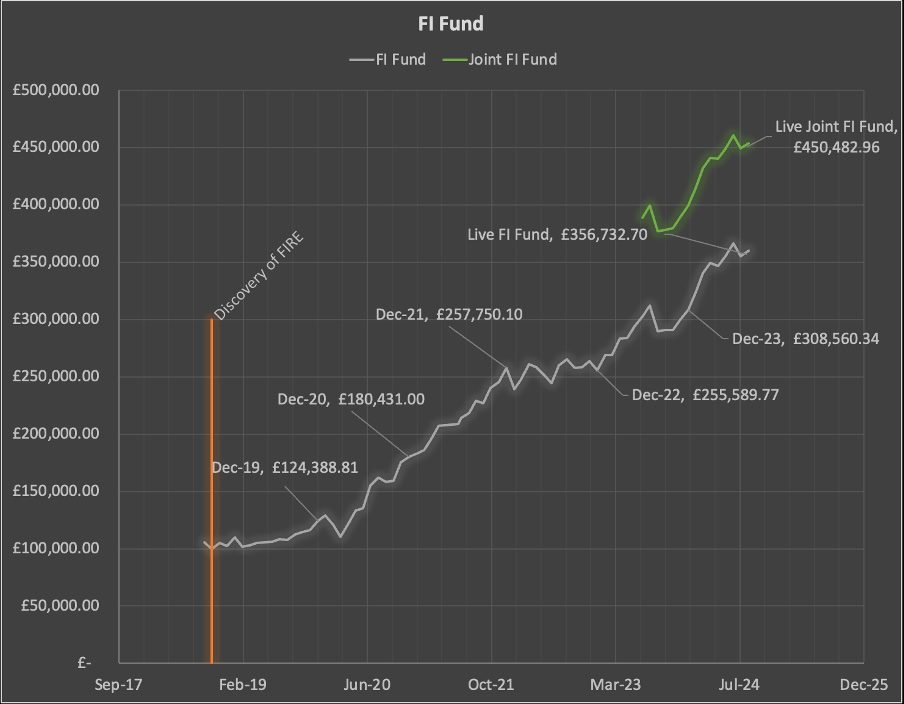

Fi fund = £450,482. (Jul: -£11,477; Aug: +£4,467).

Net worth = £684,785. ($900k USD).

I guess I should be chuffed that we crossed the $900k net worth value for the first time. I think the exchange rate has made this possible. Roll on $1million.

Spending

As mentioned, we did a few trips away and were still paying for the renovations or paying back the renovations. I used my monzo flex card which allows you to spread payments over 3 months interest free. I thought this was good because it meant you can spend then keep money at work in your savings or ISA account.

Anyway, just a warning that it seems to slam your credit score. Not sure why but mine dropped 150 points because of using it. Might be an idea to not use it if you are applying for a mortgage or something.

I’ve also noticed that when you are financially down, this is when issues crop up. For us it was our dishwasher breaking down and the washing machine dying within a week. Luckily the dishwasher was covered by warranty, so we got that repaired for free. The washing machine on the other hand was kaput. It served us well over 12 years, so I’m not bothered. To replace we got a washer drier which we got at 20% off thanks to the Blue Light discount that Mrs Wealthster gets as an NHS employee. I honestly don’t know why people complain about washer driers, its great and has saved a lot of time hanging up washing or forgetting to take the washing out of the machine and having to rewash!

It has made me consider that our spending is getting out of hand. I think i will make some effort to rein it in this month. I did decide to spend more and move away from the extreme frugal life but i think i am risk of going too far the other way. Let’s see how it goes.