June has been a long and tedious month here at thewealthster.com HQ.

While on furlough, I’ve been dabbling in a few things to pass the time. These might have been called side-hustles if I had a main hustle!

I must also admit to being a bit disinterested in my blog this month, for which I apologise. I think the lack of steady income is taking its toll on progress towards FIRE, I have also slowed. That said, it’s certainly not all doom and gloom as you will see below!

Website

The first side-hustle was making a new listings website. It took me two solid weeks of playing with the WordPress template I purchased, but I’m pleased to report, the site is now up and running. Making the database structure and categorising everything a challenge, but once done, the template made it easy. It only has 1 advertiser at present, but I’m trying to grow this through twitter and Instagram. I’m also bothering friends to list their businesses on it for free, so it looks useful!!

I had the idea many years ago, but never put it in motion, and now having the time to do it, I’ve finally done it. Luckily no one beat me to it. If it takes off, it could be a real money-spinner.

I’ve been messing around on Twitter a lot and have increased my following. Not really sure what I’m doing, but it seems to take up a lot of time.

Freelance

I also picked up some freelance work through LinkedIn. I reached out to someone really asking for career advice as I could see they were running their own consultancy in the field I’d like to move into. We had a long chat, and it concluded with me setting up a limited company, getting my professional indemnity insurance and doing a little bit of work for him.

I’m charging £60/hour, so again, this could be good if it takes off. Once I have some more experience, I could increase that rate to around £100-125 /hour, but I’m learning the ropes at the moment and feel charging more would be highway robbery at this point.

Employment

I’ve had a few leads and actually said no to several recruiters. My CV is pretty ‘nails’ in my field, and I’m a good catch for a project manager. However, as mentioned, I don’t want to do this anymore. The job was making me miserable and not doing it for 6 weeks has made me realise this! I’ve been made redundant from that job, and I need to force myself to make the change. Staying in PM is the easy route and will lead to further dissatisfaction.

A head hunter referred to me by one of the recruiters who I turned down contacted me and said he has several companies he’d like to try. The feedback is positive, but no one is hiring right now. It’s a bit of a wait and see situation.

I also sent my CV direct to a few companies, and one called me right away to chat. Sadly, I will have to wait and see with them too, as they are also not hiring.

So while I’m getting some positive news it’s a waiting game.

My current employer also offered to extend my furlough until the end of July. I decided to take this offer but was tempted to bin it and get my redundancy package earlier. I’ll have to wait until the end of July for the package they are going to give me. There is a risk they might find me a role, but I’m kind of praying they won’t find me a job as I’m totally done with them and would rather not go back.

The Numbers

Expenses

Expenses are reduced this month, primarily because they are what they should be. A further reduction could be possible once my business start-up costs are repaid (hopefully by some work). I bought a 27″ monitor and some textbooks to assist me.

I should note the groceries are for two of us and I split them with my partner.

Miraculously I have kept within my reduced salary.

Savings Rate

Weirdly enough, my savings rate was MUCH higher than expected. I put this down to the reduced income, making what did get saved have a bigger impact on the %.

The only positive is I noticed I’d been calculating my tax rebate on my pension incorrectly and it was, in fact, more than I was logging. I have also kept the direct debits taking money out of my current into savings at their current rate.

Investments

My first month using the revamped investment tracker wasn’t without its teething problems. I took the iron to the many little niggles with the spreadsheet and it’s now working.

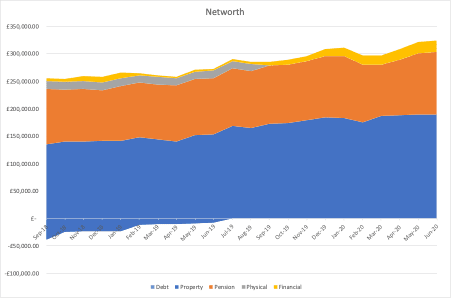

My net worth gained a surprise 0.89% this month. That was a huge surprise as everything was feeling rather gloomy. That in itself makes tracking this worthwhile as I would have assumed a loss.

I will also be looking to consolidate the pensions I have now that the tax year has been and gone and my employment ended.

Conclusion

The month has been both productive, unproductive at times, and frustrating. I have so much free time, but can’t go anywhere. I’m looking to plan a trip out of London soon, which will be great. Maybe up to Scotland to see my Mum. Also, there is an option to go to Europe now following the lifting of travel restrictions.

The lessons of this month are; keep the faith and be patient.

How’s your month been?

The website sounds promising and will be a nice passive income generator. Good luck with the freelancing – start small and work your way up to higher rates!