Fun stuff

We ended March by travelling to the other side of the planet to Melbourne, an epic 24 hour journey via Abu Dhabi. We got to enjoy a brief stop over in the beautiful new airport there which really is fantastic. It was a relief to escape London and my work for a break.

It was autumn in Melbourne which meant that we could enjoy being there without baking in the summer heat which is what I’ve previously experienced. We took a few days with the family to visit Wilson’s Prom which is a spectacular national park about 3 hours from Melbourne. Staying on a farmstead was a peaceful few days where we could enjoy catching up and gazing up to the stars whilst sitting around the fire pit. The only off-putting thing was the warning about dangerous snakes lurking in around the property!

We also got to attend an Aussie rules footie match at the MCG which was great fun and my first time.

After Easter, we went to Lorne which is a beach town on the Great Ocean Road. We were extremely luck to get to stay there at my sister in-law’s partner’s holiday home. The beach house is owned by a CEO of a major company so is spectacular, to say the least. Really beautiful place. Then it was working some odd hours for a week and back to the UK.

We did endure some drama returning from Australia as it was the night that Iran decided to launch a few hundred cruise missiles at Israel. Our flight was supposed to cross over the flight path of these missiles. I was considering not boarding our flight unless they could tell me that we were not flying anywhere near that area. Remarkably nobody knew. I decided to risk it as I reasoned that the air line would not risk it. In the end we flew around the region and were safe. Still, it was a stressful experience and it made me think that you and you alone are responsible for your safety.

No rest for the wicked though as we were to be witnesses at our friend’s wedding in Edinburgh the weekend after we return. A lot of travel. Also being slammed at work the entire time has been exhausting.

Work stuff

The other big news in March was that I got a 9% raise and an OK bonus. Much to my bosses despair, I then promptly resigned as I had received an offer from a competitor firm. I did not plan on leaving my company but there are always a few grumbling issues and when someone dangles a large pay rise in front of you, it’s hard to resist. As a result, I had mixed feeling about leaving as my current company have been good to me. However, clearly, I was being underpaid as this is very much a sideways move in position but one which will net about 30% more pay.

So now I am extremely satisfied with my income which will be £125k with the opportunity for a 20% bonus. Good news all round. This feels like the culmination of several years of hard work and redirecting my career. Again, I put this in part down to not drinking which led to a vastly improved work performance which led to my reputation being excellent and led to me being headhunted. It is the second and third order benefits of being sober that are the real winners. These are things you can’t predict and wouldn’t expect to come out of it.

Other news is that Mrs Wealthster also got a pay rise. She works in the NHS and it was a result of being there for 2 years. I think this is actually a great way to keep people motivated and feel rewarded. As I’ve seen in my company, a pay rise is by no means guaranteed! Well done her. She is now looking to push to get to the next pay band.

Investing

After a lacklustre effort at topping up my ISA on a month-by-month basis, I decided to put this off until I got my bonus. As this bonus was less that expected, I then decided to pop 50% of my emergency fund into the ISA so that I could use my annual allowance. I figured this was ok as I will now be taking home about £1000 per month so will quickly replenish this.

As a result, my ISA breached the all-important £100k barrier. Another financial achievement reached!

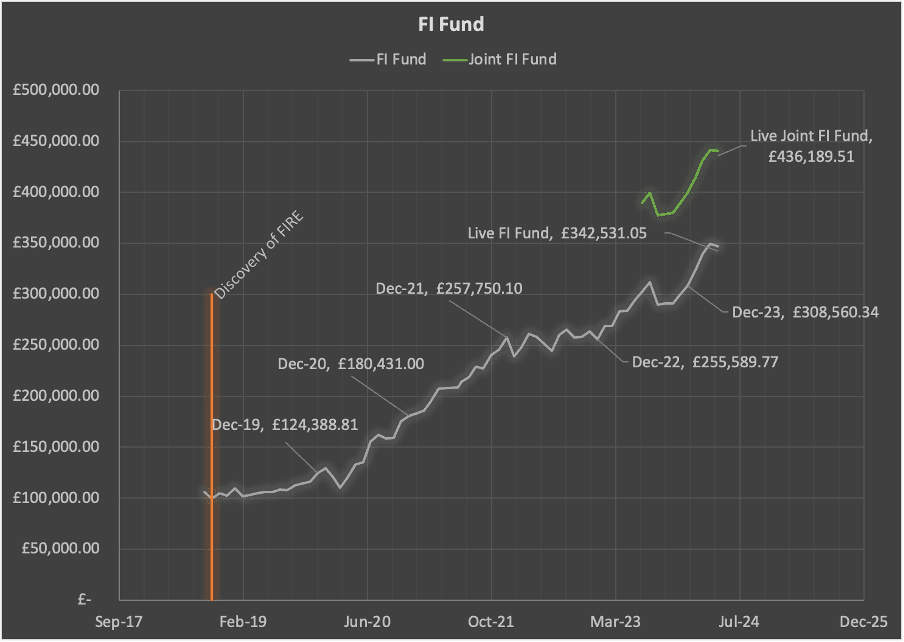

The FI fund was down about £2300 from March to £440k (also the live value has declined slightly more as shown in the graph). This is not really concerning considering the rises it’s had in recent months.

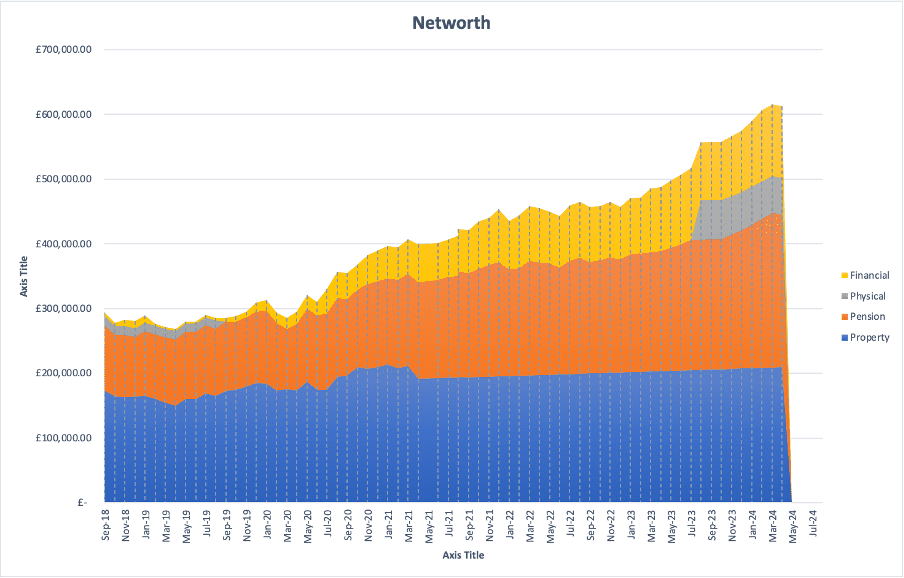

Networth was about the same as last month at about £675k.

Spending

I haven’t done my spending update in full this month. However, i do know that we splurged a bit on holiday by eating out at a nice restaurant in Australia. We didn’t pay much to stay in Australia thanks to Mrs Wealthster’s parents (we stayed at their house), and our trip to Lorne was gratis too. Weirdly i might have spent less than normal whilst in Australia.

I bought an Apple Watch in Australia for about £100 less than in the UK thanks to a strong pound and weak Aussie dollar, and a tax refund. I also bought a nice suit for myself which i will wear occasionally to my new job.

Look ahead

I am hoping to end my notice period of 3 months early and take a 2 week break between jobs. I’m due to start in mid-June. Hopefully this will happen and i can go somewhere cool. We are looking at visiting Valencia and staying with a friend who has just moved there. I also have a crazy long weekend in New York for a good friend’s stag weekend. I normally balk at going on such weekends but as it’s been a long time since i’ve been on a stag i will make an exception for this. Plus it will be lots of fun.

Congrats on the new job and significant pay bump!

How much of it are you going to be putting into your pension? (I assume not much as you mentioned getting 1k extra per month.)

After moving back from the US the tax rate here is hard to stomach so I’m thinking I’ll max my pension contributions so I can maintain a big savings rate. I’ve heard rumblings that the £60k allowance may not be here for long.

Thanks dude! I will probably only put in 10%. This is for two reasons. First, I’ve calculated that I’ll hit the life time allowance at about that level of contribution. I know it’s been abolished, but I think the new Labour government will reintroduce. Therefore I don’t want to put more in than I need to. The second is I’d rather have the money available to me to use before age 57. I do want to buy an actual house at some point and I can’t if my money is tied up in the pension.

Plus, last year I decided to ease off on the savings rate which had reached 70%. I think anything above 35% is good for me these days. Although with the more money I have I naturally won’t spend more so that rate may just be higher.

Did you manage to get a job sorted?