Hello! Another update from the Wealthster. This month I talk/moan about all the difficult things that we have experienced this month. Mum in hospital (gone crazy) and fertility issues. I promise this is still a personal finance FIRE blog. We’ve just been blown off course slightly in recent times and it’s only fair I am honest about it all. Anyway keep reading to hear how it all went.

Life getting on top of me

The past few months have been emotionally tough in the Wealthster household. This is for a number of reasons.

We’ve been trying to sort out my mother’s new house and this involved a visit up to Scotland to unpack boxes. This was a huge task. There were two rooms entirely full of boxes because she has moved into a much smaller house. My sister lives about two doors down and had not manged to unpack much so we went up and tackled it together. She claims to have been “Overwhelmed”. I don’t buy it but there we go. This was an expensive trip because we had to stay in a hotel because my mum had no room to host us. I was alarmed at how much this trip cost (£700 for both of us including flights on a budget airline, staying in a Premier Inn and the cheapest car rental I could find!)

We tried getting someone in to unpack but due to my mother’s state of mind (see below) and inability to make even minor decisions this is not practical. We did get a guy in for a day, but I don’t think much progress was made.

Also, my mum has mental health issues which are becoming much worse as she ages. She has bipolar and this gets worse with each episode. The health issues which result from this too as a result of an unstructured lifestyle and failure to look after oneself really start to show with age. She recently celebrated her 70thbirthday. It’s a miracle she’s still alive in some ways.

The house move seems to have completely destabilised her and she was getting highly confused. This got worse until she had to be hospitalised as a result. We think it was her pituitary gland which is acting up due to the medication she is taking. We have been getting carers in to help with things, but the needs have increased. This all-costs money and time. I feel like I’m a full-time administrator for my mum now when organising her care and all the admin from the house move is considered. I just hope we can get it to a place where it needs minimum input. Get a power of attorney in place immediately with your parents if you haven’t already.

Last, we have been going through the decision to undergo fertility treatment. Sadly, after about 4-5 years of trying the natural way and a failed round of IVF we have had to accept we can’t conceive without help. We have spent a lot of time considering our options, because it is a huge decision and not how we thought things would work out. But time feels like it is marching on, and we are getting older. We really want to have a child and the only way we can do this is with help.

We did consider adoption but decided that it wasn’t for us at this time.

All these matters have been coming to a head this month and we are feeling a bit worn down by it all. However, the light is at the end of the tunnel and I think we can make it. What can I say? It never rains but it pours…

We have done a few cool things in the meantime such as going to see Book of Mormon which is both hilarious and offensive. We also saw a screening of the Wickerman where people dressed up and sang along… this was my friend’s idea!!

We also managed to do a nice hike in Hertfordshire with a pub lunch. I also hosted a Sunday roast at home and also, we had a friend to stay for a week. So definitely not all bad.

Investments

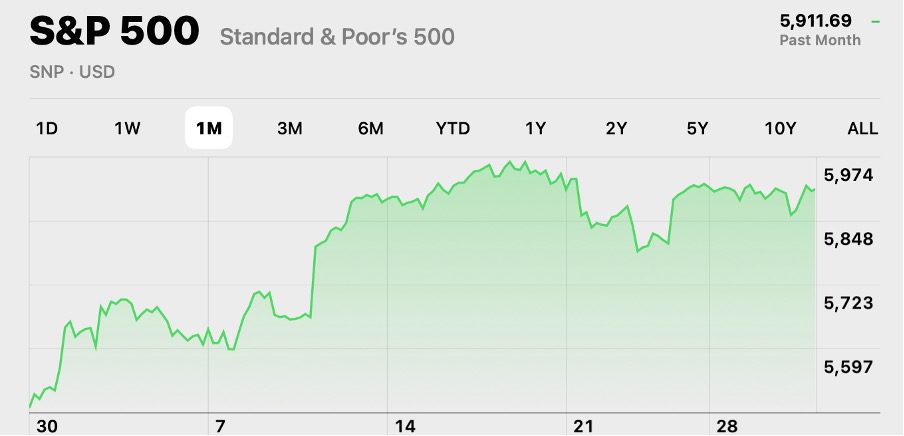

The markets surged back from the Trump tariff induced mini crash as you can see in the chart below.

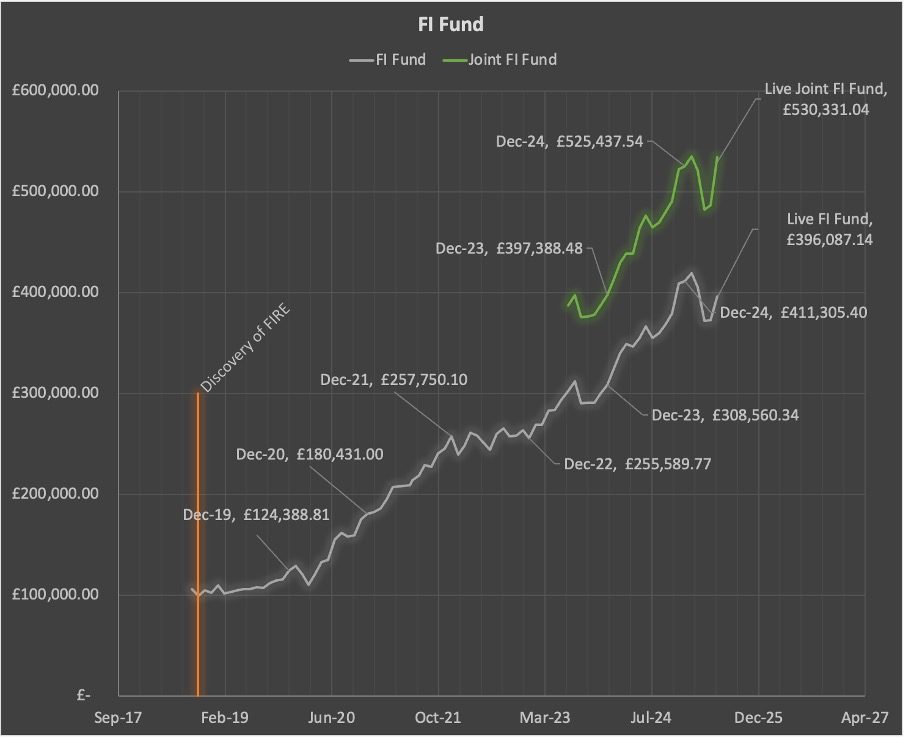

Net worth was up from £721k in April to £769k (+£48k) at the end of May.

The reason for the large jump is twofold. One was the sharp increase in the stock market. The Second was that Mrs Wealthster got a pay rise and passed her 3rd year of service in the NHS which increases her pension entitlement substantially.

For the NHS pension value in my NW calculations, I have assumed that the annual entitlement is multiplied by 25 to reflect an equivalent value. 25 is the magic number by which you multiply your expenses to get your FIRE number.

The joint FI fund has reached £534k, up (£47k) which includes the jump from the NHS pension entitlement.

Spending

As mentioned above we spent around £7k on fertility treatment this month. I expect a further £8k to be due in the next month. I am considering using my interest free Monzo flex credit card to pay for part of this to reduce the impact on my savings. I can’t see anything wrong with doing that to spread the payment out if its interest free. I will have to pay it back within 3 months to get the interest free deal.

Otherwise eating out was higher because we had a friend visiting from Australia and we went out to dinner a few times more than normal.

Other than that spending was generally lower than usual overall.

My savings rate was minus 31% because I took out money from my ISA to pay for the fertility treatment. This is something I feel strange about because I’ve for so long forbidden myself from spending money from the ISA. However, this is also real life and an investment in our family and is extremely important to us. So, I’m just grateful we have that pile of money available.

I’m sorry about your Mum, sounds super stressful with a lot of pressure on you. You got this, though!

Good luck with the fertility treatment. Remember that you’ll always miss the life that you could have had, the grass is always greener, yada yada – if it doesn’t work out, embrace your other life – our baby is 8 months old now and there hasn’t been a single day where we haven’t missed our old, childless life. But then others (and us as well probably if it didn’t work out,) miss the child-life they didn’t have. FIRE almost has no meaning for us now, as looking after him is a full time job, just when we got enough money to start enjoying it 😀 Of course, it gets easier (they say…)

Thanks mate. Yes it’s been a lot. Feeling a lot better now! I’m sure we will miss the child free life but man does it feel crap not being able to have a kid when you want to. Fingers crossed it will all work out.