Intro

After a two-month absence from blogging, I have finally managed to get round to giving you an update. My absence can be explained by the fact that Mrs Wealthster and I were getting (and got) married, which took up a considerable amount of time. Secondly, I was under the Kosh at work and, as of last week, had worked about 15 days straight, pretty much from 9 am-11 pm most days. Thankfully the case I was working on settled, and now when I thought we would have a hearing this week, I am twiddling my thumbs at home (very gladly, might I add!).

Wedding

Our wedding date was in mid-June. It was a fantastic day. We limited the ceremony to close family only, and I also had a best man there. In total, there were 12 of us. After, we had a meal at a favourite local restaurant with everyone who was at the ceremony. After dinner, we went to the local pub and had a nightcap. It was such a happy day and all within about 3 miles of where we live. I will write a piece on our big day and what we spent etc., as I think it was quite an unusual way to do a wedding. Neither of us wanted a big wedding, and the thought of spending tens of thousands on a big wedding was unappealing. We decided to limit the size of the wedding but not to put any limits on what we spent. I haven’t fully worked it out, but I think the whole thing cost us about £4000 (including rings which cost £2000).

We had a week off after the wedding and basically hung out with family and friends and showed Mrs Wealthster’s family and my best man and his partner around London.

It was quickly back to work, and, as mentioned, it has been a brutal two weeks.

Anyway, the next step will be to go on a honeymoon. We haven’t planned this yet, and it’s exciting to be picking a place to go. More on that later.

May 2022

May was peppered with bank holidays, and I particularly enjoyed the long Jubilee weekend, which was spent catching up with friends and drinking too much. We managed an escape to the lovely Surrey countryside for some walks amongst the forests. Other than that it was a very London-focused month for us, and we haven’t really left London much since Easter now. Although, Mrs Wealthster (or Ms as she was) spent the long week in Tenerife at a yoga retreat. I opted to stay in London as I supposedly had another hearing taking place, which was also settled.

BST festival

We booked tickets some time ago to the BST festival to see The Eagles and The Rolling Stones. Both concerts were great, but the Rolling Stones blew me away. Unbelievable energy considering their ages. Both bands were supplemented by younger musicians who brought the energy levels up. Great to hear classics like “Hotel California” and “Desperado” live from the Eagles, and of course, amazing to hear the greats from Jagger, Richards, and Wood.

Leasehold

I have talked previously about the perils of buying leasehold property in the UK and being the unlucky owner of such a property; I have endured a long period of woe. The landlord of my building, for years, has been charging unlawful service charges. However, we are lucky in that we have some people dedicated to fighting these charges. After two court cases and then a wait of over three years, some (failed) defamation lawsuits from the landlord against these people, the landlord finally refunded me £14,292. I will add that this ridiculous situation has taken millions of pounds of legal fees to win. The landlord even tried to charge the leaseholder its legal fees as a service charge when it LOST the case against the leaseholders. I, for one, haven’t paid a penny in service charge for four years now, and nothing has happened. Why? It is because I never owed them what I paid, and they can’t enforce it. Finally, that money has been refunded to me.

We have made another court application which will hopefully bring the landlord to its knees. There are still further fees that have been ruled unlawful that I have paid and am owed.

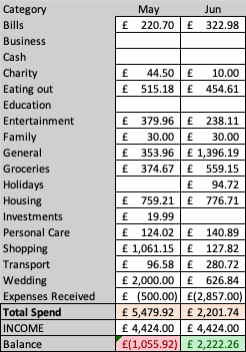

Spending

All the above happiness contrasts heavily with my finances! It’s been a free-spending month, and, having to absorb wedding expenses, taking taxis with relatives and guests, and having a week off in London was expensive.

I have been somewhat dreading this month’s spending update as I expected it to be huge following the wedding and the expenses there. However, this was just not true and probably shows the value in doing these monthly updates as it gives me the truth about what happened rather than the narrative I construct in my head. Thanks to the wedding being small and some of the costs having already been paid in previous months, the spending involved on the wedding was minimal (£626).

Mrs Wealthster’s father kindly paid for our wedding meal which I suspect the bill was about £800. Also, Mrs Wealthster and I split a lot of the costs of the wedding, which was great too. Least of all her bargain of the century which was a second hand wedding dress she got for £10!! Let me tell you I was concerned about this but it really was a fantastic dress and she looked stunning.

My spending in May included a new Samsung 50-inch TV for £699. I traded in my 11-year-old TV and got £150 off, which I thought was very reasonable. The reason I upgraded was that following getting the PlayStation 5, it was clear that the old telly was shot. I must admit I really like the new TV. Such an improvement, and when gaming, it is a massive improvement (not that I get much time to game!).

We also bought some wedding rings which came in at £2000 for a platinum and a white gold wedding ring. We probably overpaid for these, but I wanted quality and went to the Mayfair jeweller where I bought Mrs Wealthster’s engagement ring.

I almost forgot to add that I sold a bunch of things on eBay which raised a total of £450 which also helped offset the spending spree. I sold a broken playstation 4 (£100), a set of hifi speakers (£240) which i bought for £300 in 2006, an old Canon digital camera I never used (£70), and some PS4 accessories (£40)

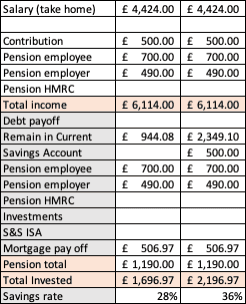

Savings

After the unexpected savings this month, I have a bunch of cash in my current account which I should really stick into my ISA. I will probably put a portion in there asap.

Investing

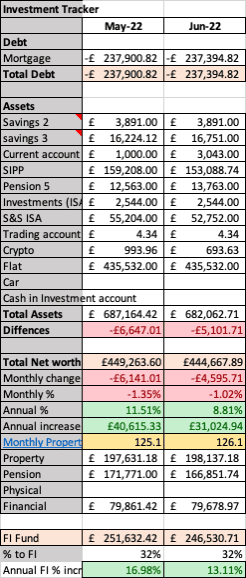

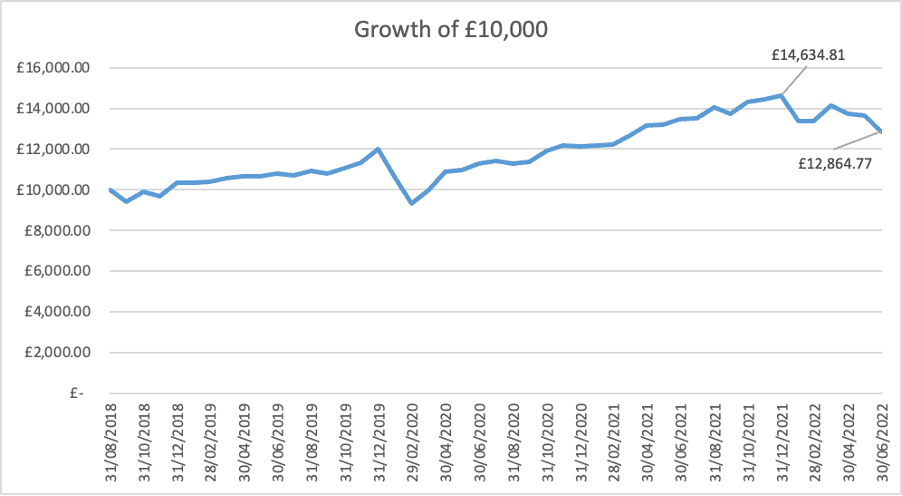

Now for the really depressing part. The markets have been going down and then down some more. This is where the quotes from Rothchild, “Buy when there is blood in the streets”, come in handy. I must remember that this correction is, in theory, a buying opportunity. It doesn’t mean that I’m not fearful or uncertain (I am) or lazy (definitely). It’s just in practice, plonking a big sum of money into the markets, which have been falling for five months, is scary.

I decided to sell my Tesla shares mainly because I bought them as a ‘punt’, and that punt appears to have ended with them gaining huge amounts and then crashing back to earth. I sold them before they ended up under what I paid and settled for a 7% profit. This was prompted by Elon Musk apparently going insane by entering and then pulling out of the deal to buy Twitter. I lost faith in him, so they had to be sold. I replaced them with good old $VUSA, which also allowed me to transfer them to my ISA as my broker wouldn’t let me buy US equities in my ISA.

Other than that, I have done very little. The combined time pressure of work and the wedding preparation as well as the sinking markets, has meant I have put off buying any further investments (yes, I am finding it hard to follow through on investing). I am going against my principle of dollar-cost averaging out of laziness and distraction more than anything else. Plus, it doesn’t feel good putting money in only for the market to fall as I did earlier in the year, so I think subconsciously, I am avoiding being proactive and making excuses. I must work harder to change this and buy whilst there are bargains out there.

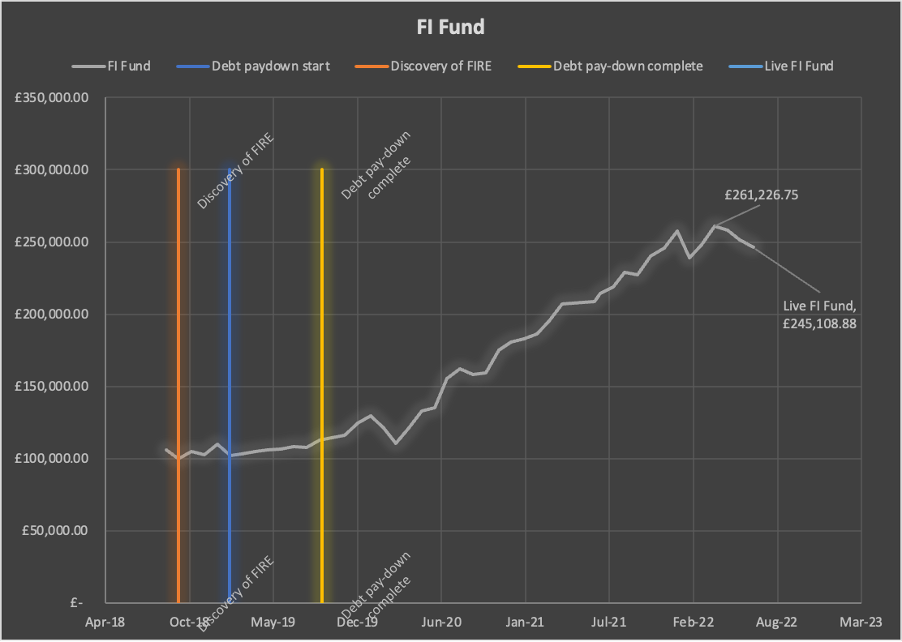

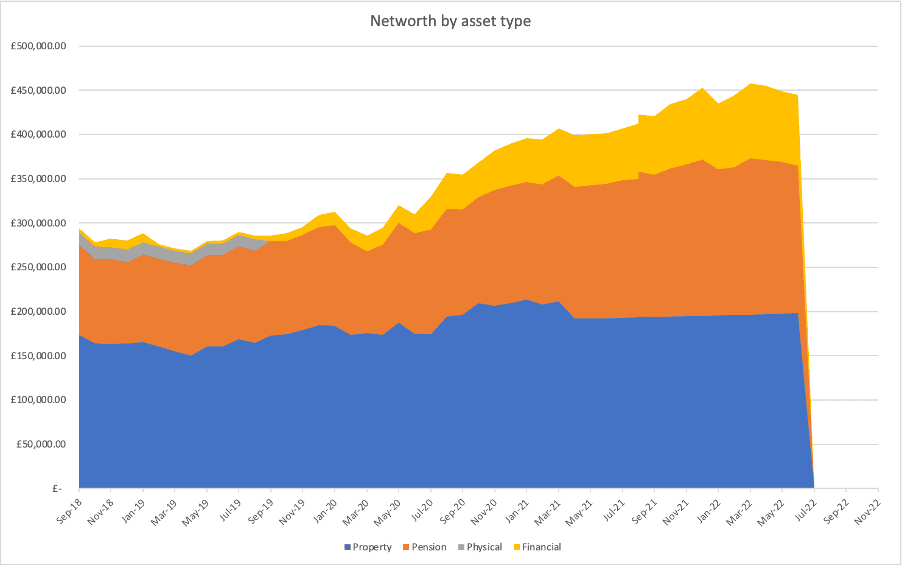

My FI fund peaked at £261k and now is about £245K. I think I have invested around £14000 this year, and it has all “disappeared”. This isn’t strictly true as I’ve only “lost” the % since investing it which is max 20%, but It makes it hard psychologically to keep doing what I’m doing. I do think long-term, but it’s still hard. I must treat this like an elastic band where I’m building up a lot of tension ready to release when the market rebounds. I must remind myself of 2008 when the markets took a long time to crash and recover, but if one had invested during that time, one would have done very well for themselves indeed. Even the recent 2020 covid crash was (still) an excellent buying opportunity and I’ve no doubt that in 2-3 years we will think the same of this period.

There was a time in my life when losing £14,000 would have been devastating. Now, I’ve barely noticed. I think I am extremely lucky to be in this position when there are stories of people using food banks, so I will not complain any further.

Anyway, I have increased my cash position as I have saved money (unexpectedly), so I’ve got some powder ready to go. What am I waiting for? Nothing. I’ll get on it.

Congrats on your nuptials – great to hear that it was a frugal and fun wedding! Mrs Wealthster’s dress – what an utter bargain!

Thanks Weenie! Yes it was a steal! She is more frugal than me!