October was unseasonably warm and as it is also my favourite time of year, extra enjoyable. I love it when the leaves turn to brown and the temperature cools to that perfect not too hot, but not too cold level. If I could live in perpetual autumn, I would.

However, in stark contrast to the pleasant climate, the markets have been in a state of high alert. With the disastrous Truss/Kwarteng budget, and the changing of the Prime Minister after only six weeks, it just seems like we are in a very strange time. Liz Truss was sunk by the Bond Markets because they didn’t believe her foolish plan to cut taxes and increase spending would work. We all know with our own budgets that this would lead to debt and possible disaster, so it seemed rather obvious that risking the same with the entire nation’s finances was idiotic and dangerous. I for one am glad she is gone.

Thankfully, to give us some respite from the chaos in the news, we managed to have a lovely week in Portugal and Spain. We flew to Porto where we splashed out on a nice hotel and spent a couple of days enjoying the city and the hotel spa. I highly recommend visiting Porto. It is a stunningly beautiful city, and it has a lot going on. One of the highlights was taking a trip to a suburb called Matosinhos which is home to Porto’s major fish market. We were too late for the market itself but were just in time to get a table at one of the many fish barbeque restaurants. We selected a place at random and it worked out great. We ordered a red snapper, and they brought it to the table for us to examine before cooking. The fish was prepared with only salt and lemon and cooked in front of us on a BBQ and was possibly the best fish I have ever tasted.

After Porto, we drove to a small island in Galicia called Illa de Arousa where we stayed in an Air BNB for the week. The purpose of the trip was to do nothing and to go somewhere that would make this possible. I must admit to doing zero research on the location and was swayed purely by the dreamy modern apartment which overlooked a small forest next to the beach. It was a very scenic island with a nature area and small town along with a working sea and fishing port. It meant a lot of sitting around interspersed with walks around the coast of the island to various bars and restaurants to eat some local seafood. We did a day trip to Santiago de Compostela (beautiful and full of pilgrims) and to Pontevedra (possibly interesting town but we arrived just before siesta!). All in a very relaxing holiday even if I did have trouble relaxing to some extent.

I also had a boy’s trip to Edinburgh for a weekend which, as you might imagine, was boozy.

Spending

It was very big spending month thanks to the hastily organised holiday. As this was technically our honeymoon, I didn’t mind a bit. We also made a large purchase of a new sofa which put a considerable dent in the monthly spending. It is partially funded by gifts of money from our parents, but we still contributed.

I have also noticed a decrease in groceries costs which I can’t explain other than perhaps I was on holiday for a week so spent that money not on groceries. Also, my travel costs have increased because I have started to use taxi’s more (and to get to airports this month) and more mainly because I am lazy and when going home at night, I view it as a safe option which seems worth it. This is lifestyle inflation in its purest form. However, as I have no car, I think that I can afford it.

Savings

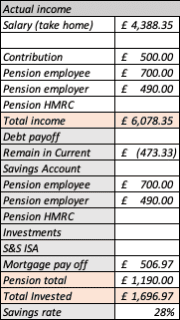

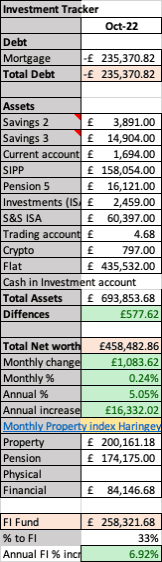

It was a poor month for savings at only 28%. I knew it would be bad thanks to the increased spending on both a holiday and the sofa. The silver lining is that thanks to my auto pension arrangements I will guaranteed save 28% even if I spend all my money.

Investing

Because I bought a sofa and went on holiday, I didn’t put anything into the ISA. I am about half way through the year and I’m falling behind with my contributions somewhat. I think I will be able to hit the target of £20k but it may mean raiding my savings.

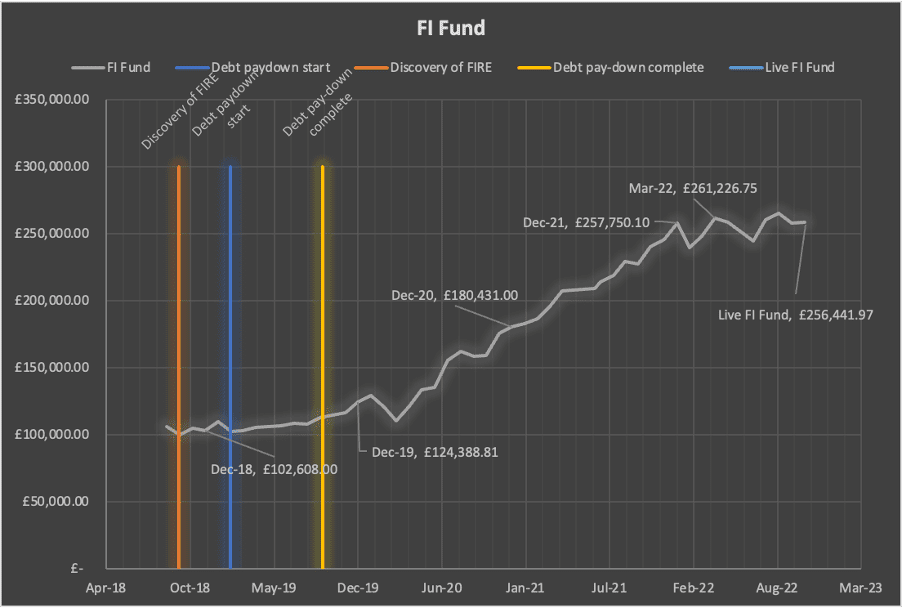

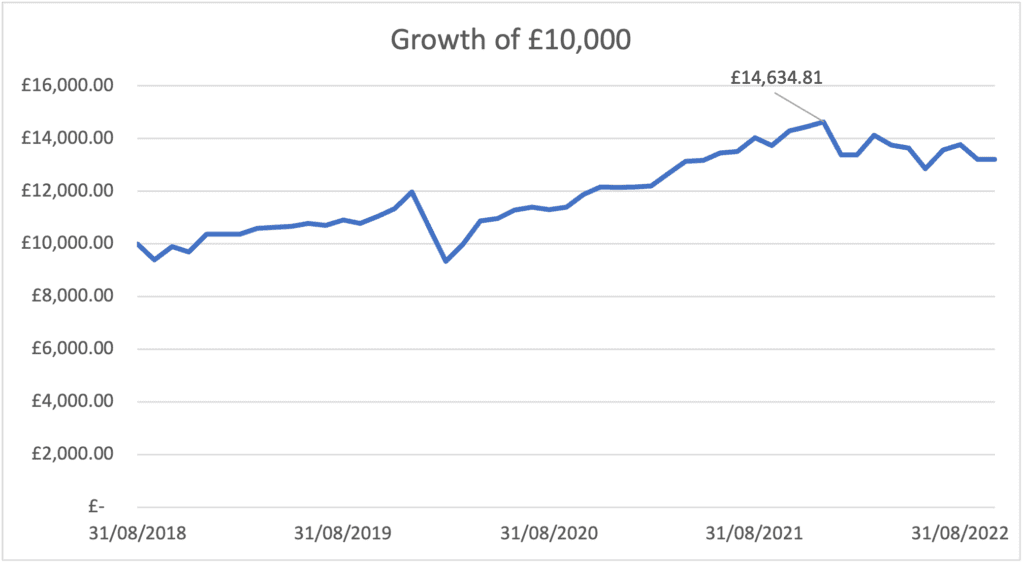

It’s a difficult time to be investing at the moment. With my FI fund largely going sideways, it can feel futile in some respects as I plough money in only to see the values dropping. However, I will keep on keeping on and keep buying these bargains.

I can’t help but feel I’m at the mercy of the markets (as we all are) compare to before where you would invest and feel like your efforts had made a difference. I have a feeling that we are not at the bottom thus far. Market corrections generally lose about 40-50% of the value from peak, and we are not there yet. Only time will tell but with the Bank of England predicting a two year recession I can’t see things improving for a while. With the Fed and BoE raising rates this is likely to have a negative effect on markets.