September was thankfully quite a quiet month. I was into my third month at my new job. My finances were coming under control once again. We managed to do a few cool things.

We went to visit my mum in Scotland and also went to my sister’s 40th birthday. That was cool. It was a very small by fun affair.

We also attended the Open House festival. This is a London event where buildings and homes which are normally closed to the public are opened up. We very much enjoyed nosing around some lovely homes which people have done interesting things with.

We also celebrated Mrs Wealthster’s 10 years in London anniversary. The celebration included a tour of all the places she’d lived in London (Yes, as she is Aussie and Clapham Junction was on the tour) and end with a nice dinner at the restaurant we had our wedding celebration at. Lovely.

Last weekend we drove up to the Lake District and stayed near Lancaster. We did a hike up Skiddaw which is about 3000 feet high and very steep! The weather was perfect except very strong wind it was a great little weekend away. We also met a lovely American lady in the pub on Saturday night who was traveling around Europe on her own at age 71. Living life to the fullest.

Investing

Again, no investing in September as I’ve been focusing on rebuilding my emergency fund. I have felt the squeeze these past few months but things are beginning to relax.

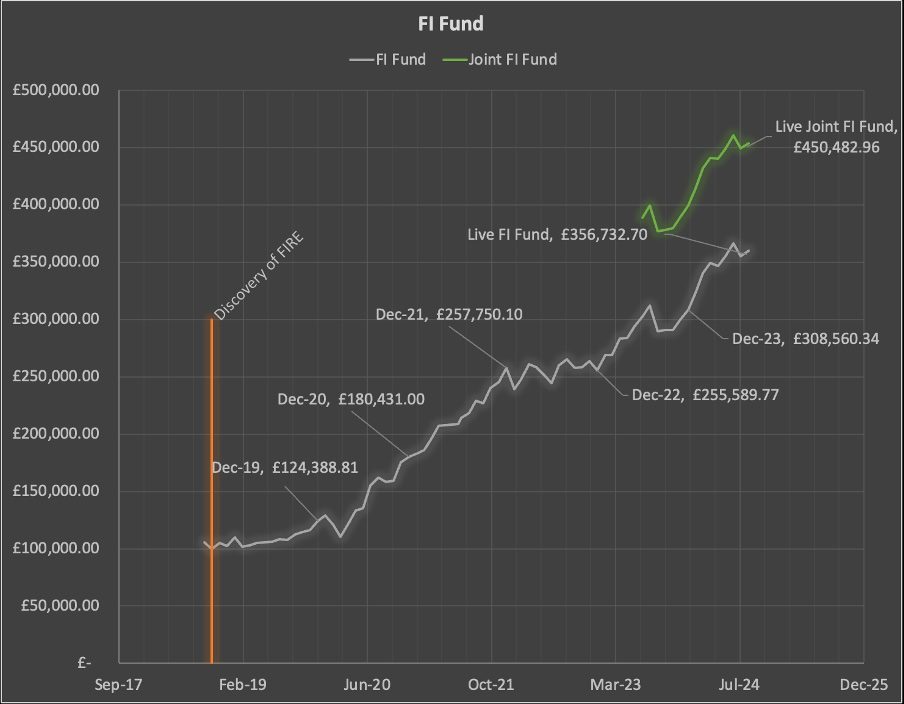

My investments have done very well these past few months. There were a few dips in the US markets in September which felt worrying, but they rapidly recovered to reach record levels.

I also transferred my old work pension into my SIPP. That was £46k which I invested in VWRP.

The other thing that boosted our networth was my realisation that I’ve been underestimating the value of Mrs Wealthster’s NHS pension. This has added about £15k to the value now I am correctly calculating it.

The annual payment is calculated by multiplying number of years service x salary x 1/80. I then multiplied that by 25 to represent the safe withdrawal rate that I use to calculate my FIRE number. This itself is based on the long tested 4% withdrawal rate which is 25 times your annual expenses. So i multiplied the annual value to get a theoretical value.

I have back calculated the networth and FI fund values to account for this as this so the numbers are higher than previously published.

As of today, 14 October 2024, we have reached a net worth of £728k which is $950k. This was possible due to the increase in value of nearly £10k from 1 September to 30 September from the bull market, and a further £13k until today.

The weird thing about the bull market was that for a time it was almost entirely offset by the increase in value of the pound. My dollar value was increasing but my pound value was almost static. However, this has now resulted in a substantial increase in our net worth.

I am holding off making any decision on what with my new work pension until we hear more about the budget from the government. There have been various voices saying that the pension tax rebate was being abolished. Then it was said that this wasn’t happening.

There are also a lot of shrill voices, I think covertly funded by various billionaires, that are suggesting capital gains tax will increase. I’m not worried about that and neither should most people as only 350,000 people actually pay capital gains tax in the UK. All my investments are in tax shelters in the form of ISAs and pension so it won’t affect me in any event.

So I’m not going to speculate until the budget is announced. I do think the government has left it too long to release this information but there we go.

Spending

I am now tracking my spending using Monzo. I was using the app Emma but I found that it was becoming unmanageable. The app started as an expense and budgeting app and it has now become more. Good for them. But I don’t need all the other stuff and I’ve found it harder to use. It also costs £59/year. Monzo costs £3/month (£36/year) to do what I want it to do. So after many years of using Emma, I’m changing.

Monzo also allows me to auto sort my salary into pots which lets me actually stick to my budget. You put all your salary into a pot and it sits there until the bill is paid. It gives you some peace of mind for sure. I think this is neat and will keep you updated on how that goes.

Spending was much reduced in September and I have a large surplus (£3k ish) which I’m using to replenish my emergency fund. I foolishly decided to invest my emergency fund into my ISA thinking this would be fine. It is not fine. Do not do this.

October spend will be reduced too, however we are going to Vietnam on holiday at the end of the month, so I expect a little bump up. Although, I have paid for a lot of the holiday up front before I’ve gone. So that is a good feeling.

I haven’t added this up yet as the month is yet to complete.

Anyway, hope you enjoyed the update. Ciao!