It has been several months since I graced this blog with an update. Why have I not done this? Simply, I’ve been very busy doing real life things. That included working a lot, having friends break up, a health scare for my mum, having the in-laws visiting for 6 weeks, the death of a friend’s parent, going on adventures in my new car, and generally being lazy or tired when I did have time.

Life updates are I’m still sober and enjoying it. It’s now been a full year since I gave up. I didn’t intend to stay sober this long but here I am.

July

We had a trip to Italy in July for our friend’s wedding where Mrs Wealthster was a bridesmaid. This was a lot of fun and in a beautiful location near Naples. There were a few bridezilla moments but other than that it was fantastic staying in a beautiful Italian villa on a hill side. We visited Pompeii, Naples, and the Amalfi coast. It was stunning. Would recommend.

August

I had my 40th birthday in August and had a few friends join me at the pub to celebrate. I stuck to non-alcoholic beers. Crossing this milestone was a huge deal. In someways I’m amazed I got this far. I used to lead a fairly hedonistic lifestyle and take some risks so yeah, happy to have made it to 40!

I bought a new car. My dream car infact. We took the new car down to Somerset and stayed in a lovely Airbnb for the night. Got a nice taste of country life.

September

September saw a huge achievement at work where a project I’d been working on for nearly a year was a success. My reputation at the firm is the highest it’s ever been. I feel like this would not have happened if I’d kept drinking. Hoping this translates to money somehow. Things looking on the up.

Sadly, that month we also had our friend’s father pass suddenly whilst out on a bike ride where he suffered a brain aneurism and heart failure. All very sudden and sad. Makes one consider that time is very limited in this life. Can you spot a theme in this update?

I went to Lille with some pals to watch one of the rugby world cup matches (Scotland v Romania). It was a tremendous success for Scotland and well organised event in a beautiful and charming city. Also a good test of going on holiday with some mates and remaining sober. I enjoyed it immensely and can fully remember the entire trip!

October and November

We had the in-law’s visit and stay with us on the newly constructed murphy bed. We visited Scotland and showed them Edinburgh and where I’m from.

I was also heads down for work as the success we had led to our client giving us a new assignment in a very short time.

All mixed in with that Mrs Wealthster has been undergoing IVF treatment which is to say the least very difficult on her. Sadly, it was not successful. I am grateful that the NHS is funding this. It was far more difficult and stressful than we could have imagined in parts, but also much easier in other respects. It is now looking unlikely that we will be able to have children. That is quite sad.

December

I’ve just survived the office Christmas party without touching a drop of booze.

We squeezed in a trip to the Lake District, staying at Kirby Lonsdale with some friends I hadn’t seen in years. It was great to catch up.

The month ended with a trip to California to San Francisco and Lake Tahoe with some other friends who we hadn’t seen in ages either. We spent Xmas in and NY over there. We went skiing at Northstar, Heavenly, and Kirkwood. I think that Kirkwood was the best for skiing, and Heavenly was the best for scenery. All in a very good holiday and well needed after a stressful few months.

Purchases

In August I bought a very expensive car which I was really on the fence about doing, what with me being a personal finance blogger and all that. I sold some of my investments to buy it (£10K) and I borrowed some money too, and used money I had specifically saved for this purchase, and *gasps* used some of my emergency fund. Mrs Wealthster also contributed to the car purchase too. It all felt like a bit of a squeeze at the time and that was a feeling I had not experienced for a few years. It also came on the month where my mortgage payments increased by £400/month. However, once the initial costs were overcome, it has proven to be both well within our budget, and an absolute pleasure to own. I have driven it to Scotland twice and France once. It has been my dream to own such a car for the past 20 year and it has not disappointed. I love it. Mid-life crisis much? Maybe. Regrets? None. Why? Because I’ve gotten myself into a financial position where I can afford it and it won’t ruin me financially as it may have in the past. Also, the vehicle is a 4×4 and such that it can be used for camping trips and for going on adventures. This is something that I feel like as I age i will either be unwilling or unable to do so this is why I think it is worth buying. I love it!

Investments

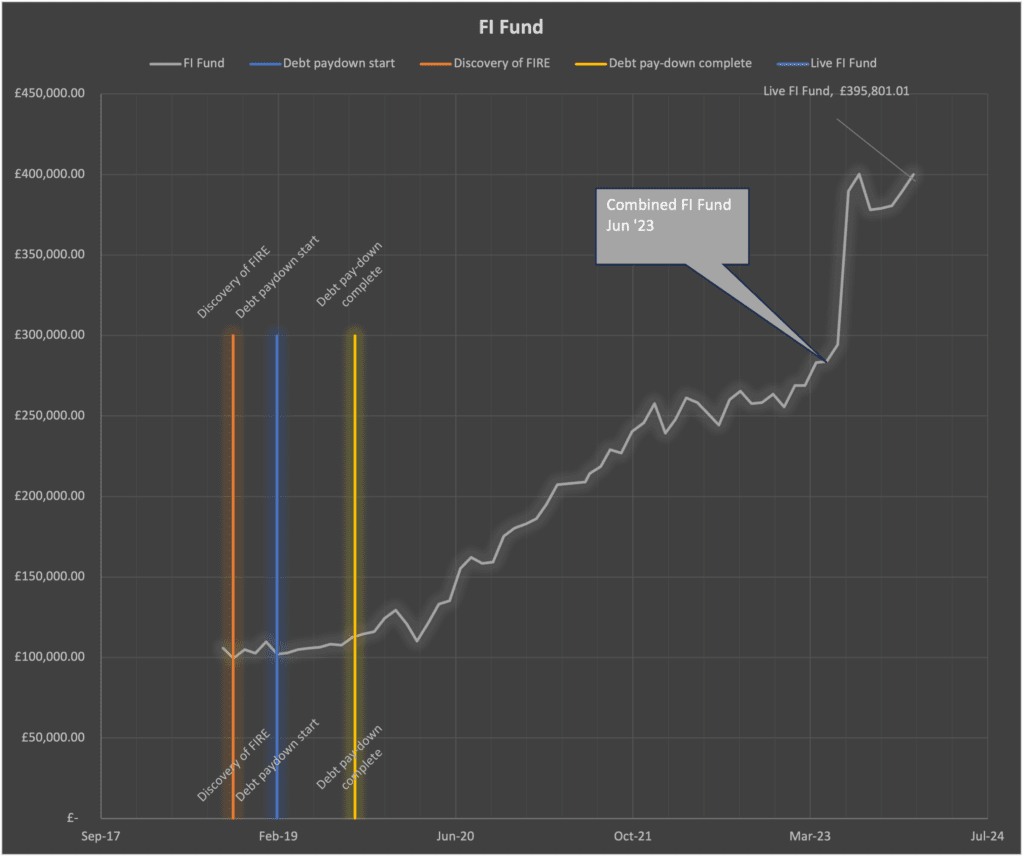

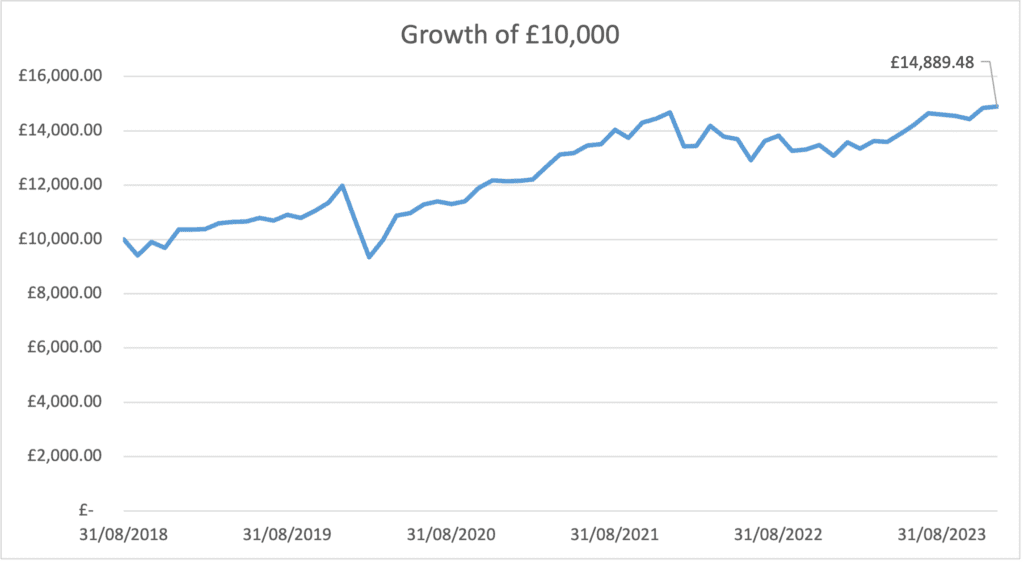

Perhaps it is good that I have not reviewed my investments in detail for 6 months. Taking money out to buy the car was extremely painful and I didn’t want to look for fear of reminding myself that I may have made a financial folly. Now through the passage of time, it has become apparent that this purchase did not financially ruin me, and that my investments are still growing. The growth has almost entirely replaced the money I took out to pay for the car in only 5 months. My contributions are lower whilst I pay down the loan but I’m hoping my bonus will allow me to top up my ISA. I also have been prioritising building up my cash savings to have more available in case of emergency or some kind of repair to the vehicle, rather than investing. I don’t expect to reach the £20k ISA limit this year and that’s OK.

The good news for me is that whilst I was not giving full blog updates, I was still tracking my investments.

The S&P 500 has been doing exceptionally well the past few weeks. This has made things seem a little better and when I reflect that it has grown 26% in the year it is surprising. Just goes to show you should keep investing. I feel sad that I have not been investing much in the past few months, but that will start again as my emergency fund reaches its target. Mrs Wealthster has been diligently investing in her ISA and pension. I have kept up my pension investments.

Spending

Spending went wild in August where my mortgage increased by £400/month and I now have a personal loan payment. My average monthly spend for the year was £3300/month all in. This did include holidays and some joint expenses throughout the year. A total of £35,785 spent in the year. This increased from last year but this was a deliberate decision of mine to spend more money. I was saving 70-80% of my income. I am now around 35% which is absolutely fine. I’ve averaged 49% over the year. As I hit 40, I want to strike a balance between living and saving money. Some things I may not be able to do in 10-20 years time so I’m doing them now (skiing for example). Also driving adventures in the car.

I will do an annual review soon. Watch this space!