June brought us some hot weather making it the hottest June on record. We’ve had some glorious sunny evenings and weekends.

It was our first wedding anniversary, and to treat ourselves, we went for a “Banya” at a Russian Spa in London. I can thoroughly recommend it. The process involves a steam room followed by a deluge of icy cold water. Then you wait in the lounge until called through for your Parenie. A Parenie involves being struck with Oak leaves on your back and front by a Parenie specialist, which is a rather invigorating experience. You then quickly enter a cold plunge pool, get out, and sit to relax. We then had some Russian food and then a proper massage. We then all entered the steam room again for one last blast. I think it was a great experience.

We also had my mother and sister visit. They were going on a cruise around the British Isles. This was the culmination of a long saga as my mum bought a cruise in January without discussing it with anyone. Unfortunately, my mum’s ambitions versus her ability to look after herself are not aligned. Our trip to Australia with my mum revealed that her health is declining. Combine that with 30 years of bipolar disorder and regular moments of confusion and hallucination, this is not an ideal recipe for a solo cruise. Luckily my sister agreed to go with her, and I paid £500 towards this.

The cruise was a success, and they had a good time. My mum probably did about 50% of the activities, which was good for her. The good thing is that she has accepted that she cannot go on such holidays alone, so I hope she won’t spontaneously book any further trips.

I have also spent much time building a Murphy bed, a folding bed, for my spare room. This will allow the room to be used as an office and a spare bedroom. Progress was good, but I have been struggling with the final 5%, as is common on most projects. Simply, the size of the room is so small and I use it as an office, so can’t finish without a clear few days where I don’t need it. It will have to wait until after we come back from holiday.

We had a friend’s 40th birthday party at his house. Also, we visited friends who have recently had a baby who unfortunately had to have an operation on his heart. It must have been highly stressful for them, but he has pulled through and recovered well.

I was treated to a boat trip on the Thames from my boss’s house. He lives in a large house backing onto the Thames and took us and some clients out on his boat. It was fun. Also, it gives me hope that I will earn the vast sums he does.

In wider news, people have snapped out of their collective denial that house prices will be fine. Also, Russia had a suspected coup. None of these things, however seem to have negatively affected the stock markets. The month has been extremely good and my assets have reached an all-time high (even if the markets had not).

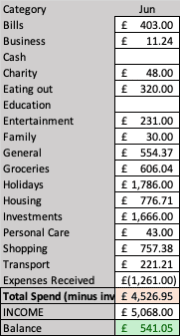

Spending

Spending remained high again this month. We bought some tickets to the USA to spend Christmas in California with our friends. It was so odd booking something so far in advance, but It has its advantages. Only £700 return to San Francisco. I thought it was a bargain. We must pay for the accommodation in November to save up for that. The accommodation is not such a bargain but this is because the UK is a poor nation now in comparison to the USA.

I had to buy a suit for a wedding we are going to in Italy and of course pay for accommodation there too. Our friends rented a villa where we will stay for six nights. The price was a mystery for some time until last week. It will be £350 each. Another bargain!

I was also spending money on the Murphy bed. No more wood this month, but more bits and pieces and tools. I figured that as I’m still not drinking that I will still be spending less, so it didn’t matter that I spent money on this stuff.

All in this is the highest spend of the year so far, but as it includes two holidays, I’m not feeling too bad about it.

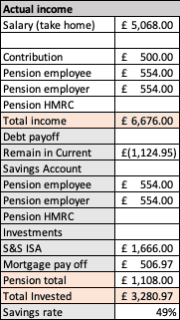

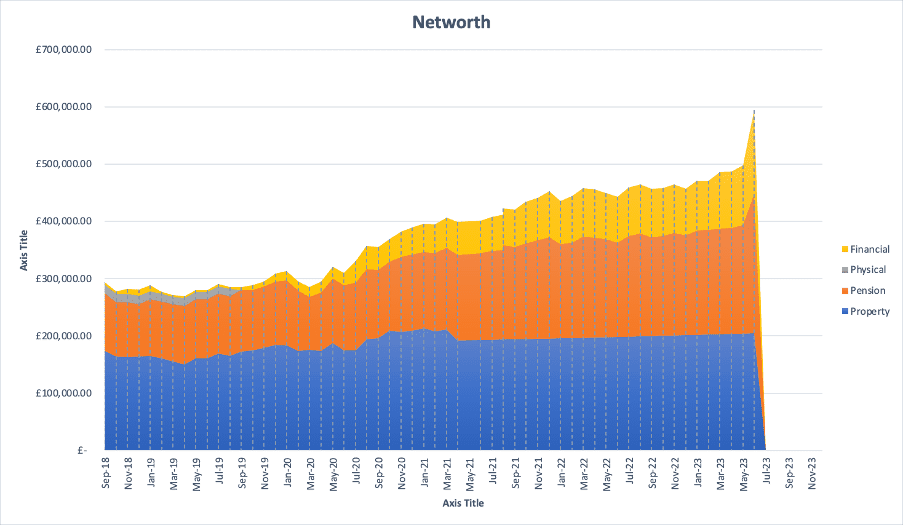

Savings

Another month of 49% savings rate. I find this strange sometimes as I felt I had spent more this month, so the savings rate was bound to be lower. However, that’s not how it works. If I auto-save this money each month, it is saved and counts. What you spend has no bearing on the savings rate. It is a proportion of earnings and savings only.

Investing

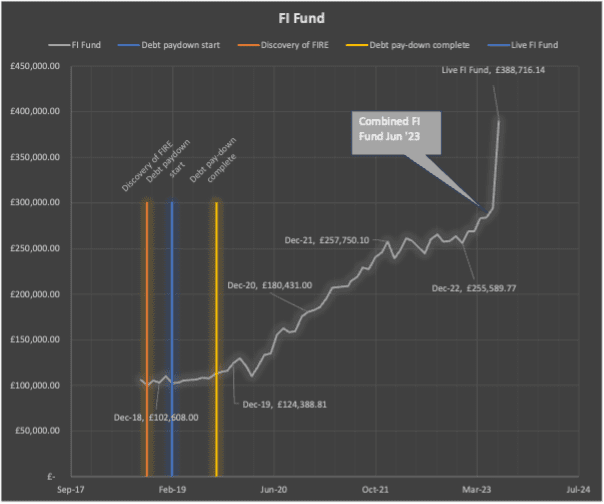

I’d say this was the best month that I can remember in a long time. Not only that, I have combined Mrs Wealthster’s assets and mine. I thought, seeing as we have been married for a year, that this was long overdue. It has created a spike in our finances, but that’s ok.

Alone, my FI fund had broken through £300,000, although now that has accelerated to £388,000 with the combined Fi fund, now knocking at £400,000 soon. The funny thing about these milestones is that you are desperate to get to them, and then once you pass, it’s onto the next.

Now with the combined assets, we are at £594k, which is amazing.

Interesting observations are that Mrs Wealthster has had an NHS pension for the past year. We were working out its value and found out that her 9.5% contribution is complemented by a 20% contribution from the NHS, which is astonishingly high.

She also has a fair bit of cash, an ISA that she pays £400/month into, which has grown over the past 2-3 years, and some money in Australia that is probably not making anything as it is in cash. We need to sort this out and invest it.

All in a bumper month for the finances, and I’m super pleased to see more gains after the past 18 months.

Interesting that you are describing booming markets – from my perspective everything has been as flat as a pancake for 2 years with little signs of any sort of growth.

Most of my investments are in the S&P500 and that is up 16% YTD. I pivoted away from the U.K. markets a couple of years ago and don’t regret it. It’s still technically down from 2 years ago but this year has been good. I’ve been dollar cost averaging in all this time and now seeing the growth.