After a fantastic start to the year of our Lord 2022 (mainly because I was chilling in Australia) we had a rude awakening upon our return to London. First, there was the rampant Covid outbreak still going on in London. Second the utterly dreary weather and long nights, and third the stock market took a plunge.

As I had been on holiday, I’d left £2000 in my S&S ISA account ready to invest because I was idle about investing it. Upon being paid on 10 January, I plonked another £3000 into my ISA and duly purchased £5000 of VUSA the S&P500 ETF. I’m only £2400 from maxing my ISA for the year so that is one positive. Shortly after buying, the index began its rapid decline. We are currently about 10% off the peak and into correction territory. Would I have preferred to have not bought £5000 in that ETF? Yes. Could I have known this would happen. No.

My policy has been to dollar cost average into the stock market, and I have been decent at sticking to that. So, this is one of these things and although I’ll have missed some bargain stocks on sale, all I can say is c’est la vie.

Other things that made January even more dreary was five days after my 24-hour flight back from Australia I got the illness that the family sitting next to us on the plane had. I clocked that they were passing around tissues and looked an unhealthy grey colour. As the UK had dropped its PCR testing requirement to re-enter, I couldn’t help but wonder if they had ‘it’. The illness was a rotten cold for a week. I didn’t take any sick leave, but I was also working from home, so it wasn’t too bad. It did remind me that there are other illnesses out there except the big one. Thankfully I’m better now and it wasn’t Covid.

I was sorely tempted to upgrade to business class on the way back from Australia. It would have cost £2000 for both of us for the longest leg and that might have made things more pleasant. In the end, we agreed that we could put up with economy class and save the money. I am grateful that I did this as I had a few unforeseen expenses which came up this month.

Holidays

After all that, Australia seems like a distant memory, but we had a great time. We stayed at a place called Lorne on the Great Ocean Road at a house which belonged to my partner’s sister’s in-laws. They are quite rich. The general situation with Covid was rapidly worsening in Australia so many engagements we had were cancelled. People are a lot more scared there as not many people have actually had Covid in Australia. I’m not saying it’s anything to be dismissive of but I’d say they are where the UK was in July 2021 in fear levels. Probably a good thing.

Anyway it was a great trip. It made me think about a lot of things including emigrating to Australia.

It was also a happy coincidence that FIREvLondon was out there too so we were able to exchange notes on our experiences. I love connecting to people through the blogging community.

Home improvements

The big expense that happened was I decided, more or less on a whim, to get rid of my gas cooker. I’d had the hob installed about 10 years ago when I had my kitchen redone. However, I’d become aware that it is apparently a very well-kept secret that gas cookers are very unhealthy for humans. They burn gas indoors and produce nitrogen dioxide and carbon dioxide to the point that the air quality of the average home is probably worse than the verge of the nearest motorway. In fact, the air quality levels would be illegal if they were outdoors. As someone with a partner who has asthma this was alarming.

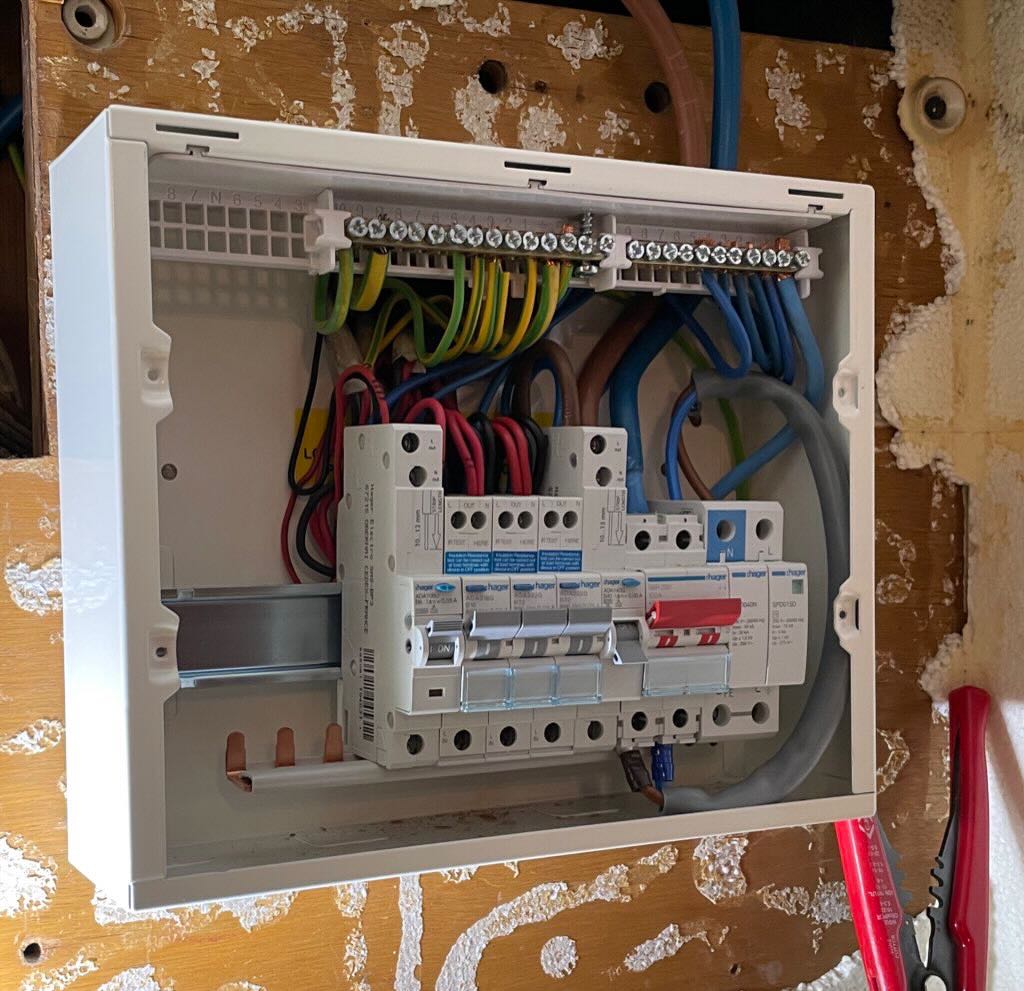

Her asthma has been playing up ever since the pandemic started and it occurred to me that this coincided with us working from home all day and cooking a lot more thanks to the lock down. As gas hobs are proven to worsen asthma it seemed insane to live a moment longer with the hob in the house. So, I decided to get an induction hob. Unfortunately, this required me to replace the ancient circuit board in my flat. I knew this was the risk, as when I put my kitchen in, I wanted an induction hob, but it was going to cost £1000 to re-do the electrics so I stuck with gas. Ten years on it still cost about that much to re-do the electrics. I also had to pay a gas engineer to disconnect the hob and cap the gas supply (it only supplies the hob).

All I can say is after only one week I am so impressed with the induction hob. It’s much better than the gas hob and I hope our indoor air quality has improved. Also the electrical safety of my home has exponentially improved with built in surge protection and RCD protection on all electrics. Of course, my wallet has taken a hammering as a result and in total I probably spent about £2000 buying the hob, disconnecting the gas, rewiring the flat, installing the hob power supply, and all the new kit.

The good thing is my flat is now able to be rented out if I need to. I don’t intend to sell my flat and if I move out it will be rented. So, this future proofs it from that point of view.

General

We spent a week being jet lagged and waking up at silly o’clock in the morning. I actually quite liked getting up that early and think I will try to continue doing so. I’m trying to get fit and in shape too.

Also, after I was over my cold I was able to enjoy a few beers in a Hackney pub. It was actually a great laugh and felt normal. Of course I was taking a risk with the Covid but I think I’m ready to make that leap.

We also went to the theatre to see “Ocean at the end of lane” which was excellent. Well worth going to see.

Now onto the numbers.

Spending

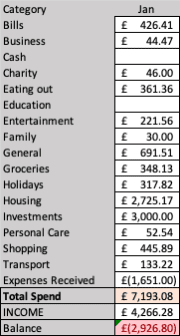

As noted above spending started as being ok on holiday as we stayed at my partner’s parents’ place. The parents also insisted on paying for most of our meals etc, so we spent very little in Australia. We also stayed with some very rich people too who also paid for everything. I don’t want you to think I was sponging but despite offering to pay every time it became embarrassing so I gave up.

The financial pain came from the cooker install but technically that’s an investment as it improves health and safety in my home. However, it took a raid on my savings account to pay for it all. I’ve spent about £700 on a new induction hob, and £1400 to do all the electrics etc. My partner generously chipped in a third of these costs.

I also bought a new toaster and kettle as I had been given a voucher by my employer of £100 in lieu of a company Christmas dinner. All together it felt like a high spending month.

Investing

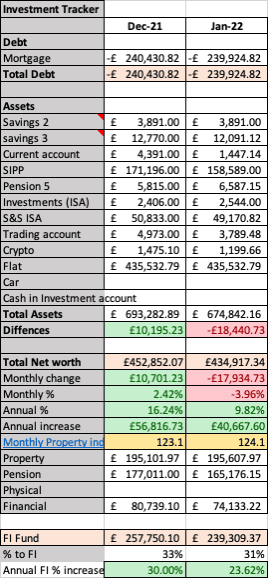

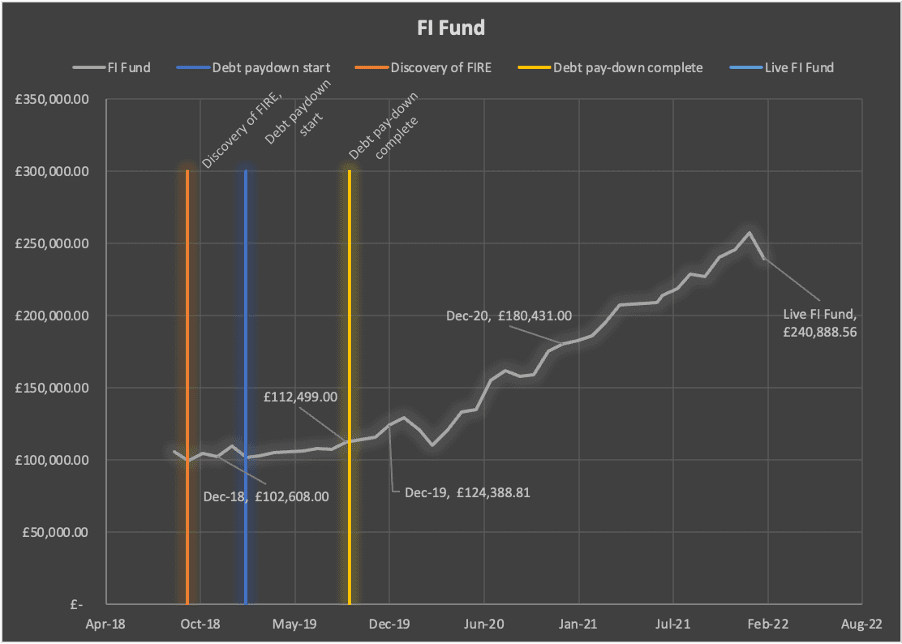

I have posted figures from December 2021 and January 2022 side by side for easy comparison of the damage here. I’m down £18,440. This is painful and disappointing (especially as I dumped £5000 in just before the plunge in value). I took a similar loss in February 2020 when the markets plunged due to the Covid crash. I’m now sitting around the same value as I was in… October 2021. So, when it’s put like that, it’s not that bad. I’m aware that things could become worse. Inflation is rising rapidly, Putin is poised to strike in Ukraine, and the Fed is raising interest rates. It’s not looking great.

Let’s not forget that interest rates are at a historic low. In the 1970s and 1990s they were up above 11% annually. I don’t personally believe this will happen as it will cause many people who have large mortgages (i.e., anyone who bought in the last 15 years) to be in hot water. So, I expect they will creep up slowly over the next few years.

I’ve got to keep the faith and trust in the process of investing. There is no guarantee that the bull run will return, and we could now be entering an extended bear market. However, I am in no position to comment on this beyond a mere observer. I’m going to keep investing and hopefully pick up some bargain stocks.

I am in for the long run. I try to take a five year view on things and I think the chances of the market being lower in five years are low.

Let’s hope for a better month in February. Until then, the beatings will continue until morale improves.

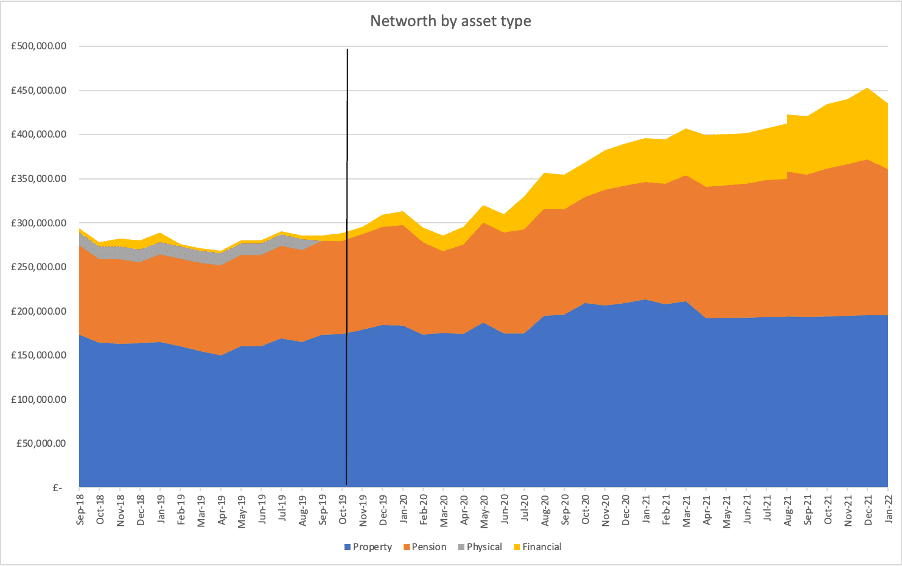

Look at that steep decline… not fun! Similar dip in NW below.