During the week I watched the film “Hot Tub Time Machine”, which if you haven’t seen, is a 2010 film about three middle aged men and a nephew who unintentionally go back in time. After all individually suffering various problems in their lives, they decide to go to a ski resort they’d visited in their youth and that they associated with good memories. However, much like with their lives, the ski resort is now rather dilapidated and not how they remember at all. Anyway, to cut a long story short, they get drunk, go in a hot tub, which for some reason turns into a time machine, and they go back in time and get to relive a crucial point in their lives.

Whilst that may sound like a dreadful movie (it’s actually much better than it sounds!), the film got me thinking. I’ve been doing FIRE for about 3 years now and I’ve made very good progress. However, there are always two things that bug me about my FIRE journey. Firstly, it’s that I started it at age 35, which is quite late. Secondly, I am acutely aware that when I think back to my youth I think “Goodness me! Didn’t I waste a lot of money?!”. What would have happened if I could have a second chance?

Going back in time

Now I’m a realistic person, so I’m not going to assume that I would establish the next Google or whatever, but what if I assumed that I lived the same life, but made better spending choices? How would this impact where I am now? Also, how much longer will it take to make up for the ‘mistakes’ of my youth?

To aid this I found a spread sheet that I had used to track my income data which was most useful. I used the salaries that I had logged.

Some reasonable assumptions

I assumed that I could save varying rates a year as detailed below.

I started out in 2006, in London as a graduate earning a paltry £26,500. I thought this was a crazy amount at the time. However, after about 3 months in London, I realised this was not at all a large amount of money. I had to ask my Dad to bail me out of a credit card debt. The reason? Spending a lot of money on ‘fun’. I have assumed that if I wasn’t a fool, I could have only saved 20% at this point.

In 2008, I moved to the Middle East for about 3 years. I genuinely saved 50% of my income as my rent was paid for and I didn’t pay tax. I spent a crazy amount on boozing and partying and did a lot of travelling. I guess I got the best of both worlds so I’ve left that at 50%.

Upon return to London, I was in a good financial position and was able to buy my flat just 18 months after returning. Then, divorce struck. I got sad and had to pay a lot of money for various things. I then spent lots of money on eating out, dating, drinking, and partying. This is the period where I wasted a lot of money. I’m more than sure that if I had been sensible, I would have saved 40%+ if I’d tried. However, I just never tried. It never occurred to me what was possible.

The final assumption is that I used the actual growth of the S&P500 over that time.

For those of you that don’t know, what I call my financial independence fund (FI Fund), is a combination of my cash savings, my ISA, my SIPP pension, and any other investments. It does not include my home equity. I reason that I cannot live off my home equity so why track it?

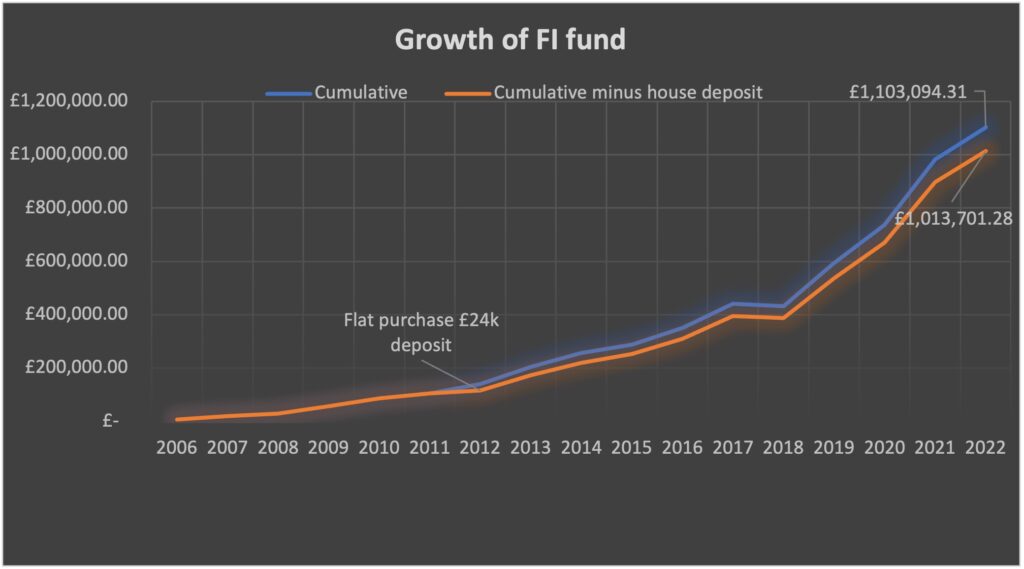

Additionally to the pure investing assumption, I decided to model what would happen if I had bought my flat or not bought it (as I really wish I had not, for reasons too numerous to discuss here). That assumption meant taking £24k out in 2012 to pay the deposit. The difference isn’t huge, (£90k) but the increase in value of my property (£200k) is much larger so it was a very good investment, despite the other issues, to go with the flat purchase. Although it should be more!

Results of my time travelling adventure

I’m sure you’re dying to see the outcome so here it is.

As you can see from the graph above, my FI fund could have been between £1.04m and £1.1m.

So the conclusion is, damn, I could be retired by now and have my flat.

Sadly, I don’t have a hot tub time machine and I don’t have a second chance at life. Whilst I look back fondly on the fun times I had in my youth, I can’t help but feel I could have done better with my saving and investing. My conclusion is that there is a balance to be struck. I went extreme with my partying mainly due to the problems I had in my life. I don’t regret it, as what is the point in that, but doing this exercise shows that time is the biggest wealth builder.

Another way?

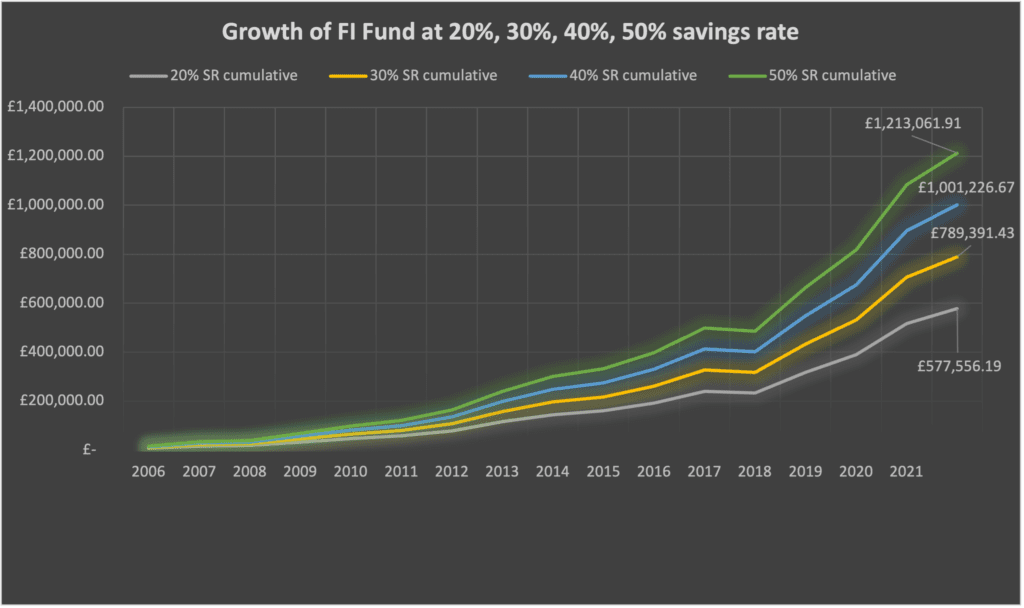

To see what could have perhaps happened in a moderate and extreme version of this scenario I re-ran the exercise on a 20%, 30%, 40%, and 50% savings rate across the board to see what the difference would be. As you can see in the graph below the results are wide ranging.

The value of my FI fund would have been between £597k at 20% savings rate and £1.25m at 50% savings rate. This is quite surprising as the 20% savings rate is very easily achievable for most people still ends up with the result of nearly £600k. I’d be about 1-2 years from FIRE, for very little detriment to my life overall.

Fifty percent is extreme and although I have been averaging that for the past two years, I have only achieved that through having a higher income and living through the pandemic and consciously playing catch up. So, whilst it’s great to imagine where I could be, I doubt I would have achieved 50% savings rate earlier in life. I must conclude that I would have ended up somewhere around the 30% savings rate mark which would have given me £816k.

The conclusion here is that if I’d held a little more back, I’d be in a much better position. The point is that the maths behind FIRE works, and it is possible to get to financial independence without having a ludicrously high income. I have proven that I could have reached it by now. This is reassuring and motivating for moving ahead.

I decided to look ahead as this is all I can do.

Looking ahead and getting back to the future

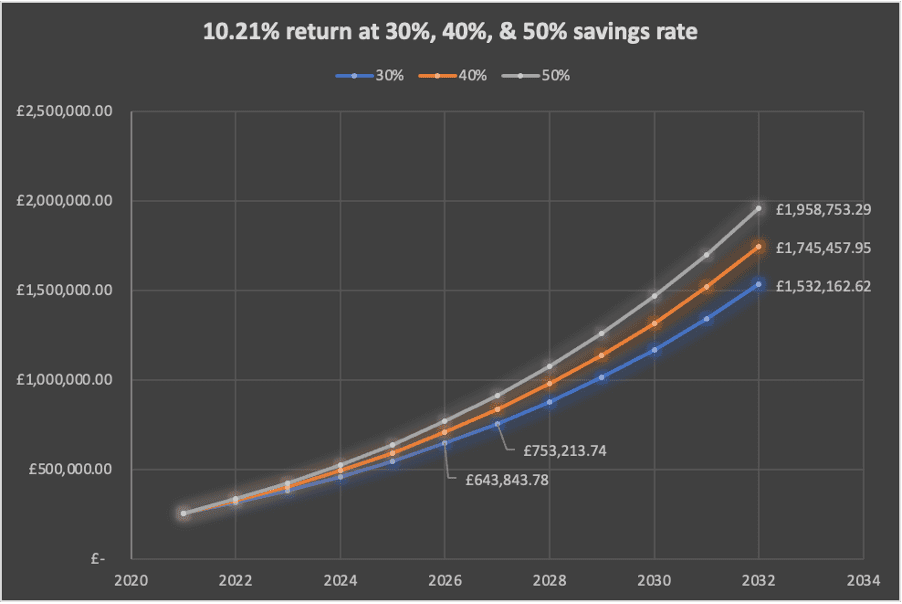

Looking ahead is good. I decided to start with where I am now. As of the end of 2021, My FI fund was £255K.

Assumptions

In this model, I have made the following assumptions:

- Firstly, that my salary will increase by 5% annually so and I will get a 10% bonus annually.

- Secondly, that the savings rate will remain at 50%.

I then worked out the average growth of the S&P500 from 2006 (the year I started working) until now (10.2%) and then corrected for inflation (fingers crossed inflation gets itself under control).

Results

The results are pleasing.

My calculations say that I could reach my FI number around the years 2026 to 2027 when I will be 43-44 years old.

Double check

Just to be on the safe side I checked the same with a 30%, 40%, and 50% savings rate, because you never know what life will throw at you. I used the 10.21% the average return giving results as follows.

As you can see, it’s very good news for me. It looks like I will still hit fire in 2027 at age 44 even with a 30% savings rate. That’s a whole 23 years before the standard retirement age of 67. The interesting observation is that savings rate does make a difference, but not a huge difference. I would hit my target at 50% savings rate a year earlier. It may be that after a few more years of pounding the 50% rate I can ease off a little and start to spend more freely.

Banker on FIRE made a great article about this recently.

I will heavily caveat this model as it does not consider market crashes and other things happening. It’s purely for entertainment and to motivate me to keep saving and is not financial advice!

Conclusion

In conclusion, starting early on this journey is important. You can’t go back in time like the gentlemen in Hot Tub Time Machine and get a second bite at the cherry. Savings rate is important in the early years, but the importance appears to decreases as your wealth increases as the markets start doing the heavy lifting. If you are like me and are starting later in life, you need to have a much higher savings rate to play catch up if you didn’t save wisely in your youth. However, the best news is you can start late, like me, and still make FIRE at a relatively young age.

I’d be interested to hear about any late start FIRE people so please tell me about your journey in the comments!

Funny movie and good way to start you article. Your point about starting early is spot on.

My biggest “mistake” would be aggressively paying down student loans in my 20s and not even contributing to a 401k (company didn’t match) until late 20s/early 30s. Great to get out of debt, but in hindsight that 5% interested paled in comparison to the market returns, not to mention compounded returns over time. Would love to fire up the hot tub and invest earlier (said everybody).

I see the same thing with people paying down mortgages too. I’m in the find a balance crowd. Maybe overpay a little and invest a lot!

It’s fun to play around with these scenarios, but it can be rough to look at the outcomes and think ‘What was I doing?!’ Don’t do that to yourself, Wealthster!

Oh for sure. No regrets of course and I can’t change the past but maybe others can learn from my mistakes. 🤗