Hello!

Firstly, I want to say sorry. I’m sorry that it has taken me this long to work out that I had to manually do something with the email addresses that you have been submitting to subscribe to my blog. This makes me look monstrously stupid, and that may be true, but please forgive me. Thank you for subscribing and I’m glad to have you onboard.

Secondly, I also want to apologise for missing my February update. I was on holiday in Australia from the end of February and didn’t have my laptop with me. Here we are though. I’ll do a double update assuming I can remember what I did in February.

Life update

February seems like a distant memory now. It was an intense month for work as I had many deadlines before I went on my journey around the world to Melbourne. It was so ridiculous that I was working until 11pm on the Friday before I left on Saturday morning to get everything done. It was done and myself, Mrs Wealther and Mum Wealthster set off from Gatwick to Melbourne early the following morning.

Before we look at the trip however, I got the good news at work that I was to be promoted to Director at my firm. This has been a long standing goal and I really felt it was long overdue, but it still felt sweet to get the promotion. Now, I’m not a real director as this is a consulting firm, but its given me a decent pay rise of 14% and access to better work opportunities. I should also get a better bonus next year. It’s also recognition that my hard work has paid off and that the firm thinks I’m ready to be at that level. All good.

I reached day 90 in my sobriety journey. I’m finding it easier and easier not to drink and don’t really miss it much. I feel sharper and have more free time too. I’m also sure that my promotion came as a result of improved performance at work. My stress levels are substantially reduced now despite the heavy work load in February. Who knew it would be this good? As I said on twitter, i kindof hate that I feel this good.

A trip abroad

We had been planning to take my mum to Australia for a very long time. The journey had been thwarted many times by either the pandemic or by her health, or by ludicrous flight prices. We booked this trip in March as it was the cheapest time to go after Christmas.

It turns out the weather is great in March in Melbourne. It could even be a little on the chilly side in the mornings, but soon warmed up to 25C which is great for a Brit like me.

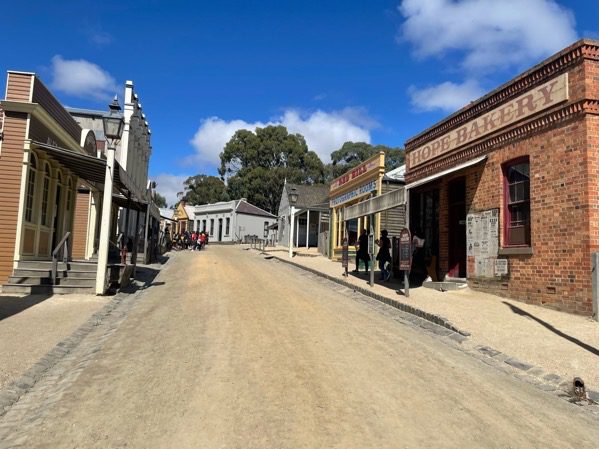

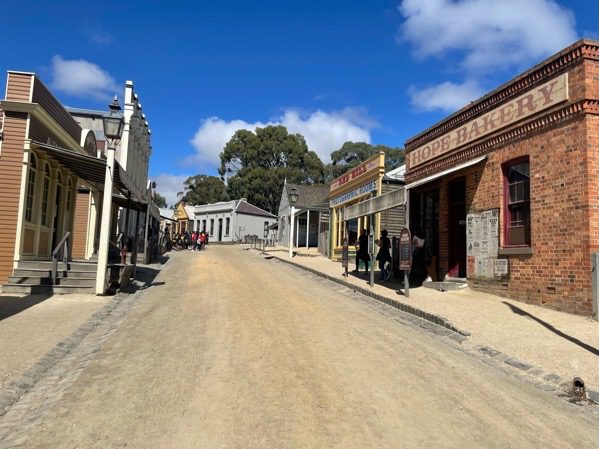

We did some wonderful things like visit Healesville animal sanctuary, attend an outdoor music concert at the Sidney Myer Music Bowl, visit a thermal spa on the Mornington Peninsula, and visit a mocked up gold rush town called Soveriegn Hill in Ballarat. We also had a big family gathering where we cooked a lamb gryros on the BBQ to celebrate our marriage.

I also did this all without touching a drop of alcohol. Today is day 90 and I’m very pleased to have made it this far.

Spending

Not too bad as it happens. We had already spent the money on the plane tickets in November, and as Mrs Wealthster is Australian, we had zero accomodation costs in Australia, it wasn’t that expensive. Also my non-drinking has been profitable.

I did have to buy a dishwasher which was inconvenient. It bit the dust in February and I couldn’t get one in time before we went to Australia. That meant when I bought it once I got back, it took another 2 weeks to arrive. Finally, today, we have the dishwasher installed. It cost £730 all in including the installation. Honestly at £110 to get someone who knows what they are doing to put in it place, i think it’s worth it.

I also bought myself a very nice pair of boots which were made by Grenson (£320). I’m hoping they last me a long time. Certainly these were a treat and are by far the highest quality and most comfortable shoes I have ever owned. I had been umming and ahhing about it and finally bit the bullet when i walked past their store in Bloomsbury. So far so worth it.

Total spend in February 2023 – £1944.

Total spend in March 2023 – £3093.

Savings

Savings rate for February was a mighty 84% and March was a respectable 53%. This is primarily due to a low level of spending in February and the receipt of my bonus which I mostly saved. Bonus wasn’t huge this year but we were forewarned that the company hadn’t done great. It was still decent in my eyes and I’m grateful to have it.

Investing

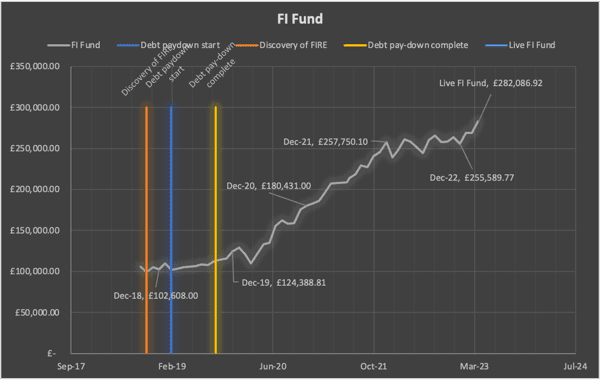

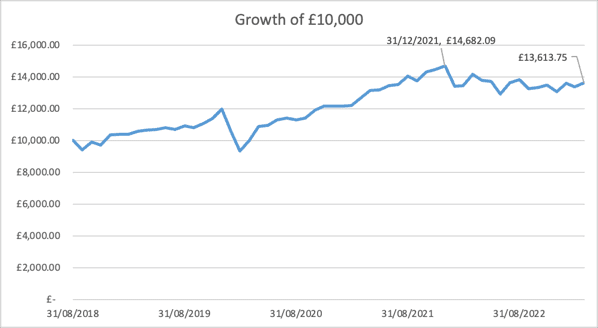

I seem to recall that February was a very good month for the stock market and being quite excited about it. However as I did not take down any measurements due to being on holiday without my laptop, I can’t tell you how I did. A quick review of the chart below shows that by the end of February things were “OK but down on the start of the month.

March followed and the markets went into a decline once more. We seem to have had a bit of a rally in the past week so now my portfolio is looking decidedly better.

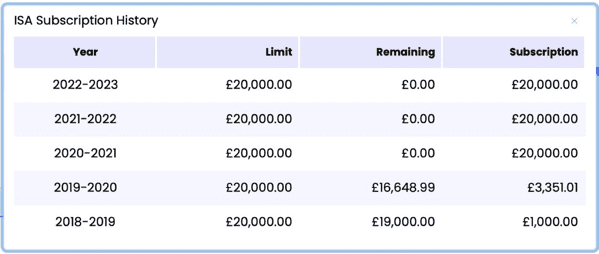

The other good news is that I managed to max out my ISA for the third year running. I had to find £7000 in the last two months to do this. I decided to whack my bonus in there (or part of it) to help. You can see where my investing journey started to get serious in 2020.

I’m optimistic about the future and hope that my patience and dollar cost averaging into the market will pay off.

My FI fund is up at a record level of £282,086. I’m getting very near to the big £300k that I have been waiting so long for.

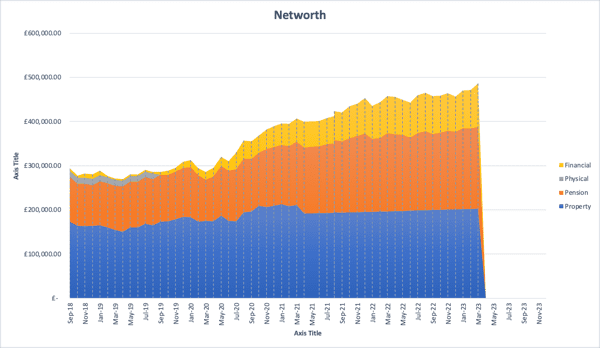

Networth is also looking healthy and at record highs. A note about my networth is that I have not been counting any changes to the value of my flat due to the leasehold issues that it had. It is effectively frozen at the value I had when I remortgaged in 2021. I am now hoping that within the next year that the government will effectively abolish marriage value and reduce the fees to renew my lease. I also hope that the long running court case in our block will free us and allow our flats to be sold at the right value going forwards. Some sales have started to go through at values that are nearly acceptable (but not quite).

Returns have been improving slightly. Still way below the peak in December 2021 but we soldier on. I’m up 4.1% for the year to day and 2% in the month of March 2023.

We have Easter to look forward to and I hope to catch up with a great aunt.

Another thing is we are going on a trip to Somerset as a repeat of last year. Our friend have booked a cottage and we will stay with them. They are insisting that we pay nothing to join them. This says that either they think we are “broke” as we don’t spend much on flashy stuff, or that they are very generous and like us. I hope it is ONLY the latter but maybe I need to be spending a bit more.

Anyway, I hope that this post works as I’m using a new piece of software so that I don’t have to copy paste from Word to post.

Out of interest did you max out your pension allowance for the year? If not what was your rationale for prioritising the isa

I didn’t max out my pension. The reasoning is twofold. Firstly, I’m doing this to hopefully retire early so I want access to my money and flexibility to use it for say a house deposit if I wanted. The second reason is that I had calculated that if I put any more into the pension than I do now, it would have passed the LTA. I know that the government has removed that recently so perhaps I should reconsider what I’m doing. The flexibility that the ISA gives is the biggest attraction to me.