It’s a miracle that I’ve found time to update this. April brought us two bank holiday weekends, but it also brought me a significant workload and deadlines. A demanding client made us work hard for our fee. I worked for three weekends straight, sometimes from 9am until midnight to get the task done. What a joke. I hope this is a rarity. It certainly hasn’t happened before and the reason it did was a royal cock up by my manager. Enough said. Shit happens.

Anyway, Easter weekend was a pleasant affair. We hung out with friends and visited my 91-year-old great-aunt in the Cotswolds. Despite nearly killing us whilst driving back from the station, we had a good time with her. We had some lunch and got to hear stories about her very interesting life (several times – I think her memory is going). She was the first lady to work on the Sydney stock exchange – a feat she puts down to being in the right place at the right time. She started as a secretary in a stock broking firm, they liked her, so she was trained to be a broker. As she said, several times, they would buy 10,000 shares at half a cent and sell them for 2 cents the following day. She was very proud of her work and what she had achieved. It was very motivating to speak to her and hear these stories of how she broke through the glass ceiling (and made a ton of money apparently too). Her advice was to do what you want and don’t give a damn what anyone else thinks. Live your life how you want, even if it means moving away from family etc. Interesting take.

We did get away to Somerset and Deven with some friends. We did a coastal walk and visited Lynmouth. It was beautiful and quite rugged. I had no idea of the landscape in that part of the world. Sort of a temperate rain forest surrounded by moorlands.

Mrs. Wealthster and I were also unwell for part of April too. We had a virus that affected us in different ways but was still nasty.

I have also maintained my sobriety. I’m currently on about 123 days since my last drink. The benefits have plateaued at this point. However, I am finding life a lot easier without alcohol. My memory and mental clarity is significantly improved compared to when I was drinking. This alone is worth it. I have also lost weight and slept better.

Mortgage woes

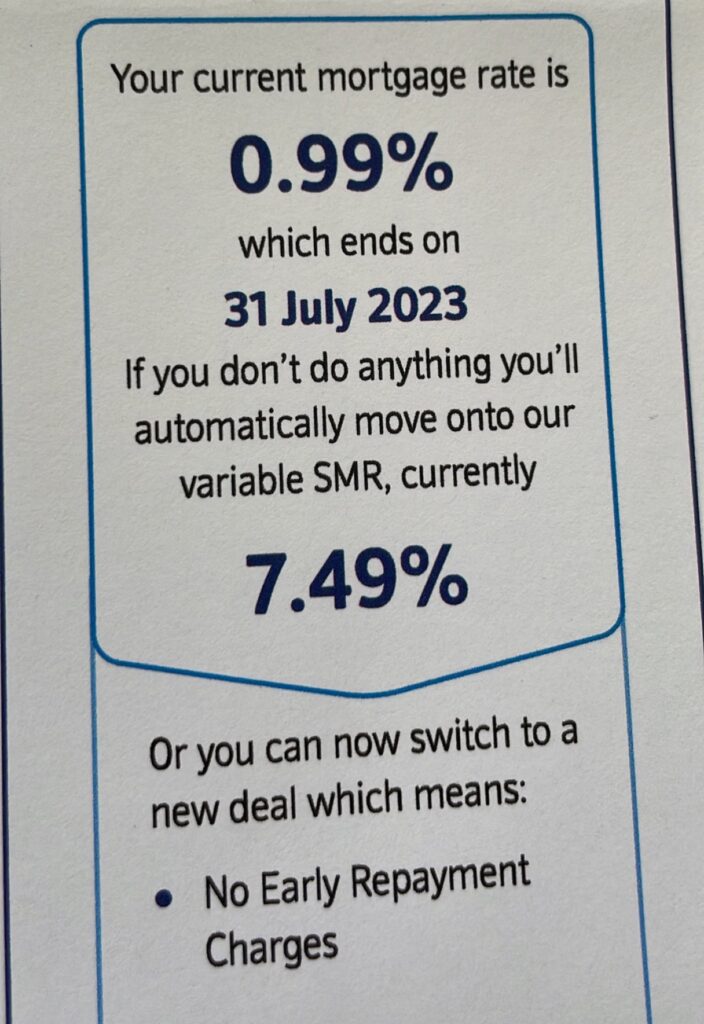

The main financial news in April was the letter from my mortgage provider landing on my doormat proclaiming that my fixed rate was coming to an end. I am lucky to have been on 0.99% for several years.

If I don’t take action my rate will rise to 7.49%. This is seemingly insane but it’s the going rate. I will be able to renew to a lower rate. The question is do I fix it for 5 years or simply stick to a 2 year again? Some think it better to go for the short term in the hope that rates will fall. I don’t think rates will significantly decrease but I also don’t want to be locked in for 5 years. It is a long time and I may want to move house or move overseas which would mean I could not port my mortgage and would incur the penalty fee.

I’ve some time to decide but I want to get this done sooner rather than later before rates rise again.

Either way, I’m looking at about a £400 per month increase in mortgage costs. I am not happy about this as this practically eats up my recent pay rise of about £550 take home per month (not including pension etc). That is sad.

Spending

TBC because my app is not syncing with my accounts. Sorry!

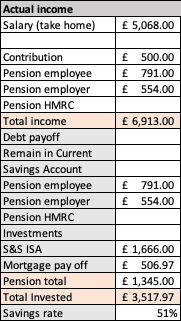

Savings

Savings this month were 51%. I think the fact my salary has risen is making this easier to achieve (unsurprisingly). I don’t think it will last with the increase in the mortgage payments though. For now, I will wallow in the glory of a 51% savings rate every month this year so far.

Investments

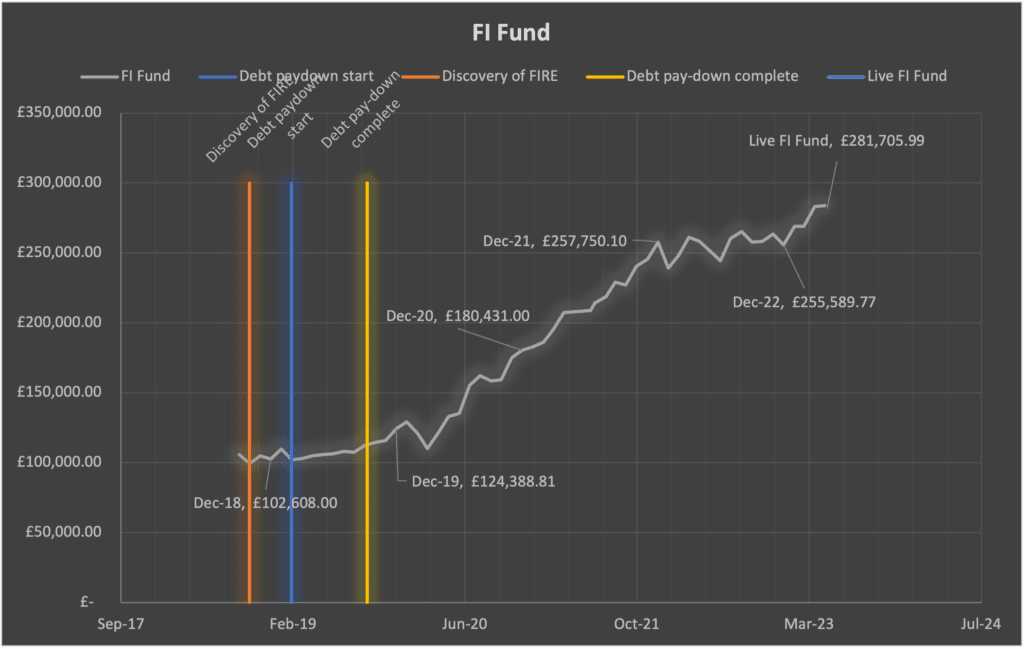

Investments have felt frustratingly flat, as they have done for the past year or so. The strengthing of the Pound against the Dollar has meant that my gains in my mainly American-based investments have canceled each other out.

I have still achieved a modest increase in value of 0.25% which is less than I contributed last month. Technically a loss. But we must keep dollar cost averaging.

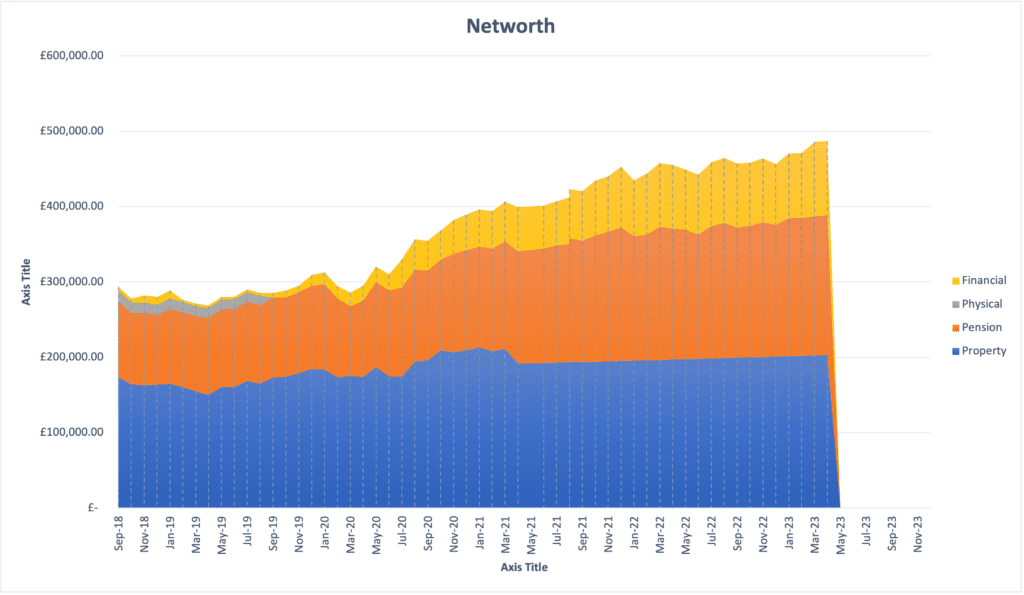

Networth is £487k and slowly approaching the big £500k. Let’s hope it gets there soon!

That’s it for April. What have you been up to? No one will respond or reply to this but hey ho.

Found your blog from Reddit and seeing your last sentence I thought I’d surprise you with a comment! Enjoyed the read.

I too have been feeling slightly depressed by the sideways markets and my mortgage renewal. Good luck on hitting 500k.

Very kind of you to say so, and I’m always glad that people read this and especially glad when they comment!

It is a bit depressing but I’m hoping in a few months we will see some growth. Would certainly cheer me up!

The commitment to dollar cost averaging is a wise strategy, and it’s great to see you staying disciplined despite the temporary setbacks. The slow but steady approach is often the key to long-term success in the market. Thanks for sharing your investment journey with us. It’s always interesting to hear about real experiences, and I can totally relate to the frustration of flat markets.

https://marketplacetitle.com/