It has been an exciting month in the markets this February. The S&P500 has reached all-time highs and Bitcoin has been on a crazy upward trajectory. I am only feeling FOMO on one of these though (Bitcoin) as my holdings in this are miniscule. I have to remind myself that the last time i speculated on Bitcoin I end up down 80% and I have no doubt it will be the same this time. I might take a punt but let’s see.

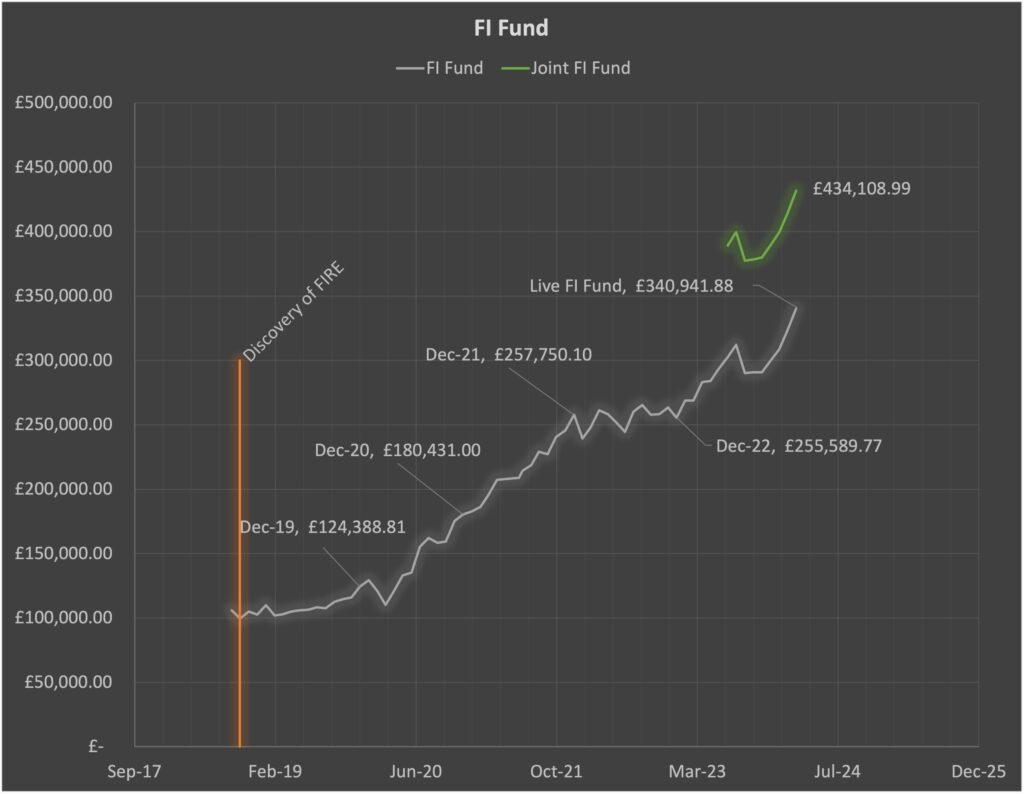

The benefit of investing through the bear market is now paying off. We are up £18,412 in net worth in one month which is just phenomenal. To think this is on the back of three preceding months at between £10k-16K per month, our FI fund is booming and is now at £432k (up £16.5K which includes my bonus!).

Other than that work has been fairly relaxed this month which is a welcome break from usual. A few things have happened which have made me question staying at this company. This is on the background of what was a good pay rise of 9% and a bonus of about £13k (less than expected as the company has not met its targets). One of the saddest things about being a higher rate payer is how little such pay rises yield into your bank account compared to the additional money flowing in.

As if by magic though, a Managing Director from a rival firm got in touch on LinkedIn. I have been to two interviews with them. Let’s see what they offer as they are very keen to get me started. I’m 50/50 about the move. I’ve been burnt before by a move so am wary, but I think there might be more opportunity as less internal competition for work in that firm as its smaller.

We also managed a trip to Scotland for my mum’s birthday over a long weekend. We drove up in the car.

Other cool things done were going to a VR experience, going to the theatre twice to see “Police Cops”, a hilarious comedy show, and “Double Feature” which is the story of Alfred Hitchcock and Tippi Hendren.

Photos were few and far between this month so I don’t have any that are worth posting!

Spending

Spending this month was high as I had to pay for a service and MOT on my car. Yes, this is an obvious expense which I have budgeted for, but the £611 hurt on the knowledge that I didn’t have any car maintenance costs last year. It was higher as apparently a fox has been eating through wiring under my car. This was not something I expect!!

I also had the impression that I was eating out a lot this month, but the costs don’t seem to be higher than average. It was probably due to the fact a new bakery has opened nearby and I have been gorging on their delicious pastries which cost an eye watering £4.20 each (the are the best I’ve tasted outside of France so there is that). But in the grand scheme of things eating 3-4 pastries in the month is not going to move the needle. It’s interesting that we can get in the habit of focusing on these things when the obvious issue is owning an expensive vehicle. On that note we also had the cost of fuel for driving to Scotland and back adding to the costs, but as that is comparable to flying and renting a car, I can live with this.

Saving

As I received my bonus this month, my savings rate is artificially high at 81%. I am planning to put as much as possible into my ISA. I have £15k left of the allowance and I think I could find a large part of that. I had already resigned myself to not making the target this year. I may move some of my emergency fund in temporarily to lock in the amount for the year and refill it once I have more funds available. I believe you only must have the amount in there on the last day of the financial year.

Investments

As mentioned previously, the FI fund is up £16,576. You can see its crazy growth taking off here thanks to the increase in the markets. Our net worth is now £664K creeping towards £700k.

I wouldn’t go for bitcoin again, it’s only worth the risk if it can 10x or 100x, and do you really see it doing that again? I’d rather bet on a single stock in this market.

Your chart is too small, I tried to zoom in! If you use Google sheets for your charts (it looks like you do,) you can click on the 3 dots and click on “Publish chart” then you’ll get an iframe you can put into your website. This makes it interactive and viewers can click on different data labels.

Wise words on Bitcoin. I think the FOMO is great but I should accept that it is folly to enter the frenzy and what I’m doing is working very well for me.

I don’t know what happened to the chart but I have fixed it now and replaced with a clearer image. Thanks for pointing out! I use Excel and although I’d love to have an interactive chart, it’s not going to happen this month. Maybe I will see if Google charts will import my excel and produce the interactive version. Thanks for the tip!