I have finally gotten around to producing an update. My excuse? I have been extremely busy these past two month. Firstly, work had its intense moments. Deadlines were looming and it became all consuming.

Ms Wealthster and I both caught Covid for the second time too which knocked us out for a while. It really wasn’t anywhere near as bad as last time and I would say for myself it was mostly like a rotten cold. Much better than the time before we had vaccines, when I felt very unwell indeed.

However, the main reason for being busy was my life outside of work. I feel like every weekend in February and March has been spent catching up with friends, visiting family, and going on holiday! All great fun.

A summary of the fun that was had:

- Going to 6 Nations match in Cardiff.

- Hosting a wine club at our flat.

- Several birthday parties.

- A trip to Scotland for the weekend.

- A skiing holiday in France.

- A long weekend in Seville.

All these events led to all my time being taken up and blogging took the hit. Luckily, I did update my numbers at the end of February, so I have not lost the data. So here we go on the update.

The biggest use of time however was that we have finally decided on a date for our wedding! It will be in June this year. More to come on this but it will probably be the most frugal wedding I’ve come across. We are having a small registry office wedding with family only, where we will celebrate with a nice meal afterwards. Then we will have a party in a pub probably in August in London, followed by one in Melbourne in September as Ms Wealthster is Australian. We wanted to keep things local to our area to support local businesses that we saw struggle through the pandemic. I’m very excited about this as its uncommon to have a low-key wedding these days. Everyone we have told also is delighted at the lack of potential fuss. This was also entirely down to Ms Wealthster’s supreme frugality. She has bought her wedding dress second hand for £12, but she might get some expensive shoes to compensate. I think I’m onto a winner here.

Household bills

Higher oil prices because of falling out with Russia came and were putting pressure on all sort of things such as household bills, fuel, and food prices. I can’t say I’ve noticed the effect of any of these things. I don’t have a car, and my household bills were locked in at a rate up to 31 March 2022. I do expect it to bite.

I have gotten rid of my gas meter on a temporary basis following the removal of the gas cooker. It took me quite a long time to work out how to remove the gas meter, but once I found out the way it was easy to arrange.

To remove a gas meter, you need to phone your gas supplier (in my case British Gas), which meant being on hold for around 20 minutes, and then requesting. There is no information on their website on how to do this. They will then arrange for a gas fitter to come and remove the meter and cap the supply, free of charge. This is a good idea because following changes to the gas market for some reason it was decided that all suppliers should charge a standing charge. As I used only about £5 of gas a month, my bills shot up to around £18 a month as a result. Added to the health benefits of removing the gas cooker (cleaner indoor air quality) there was no point in keeping the gas supply for such a low usage.

Markets

My investments took a pummelling during February 2022. I don’t look at them that often and the drops really discouraged me from doing so. I think they were down 15% at one point. However, recently the markets underwent a rapid recovery.

As many of you will be aware the markets took a plunge with the threat and then coming of the war in Ukraine. I won’t comment any further on this as I’m sure you will have seen it on every news channel out there.

I dropped in about £2,300 to my ISA to max it out for the 2021/2022 tax year at just about the right time to benefit from this rise (by luck) which in some way makes up for when I dropped in £5k in January just before everything went south.

I feel like my contributions have masked the falls to some extent by I’m just about back to where I was at the start of the year. See below for more data.

Work

I got a pay rise at work of 5% and a bonus of 15%. This was both surprising (the size of the bonus) and disappointing (no promotion). If they hadn’t given me such a high bonus I would have certainly rage quit. However, after some discussions with management, I am assured I am on the list for promotion next time. God, I hate corporate culture. It really makes me want to set up on my own.

Ms Wealthster also has secured a new job, which is a more senior role in the NHS. She was happy with the salary offered at interview, but even happier later when she went to sign the contract and realised she would be getting an additional 20% inner-London cost of living allowance.

Savings

The bonus was used to top up my ISA. I still have some left and it is sitting in cash in my savings account. I have the long-term ambition of buying a car and the fund is now at about £8,500 as a result. Although, this may now be the wedding fund…

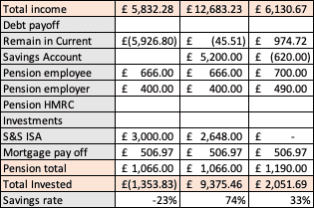

Savings rate only achieved 33% this month which is higher than I expected. If you have automatic savings deductions like pension occurring, you can’t help but have a decent savings rate. Oddly in February the savings rate was 74% but again that is because I dumped most of my bonus into the savings account and topped up my ISA to the max. Also, interestingly my 5% raise has resulted in a 22% increase in what my employer contributes to my pension. Weird.

Spending

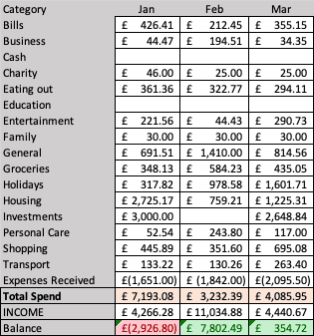

Spending seems like it has been ludicrously high these past few months. That should be no surprise as going on holiday is an expensive business. I think I spent about £800 on my ski trip, and probably about £500 on the trip to Seville. Even the weekend trip to Scotland seemed to cost an arm and a leg. All totally worth it.

Following the grand reopening following the Omicron outbreak, Ms Wealthster and I decided that there we needed to be more conscious with how we spend both our time and money. For example, we have decided to have a TV free evening a week where we do something intellectual. Last week we started a jigsaw puzzle and listened to a pod cast. We also decided to enjoy the city we live in a bit more. So we have been going to shows and dining out more. We have consciously decided to spend more money. Following the excercise that I did last month to project the difference my savings rate will make to FIRE I decided that if i reduced my savings by 10% a month then worst case it will add a year to my FIRE date. I think living in the present is worth that.

We also bought some cool things like tickets to the Rolling Stones and the Eagles in July at Hyde Park and tickets to Harry Potter and the Cursed Child. Socialising in London is also expensive.

I also ended up buying loads of household goods such as pots and pans (about £400 worth) which have turned out to be great purchases. They save time cooking and with washing up so will pay for themselves in no time.

I also had to pay a visit to the dentist. Apparently, I’ve left myself go during lockdown and me previously near perfect teeth are now at risk from gum disease. I had to get some serious periodontal work done. It cost me £300, but because I have Private Health through work, I should be able to get most of that money back.

Note spending includes some joint items with Ms Wealthster which I correct with expenses received. This month it also includes spending on the holiday which I also received expenses from my friends.

Housing included the final payment to the electrician for rewiring my flat for the parts he bought and took ages to invoice me for (nearly £500!).

Investing

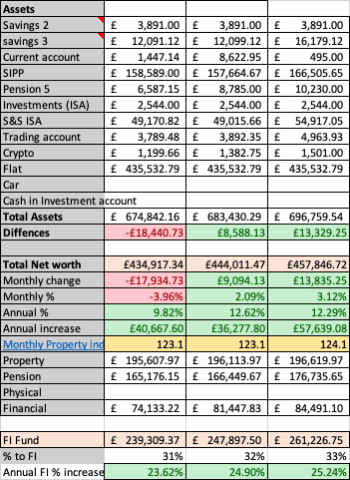

I have posted my investments tracker below.

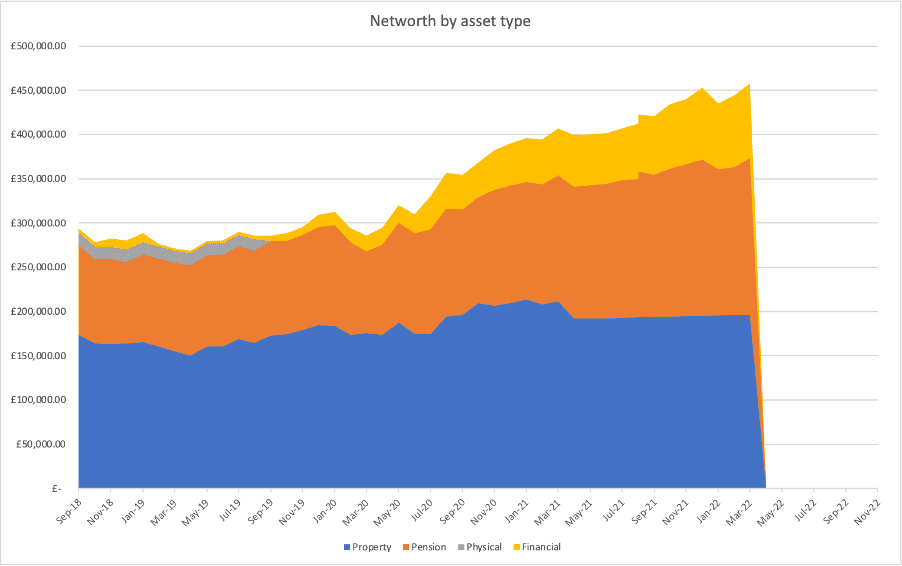

You can see that there was an enormous drop in net worth in January (-3.96%), followed strangely by a rise in February (+2.09%) and March (+3.12%). I believe this was as much due to my bonus coming in more as it was due to markets rising. However, there was a technical rise in value too which can be seen in the rise of my SIPP which I didn’t contribute any funds into.

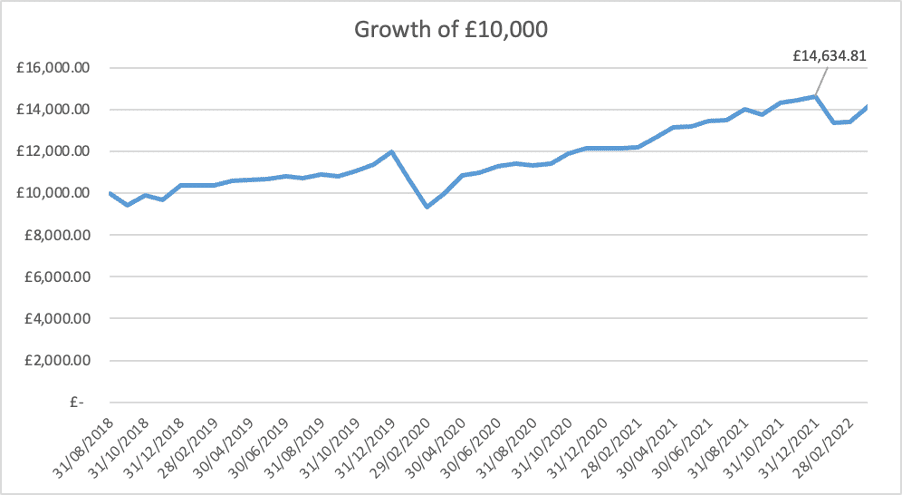

Rather than simply guessing, I use the bogle heads returns spreadsheet which shows that there was a dramatic plunge in the value of the investments and a slight upturn in Feb/March. It reports a monthly increase of 5.5% in March 2022. That is a surprisingly healthy rise. I’m still -3.5% for 2022.

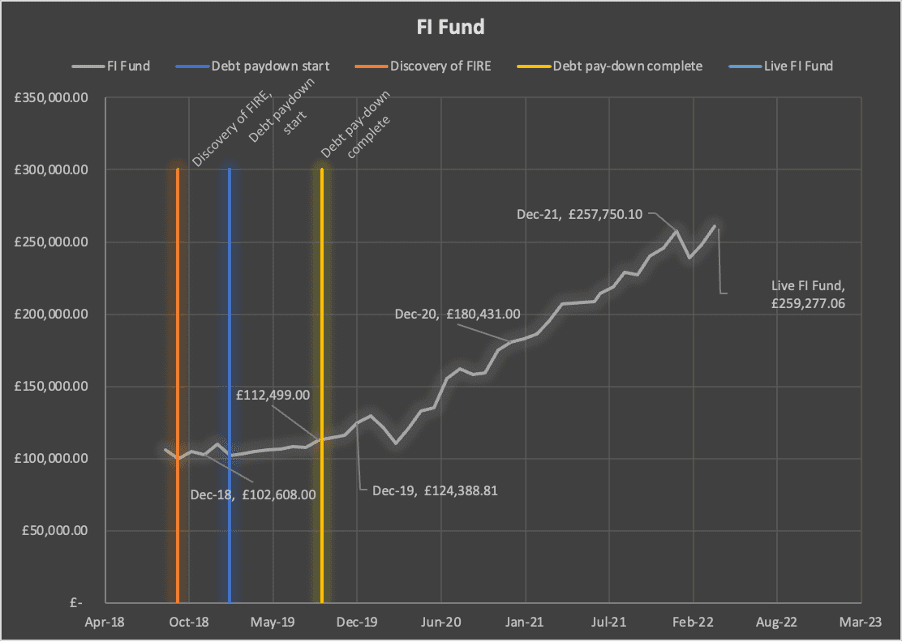

My FI fund also made a mild recovery, but as this includes my cash, this is partly due to my bonus arriving. It’s managed to reach an all-time high which is promising.

Net worth experienced a similar dip but has returned to an all time high.

That’s it for now folks.

COVID twice? What rotten luck!

Hope you all are feeling better now!

Similar to you, I put money into a Roth IRA (a US savings vehicle) early in January, and immediately regretted it when the market dropped. Oh well–can’t time everything perfectly!