One topic that has fascinated me since a young age is people’s wealth. Where did they get it? How do I compare? What is the average net worth in the UK? I take a look at the wealth and networth in the UK and where you stand in relation to others. First, let us take a moment to imagine a scene…

You’re out walking on your allocated once a day stroll and you spot a person about your age closing the door of their BMW 5 series. They stroll up their nice house (which is broken into flats), then fumble in their leather briefcase for their keys,

And you say to yourself, “Wow, how the other half live!”

Is all as it seems? Is this person really wealthy? Or is it just for show?

Those of us pursuing FIRE are acutely aware of our expenses, income, and total net worth as we track and measure these metric. I have grown my understanding as to what it takes to build wealth. This is no overnight success story and that is fine by me.

Have you ever wondered where you fit in on the grand scheme of things? What is the average networth in the UK? Hint: you probably don’t fit in where you think.

I am aware that comparison can be the thief of joy, but I want to take a moment to pull the veil back on where we all stand on this topic.

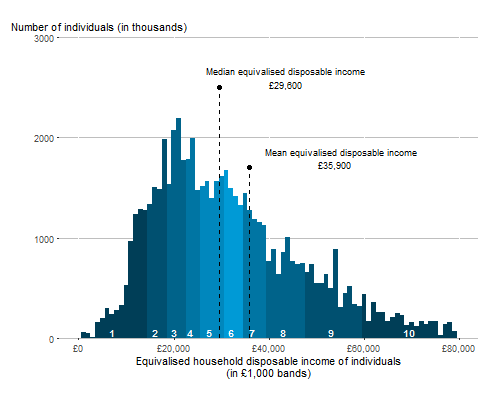

Average Income in the UK

The mainstream media regularly uses income as a way to compare how wealthy people are. I believe that while there is merit in doing this, it is a deeply flawed way of measuring how wealthy someone is. That is because how wealthy you are is really a function of how many assets you own rather than how much you earn.

As someone who is pursuing FIRE, I know I need to purchase income generating assets so that I generate enough income so I do not need to work any longer. Therefore, the important thing I measure is savings rate which is effectively the portion of my income that I use to purchase assets.

I measure my net worth in relation to the 25 times expenses. Once I reach that it means I have achieved financial independence. In fact, my income doesn’t come into play when working this out. It’s my expenses and the number of assets I own that are important.

It is also possible for someone to be earning a large income but have little assets and a large debt. Take a reasonably well-off late 20s/early 30s person who earns £70k a year, but decides they want the latest BMW 5-series and takes out a £45k PCP loan to pay for it. They are paying around £700 a month of their income. As they rent their nice Zone 2 London flat, and have only been contribution a minimum to their pension, have an outstanding student loan, and have couple of credit cards, they have a total net worth of under £20k.

They feel like they are well off because their salary is in the top 6% of incomes which allows them to spend money well. In fact, they love going to expensive restaurants and bars which make them feel rich. Overall, they are in the bottom 12% of the country for wealth.

Looking at the figures from the Office for National Statistics on the Institute for fiscal studies website. In 2021, the median income in the UK is £29,600, and the mean income is £31,400. If you want to increase your wealth, why not look at my beginners guide to Financial Independence Retire Early?

Percentiles of income

I put in my after-tax income as £5750 which includes my salary, rent and pension contribution from my employer into the calculator, it says I am earning more than 95% of the population. It should be noted that the table above is before tax.

Wow, that’s great news for me; however, I do not feel that I am rich. I live in a small flat in a good area, but my neighbours live in large houses worth upward of £1.5m. Who are they?

There was a gentleman on the BBC’s Question Time around the time of the 2019 general election who was widely mocked for saying he didn’t feel well off on £80k/year. I can understand where he is coming from to some extent, although he is still well off. With that income, I have enough money to live my life well and invest, but I am not wealthy because of my salary.

The government of this country wants us to consume products such as cars and mortgages, and income is important in deciding the amount of these things you can buy using these financial tools; however, that is not a measure of my wealth in my book. Also, as in the example above, it is easy to make people feel like they are wealthy, when in fact they are not at all

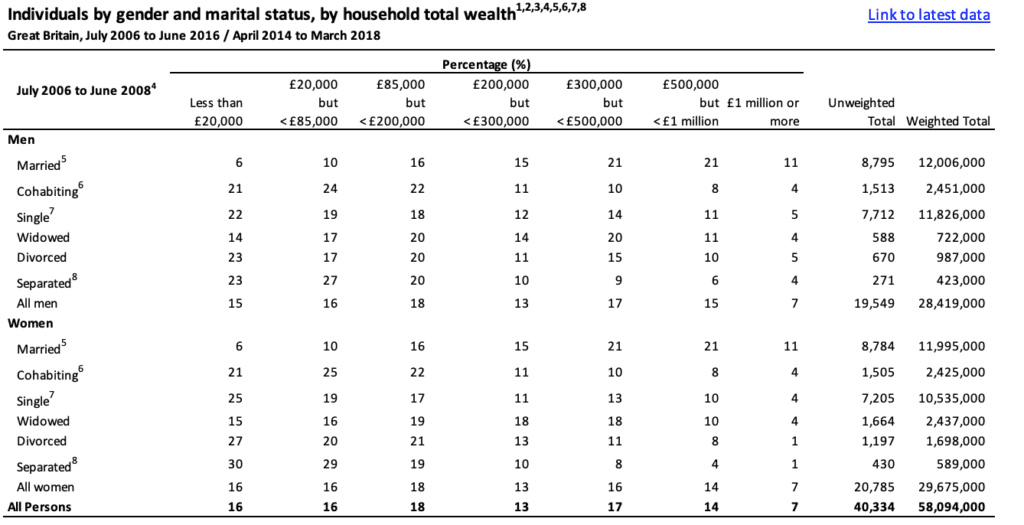

Average networth in the UK

On that counter-intuitive point, we shall now look at less publicised Office for National Statistics (ONS) figures for total wealth in the UK. They do a biennial report of net worth in the UK which can be found here.

The data spreadsheet which I have taken info below from (and is the most interesting part) is found on the ONS website for total wealth in the UK and is publicly available.

The amazing thing about the statistics is they reveal why the mainstream media use income as a gauge for wealth. It’s because these statistics can make you feel really bad about your position in society.

Let’s use my max net worth that I achieved in February of 2023 as an example which was £479k.

The ONS splits wealth in the UK into four categories; financial, physical, private pension, and property.

Private pension and property wealth are self-explanatory. Financial wealth covers ISAs, bank accounts, money under the bed less any consumer debts. Physical wealth includes the (self-evaluated) value of household contents, possessions and valuables owned such as antiques, artworks, collections and any vehicles owned by individuals (including the value of any personalised number plates).

The median (the middle household in the UK) wealth is £286,600. The mean wealth in the UK is £564,300. The fact the mean is higher shows that there is wealth inequality in the UK. That is the ONS’s words and not mine. (My guide to FIRE will help you increase your wealth dramatically.)

Graphically the wealth distribution looks like this:

As you can see, I am now (as at February 2023) at around £479k so I’m now solidly into the 7th wealth decile.

If we want to look at the overall picture in % terms. Note: I kept in the stats regarding the type of relationship for interest only.

I slip into the just above middle part. That means that there are about 40% of people in the UK who are wealthier than me.

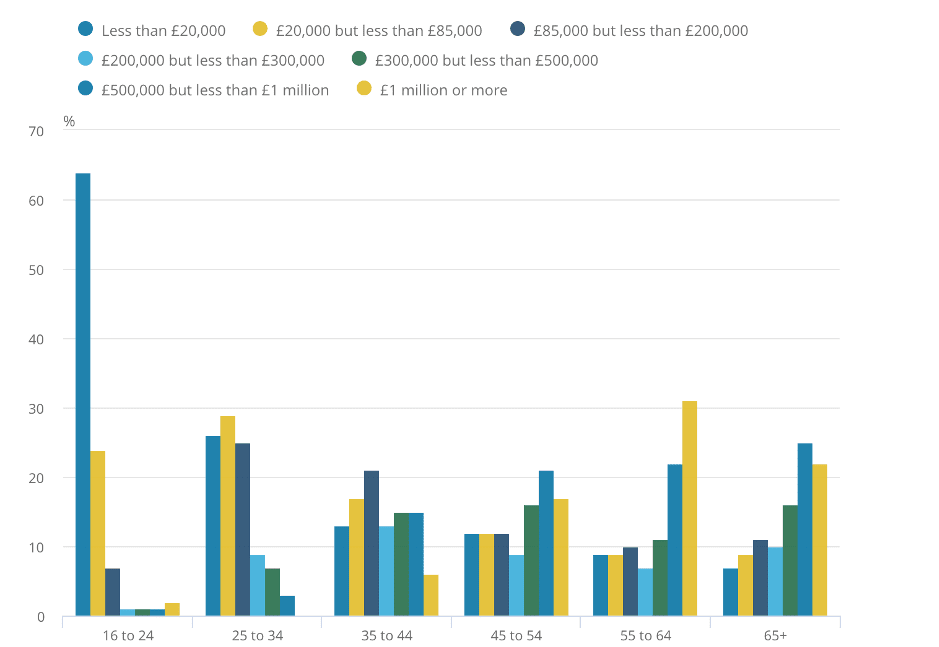

Average net worth by age in the UK

Let’s look at net worth by age in the UK. This graph shows percentage of households in a given net worth by age in the UK.

For my age group, I’m in the 64% + percentile. I’m 39 so fall into the 35 to 44 categories. That’s OK but it goes to show that as you get older, people generally get wealthier. 6% of people in my age range are millionaires.

There are many other ways to look at this, but I think that this gives you a truer picture of where you stand wealth-wise in society.

You will have heard of the phrase, ‘how the other half live’. Now I can say I’m in the ‘other half’ (but only just as my net worth is above median) if you go by population. If you go by the mean wealth I’m well and truly in the bottom half by about £200k below the mean.

It’s been interesting to look at the wealth statistics and reveal the truth of wealth and net worth of people in the UK. Many people are probably not honest about their true wealth from the outset as it can be embarrassing to be poor or wealthy. Others will inherit money which will explain the sudden rise as people get older. Many also are investing wisely in their pensions and that is shown too. Some outliers will make a lot of money by establishing successful businesses or by rising up the ranks in companies and earning fortunes.

Predictions for my wealth

I have made a large spreadsheet which I’m using to model my wealth accumulation. If I assume a 7% return on investments (clearly this won’t be a smooth journey), I should hit £1m by age 47. I would be joining around 18% of the UK’s population at that age. Hardly exceptional, but still very good.

I’m not interested in becoming the 1% but I do want to have nice things and live well, and eventually retire early. There is a long way to go here. I am not going to get hung up on comparing myself to others as this will drive me crazy; however, it is very useful knowledge to have.

I will keep on trucking, looking for ways to increase my income and save as much as I can to get to Financial independence.

I’d love to know what you think. Please let me know below.

Do you want to get a free stock share worth up to £100?

Create a Trading 212 Invest account using this link www.trading212.com/invite/GIuotlR6 and we both get a free share!

Pop in £10 into the Investment account and you’re good to go.

Nice info and certainly an interesting way to look at things. Looks like I would be in 5th decile for wealth, and looking on google I (with my dependants) would be in the 9th decile for income… food for thought

Fantastic analysis.

I think geographic breakdown would be interesting. I live in the north and the cost of living here is far lower than the south. I think wealth is also relative to where you live.

Is that data available? I would love to see that analysis.

Thanks again! Fantastic work.

Lots of that wealth won’t be “earned” though, it will be given from parents/trusts etc, so that certainly throws some of those “averages” out. You also compared your individual earnings- to household- I don’t know if you have another earner, but just something to note. I think “average” spending seems to be between 90-110% of salary as well, any saving above 20% on an average month pushes you way way into the “strange FIRE” people category. And I’m totally happy with that!

Interesting viewpoint – no doubt that the last 20 years has seen a huge jump in property wealth in UK and much of that has come with little productive effort – more luck of living in the right area. Having worked overseas for many years, I am buying a 1.5mm house in London with a net woth around 1.8mm at 52. Quite happy with that and all has been built through hard work. Still, buying in London makes you feel poor. My plan is to live in London for 10 years, continue to build wealth and then retire to a more cost effective location.

Very interesting and a good consolidation of information. Been trying to find something like this for a while but the ONS is a pain to sort though. I am 23 so I found the net worth by age section most useful. It is nice to know that my net worth of £22k puts me in the top half of wealth for my age (not that it feels like it).

Very interesting and insightful analysis. I have also thought about this a lot and would add a couple of obvious points.

First of all, the biggest wealth ingredients are property and pensions, so the boring people who settle down early are smart.

Secondly, your most valuable asset by far is your job, by which I mean the stage you have reached in your career path. If you can reach director level or the equivalent in almost any sector, the money pours in. Therefore you should not worry about how much you earn in the initial stages. Just get stuck in and make yourself useful.

Third and final point. Very few people reach the nirvana of true financial independence before normal retirement age, but I don’t think that’s necessary. What you want is financial security. A house, an established career position and a modest bank balance will give you that.

Yes, you will still need to keep working, but work is enjoyable when you are good at it and appreciated. It’s a win win.

I say, with the money you have saved you should invest in a business and make more than 5k a month. I am about same age as you and have profits of around 100k+ per year on autopilot

I read your post with interest, and you seem to have a wish to live well – having a certain amount of money will help with that, but above and beyond it I can assure anyone that it won’t make them happy (maybe fleetingly).

Personally I am cash poor, and my wife’s job doesn’t pay well (by virtue of where we live), but we are relatively asset rich. If you’re going to be poor but asset rich there’s worse circumstances in life! We are happy with our lifestyle though, because we live somewhere beautiful, the things that interest us don’t cost anything, therefore we can live a frugal lifestyle, grow food and fruit in a large garden, have flexibility with our time to pursue interests, whilst raising children and enjoying our surroundings and the beautiful nature. We have lived in the capital city too; vibrant in its own way, but once your head and mentality is out of the rat race a new set of priorities presents itself, and that involves enjoying the moment, because you never know what tomorrow brings. There’s much truth in that old proverb – health is wealth.

Hope you achieve what it is you’re searching for.

You, sir need to start a podcast… I have just consumed loads of the articles on your site and could keep reading all day!

Have you ever thought of doing something like it?

Relying on a 7% return could well bite you.

The key to success in early retirement (it was 52 for me, and I now know it could have been a chunk earlier) is to both understand and control your spending. This is not about being mean (I like nice stuff) but ensuring you get good value. The real drain is regular payments- avoid wherever possible.

Second is knowing what inflation is – for you. I have kept a spreadsheet for 30 years, and can track this. It is way below published figures. Look closely at how inflation is calculated and this stops being a surprise.

I believe that is called putting all your eggs in one basket…

So, work hard and you may become a director. To work even longer and harder. The one thing you cannot buy is time, and you have a fixed amount. Wealth is only useful after being translated into goods/services. One philosophy is ‘the last check should bounce’. So, you should aim to be penniless on your deathbed. The ideal is to work as few days as possible to earn in the standard tax bracket, and stop when you have Enough. I capitalize it, because anything more than Enough is wasted. As was the time spent earning it.