August in the UK was a long month for me. Work was very quiet, and the days did seem to drag somewhat. It finished on a high with the Bank Holiday weekend where we hosted some friends for the first time since 2020. What a good laugh.

As we are clearly creeping into September, I will mention that I was in Scotland last week for a wedding and to catch up with some family and friends. I’m enjoying working from home as I can got up to Scotland on Thursday night, work Friday, and then have a proper weekend.

This month marks the 20th anniversary of the horrific attacks on the World Trade Centre. I was 18 at the time and recall exactly where I was at the time. I was about to move to England to attend University and was out having a lunch with my Mum. We returned home and saw the new on TV. I think I watched the towers collapse live on TV. I do think it’s strange that there is a whole generation who have no memory of those events.

The other 20th anniversary is of my going to university. I’ve come a long way since then, and actually been back in university since to study law. But in those formative years I have found memories of fresher’s week and my first year in halls of residence.

Sadly, the main difference for youth these days is it costs £9000 per year rather than the £1100 it cost me. I really don’t know if I would have gone if faced with those fees and living expenses. I turned down a place at Imperial College London as I was scared of the costs of living in London. I still don’t know whether that was a wise decision, but I don’t regret my choice. I went to a top 10 UK university and have made lifelong friends.

I would only go to university if I could repeat getting a place at a top university doing an in-demand course. Otherwise I truly believe I might have been better doing a trade like a mechanic.

Anyway, enough rumination.

FIRE milestone

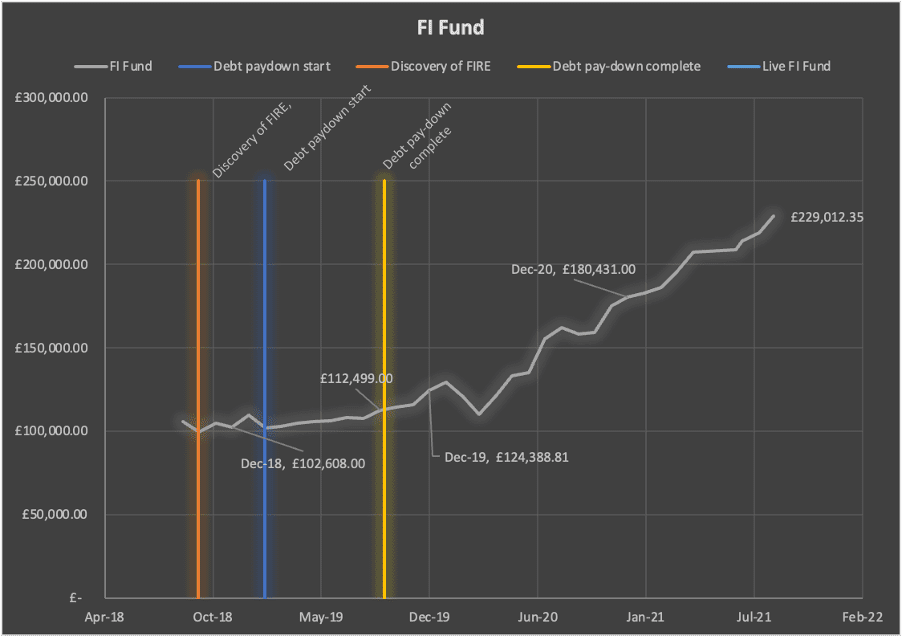

I thought I should also mention that it’s been about 3 years since I discovered FIRE. I remember the sheer enthusiasm I felt upon discovery. That has not waned however I do feel like I’m in the ‘boring middle’ part of FIRE. I’m making great progress but finding it dull.

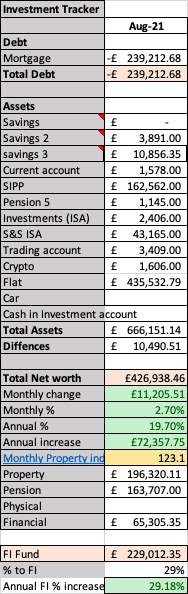

Before FIRE I didn’t know anything about investing (it could be argued that i still know nothing about investing!). I was in a lot of debt and doing a job I kind of didn’t want to be doing. I’ve come a long way since then. I paid off £40k of consumer debt. I’ve grown my net worth from £255k to £423k (an increase of £168K in three years), all the while earning between £70-80K annually. That also included a 3-month period of being on furlough and being made redundant. My FI fund has grown from around £100k to £229K. I have £60K liquid assets and cash. It is a very different scenario to where I was when I started.

I’m very pleased with that progress. The benefit of having ditched my debt is that the net worth increases are generally due increases in my liquid assets in my ISA and SIPP, rather than just my property or due to debt pay off, which I can’t use for anything. I am tempted to ease off a little bit and enjoy spending some money. But I’ve developed some good habits and don’t think I will lose control again.

Spending

I haven’t done a spending update as something has gone wrong with my app. I doubt it’s the apps problem (I suspect user error) but will try and sort out for next time.

Investments

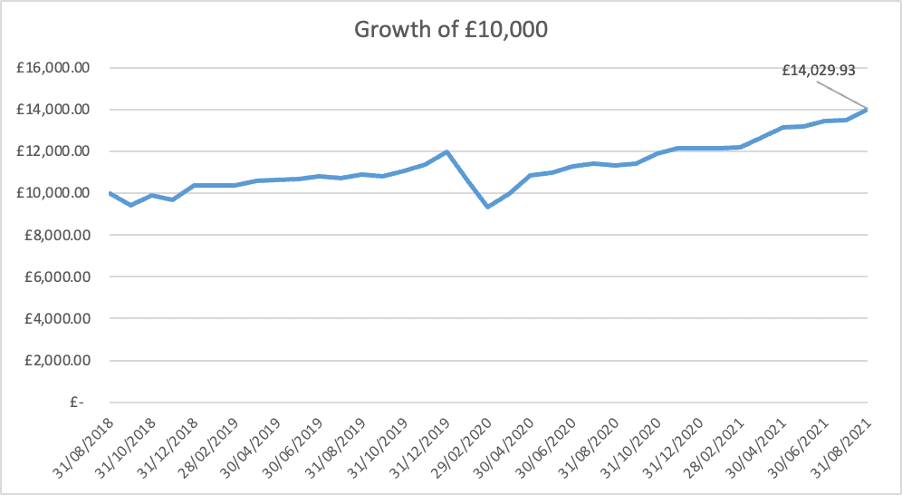

My investments had a very good month. I can put this down to a rising US stock market.

I sold off the last of my FTSE 100 ETF (£6k) and put it into VWRL. I now only hold a small amount in the FTSE 250 as the remainder of my UK bias portfolio. I am undecided on whether to sell but if there is significant growth in the UK it will be reflected in the FTSE 250 rather than the FTSE 100.

My monthly return was 3.9% which is great.

My net worth grew by £11,205 this month. My FI fund has increased from £218k to £229k. I’m very pleased indeed. I added £1800 to the fund so that leaves £7k to pure growth. I note that this was at the end of August. It’s now pulled back a couple of grand but I’m still ahead.

Car

My desire to own a car has sadly not subsided. I have been half heartedly considering buying a car for a while now. i know this isn’t the best move financially so it’s been very hard for me to go through with it. I sold my beloved BMW two years ago and mainly due to the lock down i haven’t missed it much. I’ve got about £4000 cash ear marked in a saving pot in my bank either for an old beater of a car or a down payment on a finance. I really don’t think its enough.

I’ve heard that leasing is quite a satisfactory way to have a car as you do not have ownership expenses and pay a flat rate that includes most things. I’ve previously owned a car on PCP and whilst I had no issues it felt like a burden when the value of the car dipped below the outstanding loan. That also occured at a time when I wanted to sell the car because i was doing something i had not foreseen when I bought it (giving up my job and studying for 9 months).

I can’t justify putting a large deposit down as it would be better put into the market.

I also have the little problem of living inside the London ULEZ zone which rules out owning many older and more affordable cars. Trying to balance the ULEZ restrictions on car model, with price and street cred have been nearly impossible. I don’t want to go electric as I use my car to travel long distance and I jsut dont think the tech is there to make that journey acceptable.

So with all these thoughts flying around and other things happening in my life, I go through a cycle of looking at cars on Autotrader, working out the finance on them. Deciding its a bad idea and then not doing anything. Its becoming a mental illness… Now used car prices have risen by about 15% this year so being slow on this has made it more of a problem.

This problem has in some ways been made worse thanks to FIRE and i view it as a down side of FIRE. If I was a normal person, I could easily afford a nice car on a good finance deal, but here I am depriving myself deliberately to save and invest (good thing!). Oh well. Who knew being a petrol head was incompatible with FIRE?

On that note I shall love you and leave you.