The festive period came upon us, and for the first time since 2019, we were able to fully socialise and celebrate. I love catching up with friends and colleagues at Christmas time and usually go head first into the party season. I must admit, I didn’t go out as much as I had done in my younger days, but I did manage to go to my work Christmas party and meet with a few friends from far and wide.

The other big event was my trip to California to visit my good friend. I had some spare annual leave that my company mandated must be used up before the year end. Sadly, Mrs Wealthster did not have any leave left for the year, so I decided to go on an adventure alone. The plan was to go to California and go to the Sierra Nevada mountains to hit the ski slopes. I booked my flights, and we arranged a plan. However, thanks to mother nature, the plans had to change, as the largest snow storm in a decade in California was coming. If we didn’t get up the mountains before the storm hit, we would not be able to get there as the roads were expected to close.

We had to change our plans for our first day’s location in Sugar Bowl resort because we would have been unable to get from there to where we were staying as the road would surely be closed. Sure enough, we watched the weather forecast and the amount of snow forecast kept creeping up from 12 inches, to 18 inches, to 24 inches to finally around 36 inches! I have never been anywhere near such a huge snow fall so this was both nerve wracking and exciting.

The whole time, we were aware that we were in the vicinity of a tragedy of the Donner party, a group of waggoneers who tried to get across the Sierra Nevada late in the season, but became stuck in a huge snow storm, much like the one that was approaching. Of course, the infrastructure now is much better, but there really was nothing one could do expect get somewhere safe and batten down the hatches.

In the event, between 3-4 feet of snow fell! The result was three days of crazy powder skiing which really challenged my skiing abilities to say the least. What an experience. It also made be question why I don’t live in somewhere that has easy access to skiing and the mountains which I love so much. It was only 3 hours drive from San Francisco.

We stayed at Northstar resort which was good if not pricey. It did give me the impression of somewhere that was not ready for the snowfall that had ensued in that they did not have the staffing levels to fully open the resort. Sugar Bowl seemed to be far more organised and was also for more advanced skiers. I think my favourite place was Sugar Bowl.

We heard that there was a cost of living crisis in the mountains as many people has ditched pricey San Francisco and were living and working remotely in the Tahoe area. That meant that staff could no longer afford to live in the nearby towns so were taking jobs elsewhere.

Christmas was spent in Scotland at my mother’s house. I cooked the Christmas meal which was roast leg of lamb. It was pretty good!

Spending

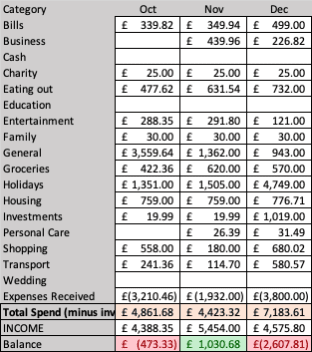

As you might imagine, my spending was rather off the charts this month. Not only did I have my trip to California, but we also booked our next trip to Australia which will happen in February/March 2023. We are taking my mum out there to experience Melbourne for the first time. The result was that I needed to dip into my savings this month to cover the costs. I am lucky to be able to do this. I did not touch my emergency fund, just the money I had set aside to buy a car (which doesn’t look like happening soon). It was scary to see that AMEX bill coming in, but also, after 2 years of lockdowns, it seems right to seize the moment and go on an adventure when the opportunity arose.

Savings

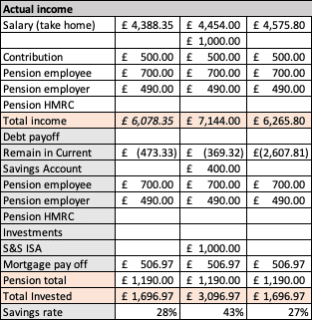

Savings were at a bare minimum this month thanks to my spending on holidays now and in the future.

Investing

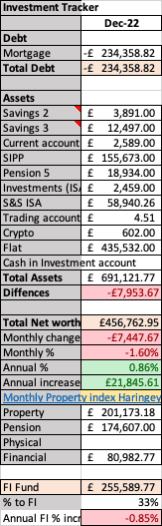

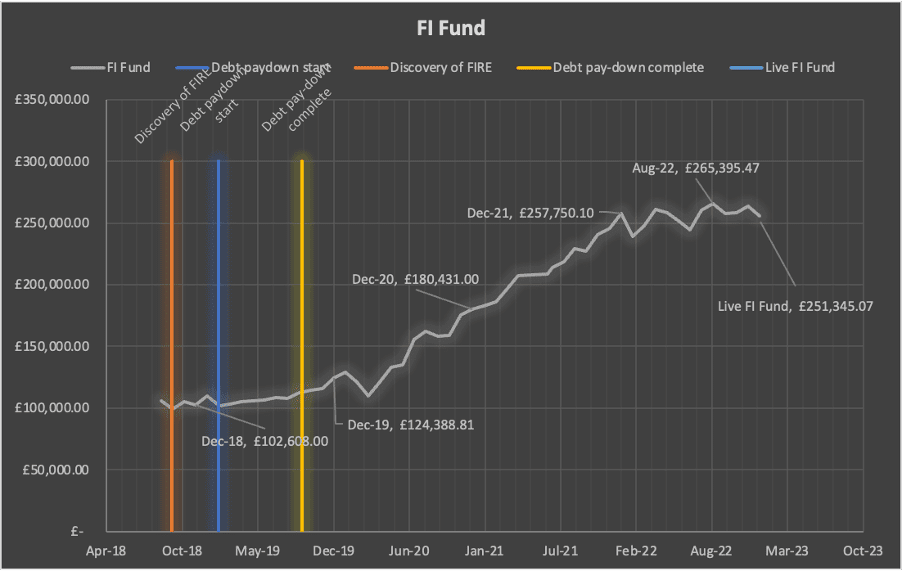

The markets have taken another plunge for the worse and with it, so have my investments. Overall, for the year, my net worth is up 0.86%. My FI fund is down 0.85% for the year despite investing £36,674 into it. The difference must be the reduction in my mortgage over the year. Yikes. That makes me feel… sad and stuck to some extent. I am really missing the progress that was being made when the market was on bull run. It’s at times like these when one begins to doubt if this is good idea. Logically, of course it is a good idea to buy now when stocks are at a reduced price. The good times will return (next year I hope).

My spending on trips has meant I am unlikely to contribute anything to my ISA this month. I’m not in the territory of not max-ing it out this year. There is a possibility I could get a decent bonus and use that to finish off the £20k allowance. Let’s see. I don’t hold out much hope. I may also use my savings to hit the amount on the date too.

Officially, my investment returns (as calculated without taking into account contributions) are -11.0% for the year. This is disappointing and my worst year since starting to record this monthly.