August Update

The endless summer continued through August. One of the driest on record which saw acres of grass turning brown and had us all sweating. `I’ve found it very enjoyable to be honest!

Work was very quiet as people went on leave, so I had another easy month at work.

The highlight was a trip to Lyon in France as a mini honeymoon. I love Lyon as it’s like a clean and civilised Paris. The food is off the charts and the city is beautiful. We treated ourselves to a nice hotel with a spa and outdoor pool which was in a former convent at the top of the Fourviere funicular railway. We spent four days meandering around the streets and eating and drinking healthily. It was made even more civilised by travelling on the train from London. Lovely.

It was also my 39th Birthday at the start of the month where I decided to arrange a little pub tour around my neighbourhood with some friends. It was good fun.

The bank holiday was a quiet one where we pottered around London and spent very little.

Spending

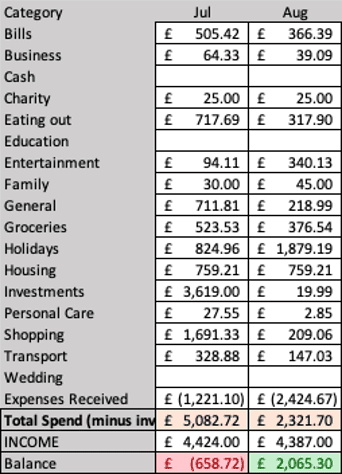

As we went on holiday our spending was up in the holiday category. We spend about £300 at a Michelin Star restaurant in Lyon and about £700 on the hotel in which we stayed. The Bank Holiday was very inexpensive, and we didn’t even eat out once so that saved us some money. Other than that, it was a normal month spending wise and I’m fairly pleased with the spending this month of £2,321.

*The spending includes some joint spending on the AMEX, so it is balanced by expense received which is Mrs Wealthster paying her share. We use the AMEX as our joint account to maximise points. The tracking app I use can’t seem to distinguish between the two cards we use.

Savings

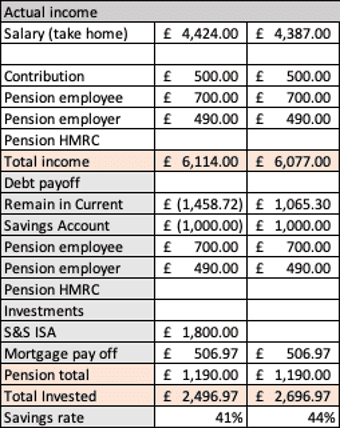

Savings were also reasonable considering we went on holiday. I haven’t invested the £1000 I put in the savings account but that was really to replenish the £1000 I took out last month. But it still counts as savings giving me a total of 44% savings rate for August. I think subconsciously I want to have more cash on hand for the energy price increases.

Car

I also have a dream of buying a car which I want to keep cash on hand for. This has meant I’m holding too much cash. This has been dragging on for months (possibly the last year) and yes inflation has eaten away at my cash, but I don’t want to invest it with a falling market, so I’ve just held it as cash earmarked for a car purchase. The problem is I feel that car prices are over inflated which wouldn’t be such a huge issue if I already had a car to sell, but I’m going in cold. Plus, it will be a “want” purchase as I really don’t need one so I’m putting it off until I feel that used car prices are more reasonable. I keep an eye on Autotrader and I think there is improvement on that front but until the manufacturers crank up production, I don’t think the prices will fall that much. Increasing interest rates should also put pressure on what people can afford as most people pay monthly on car finance. Therefore, I’m waiting a bit more before going for it.

Investing

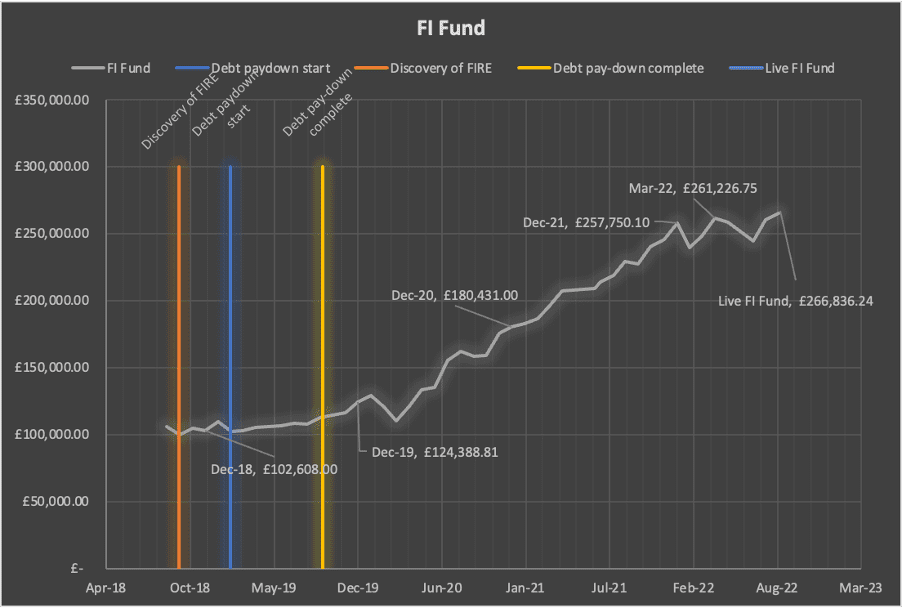

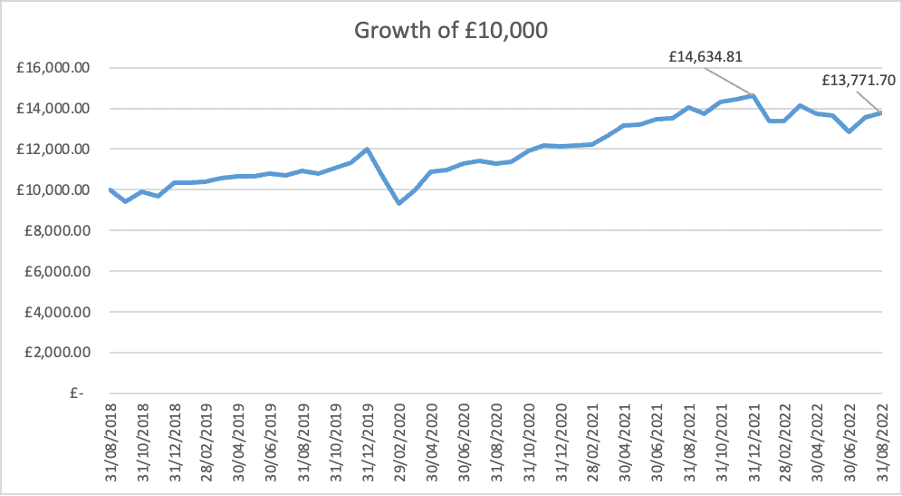

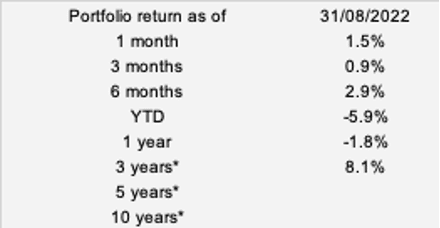

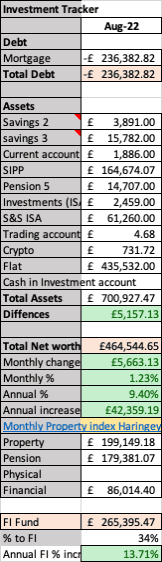

Investing was both exciting and disheartening this month. I will admit that having a lot of time on my hands this month that I have been checking my spreadsheet almost daily. This was exacerbated by the mighty increases we saw in mid-August which at one point pushed my FI Fund up to £272k. That heady feeling of making progress and seeing returns on my investments briefly returned and I started to imagine financial freedom. However, reality kicked in and the markets tumbled back down and wiped out the gains since the June low. I am now at a respectable £266K which is still the highest yet and is thanks to my savings contributions. The disappointment remains though!

That’s it for this month people.