July came and went. We had the hottest ever temperature ever in the UK when the mercury hit 40C. That wasn’t the first time I’d experienced that temperature, just the first time I’d experienced it on these shores in our very warm housing.

Otherwise it’s been a quiet month. We had the in-laws staying a while longer so we went on a few excursions. One to Southend on Sea, which I was semi dreading, but actually ended up enjoying. Of course we also saw the Rolling Stones and they were simply excellent. I couldn’t believe the energy that these guys have even at their advanced age.

We also went to Birmingham to visit an old friend who was celebrating being cancer free for five years. It was great to catch up. I also went to a stag do in Southampton. It was a good time but I think once you have a few beers caution with spending flies to the wind. On reflection, maybe it wasn’t such a quiet month.

Work has been very slow through the summer which is a welcome relief. No long days for me. The only thing is motivation is waning slightly as the tasks I am doing are quite dry and dull. There have also been several resignations from my company including my boss. I find this both unsettling and exciting. It gives me an opportunity to reinvent myself and work with different people. It’s also good as I was really getting fed up of my boss who was a micro manager. I feel like the high number of resignations will lead to a little chaos and I think this will provide opportunity. I haven’t worked out how yet but I will take advantage of it. I don’t want to leave as I need my CV to appear like I can stay in a job longer than 1 year as I jumped around a bit. I am also nearly over the 2 year mark which increases my employee rights and hopefully makes me harder to fire as is a risk in the upcoming recession.

Holiday

We have booked a short break to Lyon in France as part of our mini honeymoon. It was a place we visited in 2018 and were very fond of. The food there is to die for. So we’re going there via Eurostar and then the TGV. It only takes 5.5 hours from London. That decision was mainly due to the exceptionally expensive air fares meaning we didn’t save much by flying Easyjet compared to the Eurostar.

Treats

I bought myself a new sound system which is the first item that I have bought purely for fun/self indulgence in a very long time. It is a pure “want” and I spent a lot of time uming and ahing over which one to buy. I settled for the KEF LSX II wireless speakers. They were costly but are excellent. I was always an audiophile when I was younger and could never really afford the high-end kit. Well now I can, and I decided to go for it. I had some cash left over of from what I expected to spend on the wedding and also I made about £500 selling stuff on ebay so I was happy to treat myself. What it has brought back is the joy of listening to music at home which I think we were missing having only had a google speaker to play with. Although there is nothing wrong with a Google speaker, it is nothing compared to the rich sounds produced by KEF’s LSX IIs.

I know I’ve bought a new TV, PS5 recently but those items were to replace old or broken items. This was pure self indulgence. Careful now Wealthster, lets not get carried away with the lifestyle inflation!

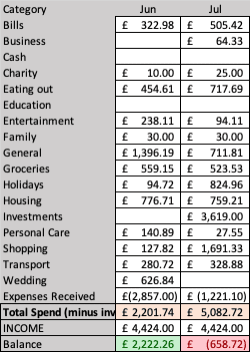

Spending

As noted above here is my spending for June and July. I have adjusted how I am measuring this and have started deducting the investment amount from the total spend seeing as it is not really a spend although it shows up as such because of the app I use to track speding (Emma). It is possible to see that I spent £658 more than I earned this month.

I put this down to my one off purchase of a fancy sound system as a treat for myself. I dipped into my savings to cover this which is I guess what they are for.

My transport costs have risen a fair bit too. That is because we went to Birmingham and I went to Southampton too which meant purchasing train tickets which cost an arm and a leg. I have also been getting a fair few Ubers lately and going to work twice a week which all adds to this cost. My view is for now it is less than the cost of owning a car so I think it’s OK.

Eating out expenses also increased which was partly due to Mrs W and myself simply going out more and meeting people, and also me buying lunches out whilst at work. Bad for the wallet and waist line.

Savings

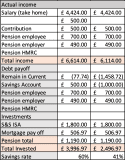

As noted last month I had built up some cash in my current account. I decided to invest £1800 for both June and July which totalled £3600. It was perhaps a bit too much and I’ve actually felt an artificial squeeze on my finances as my spending increased and I made a large frivolous purchase (speakers). I’ve adjusted my savings rate for June which has led to a healthy 60% and respectable 41% for July.

Investing

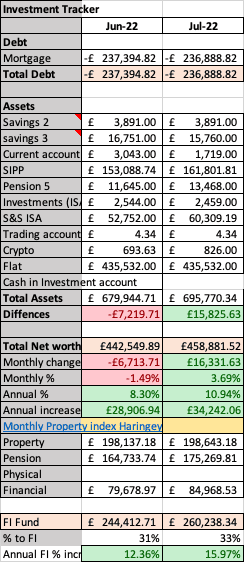

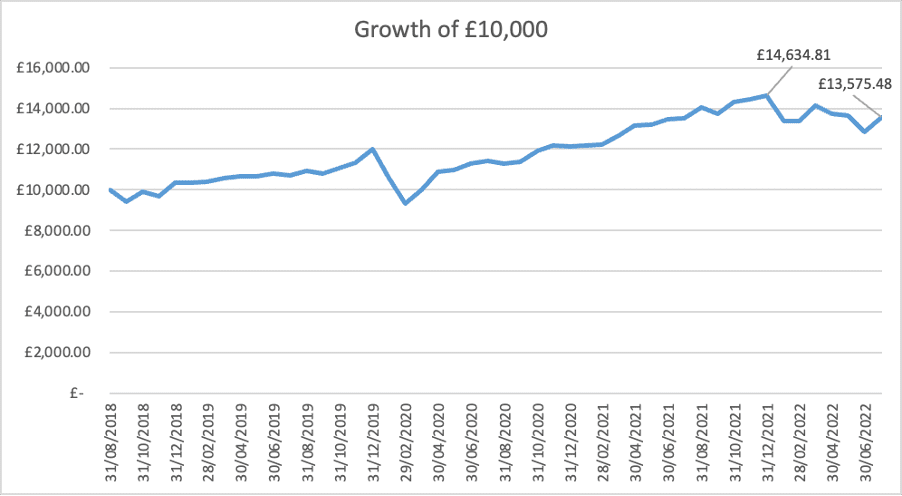

I was beginning to find investing to be a slightly depressing experience. The markets had not been kind for several months now and it feels futile dollar cost averaging (roughly) every month. July was more of the same really and although we finished up compared to June, it didn’t feel like any real progress was made.

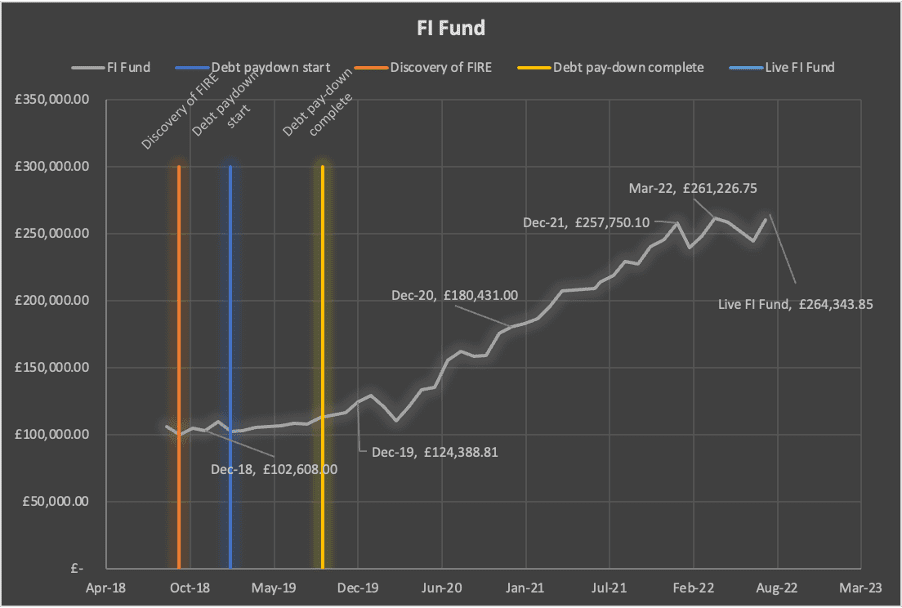

I put £3600 into my ISA this month and increased my holdings of VUSA. In the first week of August there was a slight boom in the stock market which (shown in my Live FI Fund in the chart below). I am the richest I’ve ever been with the FI fund standing at £264k. in addition to the £15k growth (including the £3600 and pension £1100). It’s still a great improvement on last month and was enough for me to feel some enthusiasm again.

I have a huge 5.5% increase in the month, however, I’m still down 7.2% year to date. It is looking like there is some light at the end of the tunnel and let’s hope it continues!