Another month has gone. Things in the UK don’t quite feel back to normal as yet. Covid cases are rising again, however the corresponding death and hospitalisations rate are not. That is a good thing, but having had Covid myself, I know it is a deeply unpleasant and time consuming illness with long lasting effects. Not to be taken lightly.

My friend who has had one vaccine dose caught Covid this week, and although is suffering mildly, it is still a huge inconvenience for him and his partner to have to self isolate for 10 days. This will be a story to be repeated amongst many in the next few months. With the vaccination rate in my area of London about 57%, there are still a great deal of people unprotected. I guess the gamble is that they are young and unlikely to die or end up in hospital.

Indeed, my experience by visiting a pub last weekend felt as if Covid no longer existed as everyone was revelling in the glorious summer weather. Added to that the football where we have seen Scotland bravely defend against defeat to what seems like a rampant England, I expect the numbers to go wild. Followed of course by England’s emphatic wins against Germany and Ukraine at the Euros.

My only conclusion is that the government has silently opted for herd immunity and is letting the virus run riot in the full knowledge that the politically disastrous (although this is arguable considering what they have gotten away with the past year) death rate will remain restricted to the anti-vaxxers. For me the many attempts to force Matt Hancock out of government, and the final blow of CCTV footage of him fondling his lover/aide in his office suggest he was not toeing the herd immunity line. It’s dishonest to not state this is the policy.

I have no faith whatsoever that this government will do the right thing. I appreciate the need to reopen businesses, but I don’t feel there is enough data to be taking the herd immunity route at this point.

Apart from stressing about Covid, I spent a lovely two weeks in Scotland which is detailed in my mid month update.

Work has been fairly quiet this month. I’ve been put forward to lead some projects, which was my goal when I started there in last August. I started in a new line of work so have endured a very steep learning curve and some moments of frustration. 11 months on I feel like I am getting the hang of the role and to have been put forward to lead is a huge moment for me.

My long term goals are to become a recognised expert in the industry and perhaps run my own firm in this lucrative world. I need a few more years of experience to be credible however, but I’m getting there.

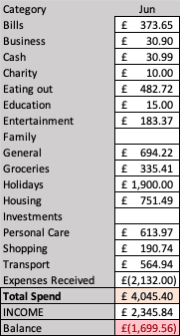

Spending

As expected, spending this month was astronomical compared to the lock down spending that I have become accustomed. A two week holiday in the UK was fairly expensive and highlighted to me the value we get by jetting off to Southern Europe and the like. Anyway I enjoyed my holiday and we have to spend the money at some point so I’m good.

I knew the ‘damage’ would be bad but actually its all within budget.

My spending does include spending from joint accounts which is reflected by the expenses received.

Savings

Savings rate this month was down to 44%. I put £1000 into my car ‘pot’.

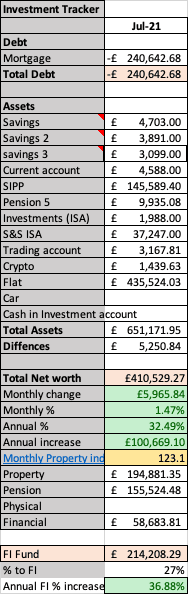

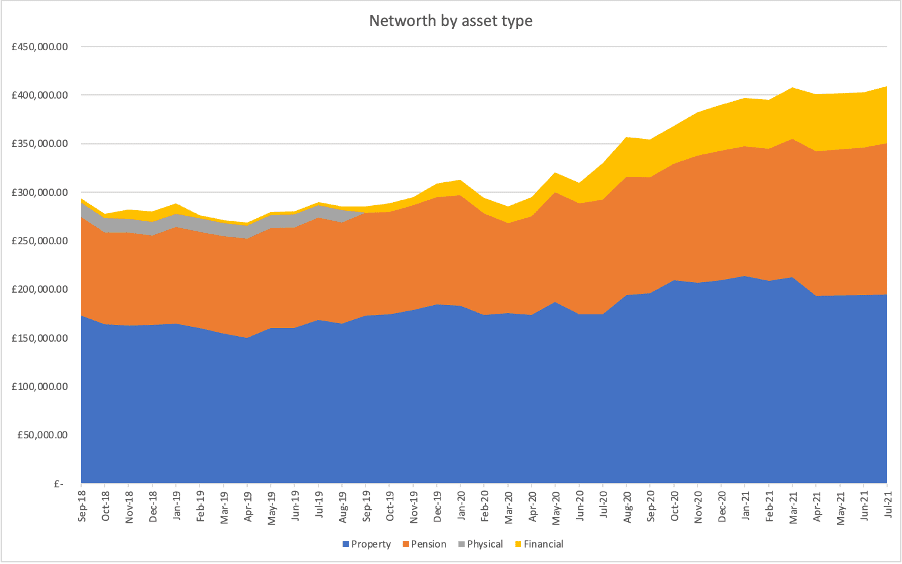

Networth increased to £410,529. I don’t know the monthly increase as I didn’t record it from the previous month, but it seems to have been a good month.

Investment update

Generally my portfolio has increased in the last few month with little actual contribution from me. I decided to spend my June contribution on a holiday. I haven’t been very disciplined with my investments contributions of late as i have a few expenses coming up which i want the cash available for.

FI Fund

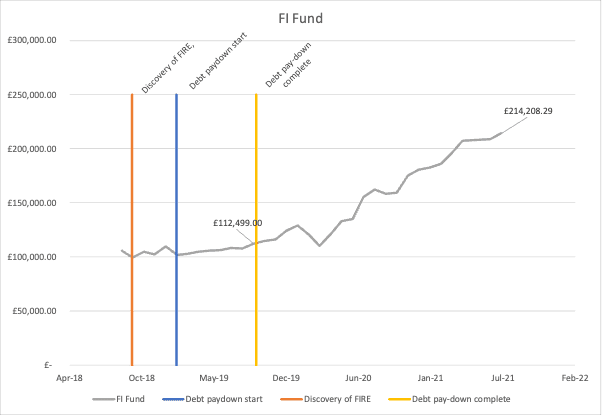

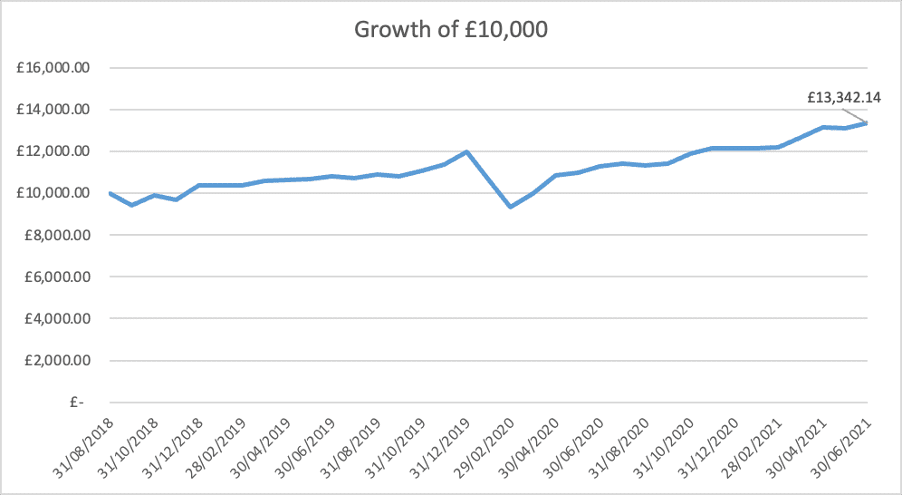

I have been tracking my Financial Independence fund for as long as I have been tracking my networth. It is actually a better gauge of how wealthy I am as it only tracks liquid assets that I will use for retirement. It does not include my primary residence for example. However, today I decided to plot the value of my FI Fund vs various milestones in my FIRE journey.

I think it is telling that from discovering FIRE in September 2018, where I was carrying significant consumer debt, my progress was non-existent. I made the mistake of trying to invest whilst carrying a large debt (which meant large monthly payments). I had low cashflow so wasn’t getting anywhere. I decided to pay all my debt off. You can see that between January 2019 and September 2019 where I paid my debts off, I made minimal progress with the FI fund.

It was only after I had freed up my cash flow and properly started investing in my pension that things took off. We had the COVID crash in March 2020, but its been a very good bull run since then. I’ve been contributing around £2000-3000 per month since I paid my debt off.

Infact, I’ve added £100k more to the fund (increase and contributions) than when I finished paying the debt. Its not a significant milestone I was looking out for, but I think it’s a good one. That means it took me 20 months to grow by £100k. Considering it took me about 13 years to reach £112k, I consider that good going. Its amazing what one can do when one puts ones mind to something.