Autumn is generally my favourite season. As a Scot, I don’t like the weather too hot or too cold. I love the colours and the crisp days. It’s the last nice time before the winter closes in. Plus, it has been a cracking month for my investments which you can read about below.

The first announcement is I appear on a podcast with Joney Talks. I’m quite proud of it and we created a great show. Check it out here! I had a lot of fun doing it and would be happy to appear on a podcast again. Let me know if you are interested in having me.

Further to doing the podcast, we have been quite busy trying to get back into the swing of things.

We went on a lovely walk in the Sussex countryside with some friends and their dog. It was great to get out into the fresh air. I love that you can get a train out of London, do a walk which includes a pub lunch, and then return. Lovely. For those interested there is a website called Saturday walking club which has many great walks and all the info you need to go (including which train and the details of pubs for lunch stops).

We have also had various events like a friend’s baby’s first birthday party, and meeting friends who have decided to leave London, and the UK permanently. I can’t say I’m not envious. Our country is just bouncing between one crisis and another.

More generally in the U.K., there was the petrol crisis which saw people forced to queue for hours to get petrol. Fights were breaking out and people were panic buying. The shelves at the supermarket regularly have items missing due to the supposed driver shortage. It feels like the UK is truly a laughing stock. In addition to those bad times, Covid is on the rise and it feels like 50% of people don’t bother following the rules on the tube regarding masks. I’m tired of it all. We’re in a pandemic still but people are doing their best to forget (me included). Sadly we can’t.

I also had a mini-crisis about buying a car, but have talked myself out of it now. It extended to nearly getting myself a fancy car.

Here are some pics from my goings on this Autumn.

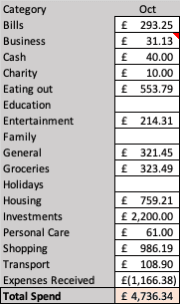

Spending

Again my spending is increasing again. I’m not concerned as £2200 is investing which is technically saving. Once that was accounted for the spending was actually £2500 which is normal. Also, I have also bought a few one off expensive purchases in the form of a Dyson cordless vacuum (£349). I did get it on a special offer with a stand which in my small flat will keep things neat. It’s a relief to get rid of the old bulky vacuum.

I also treated myself to a new Barbour jacket costing about £300 including a hood and insulation. I ventured into the store in central London and tried on half a dozen coats, settling on my favourite one. I’m very pleased with the purchase. The insulation is sold separately, as apparently, in the past people could not afford the fully padded jacket, so the lining was sold separately. I loved finding this out as it shows that historically, people were thrifty. It allowed them to buy one jacket and change the lining depending on season, giving the jacket longevity. The great thing about Barbour is that they are known for quality and for reconditioning coats once they age. This should last 10 years.

Investing

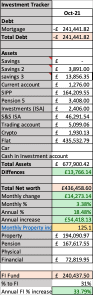

After the disappointment of last month’s performance, October delivered an increase in my investments.

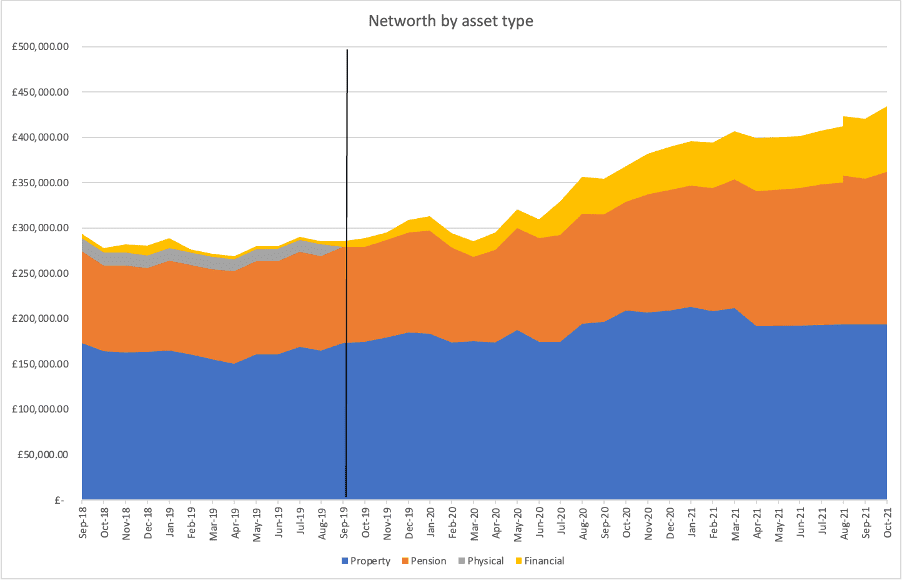

My total net worth has increased by £14,273.

It’s been due to several reasons.

First, the SP500 had a healthy month and rebounded from the declines in September. The bulk of the increase is accounted for from the gains in the stock market.

Second, Tesla, of which I have about 6 shares in, grew substantially. I’m told that an order of 100,000 rental cars from Hertz spurred this growth, along with target prices from various analysts at $1500. Either way, its helped my wealth increase dramatically in only one month.

Third, my crypto has grown by about 25% in the month.

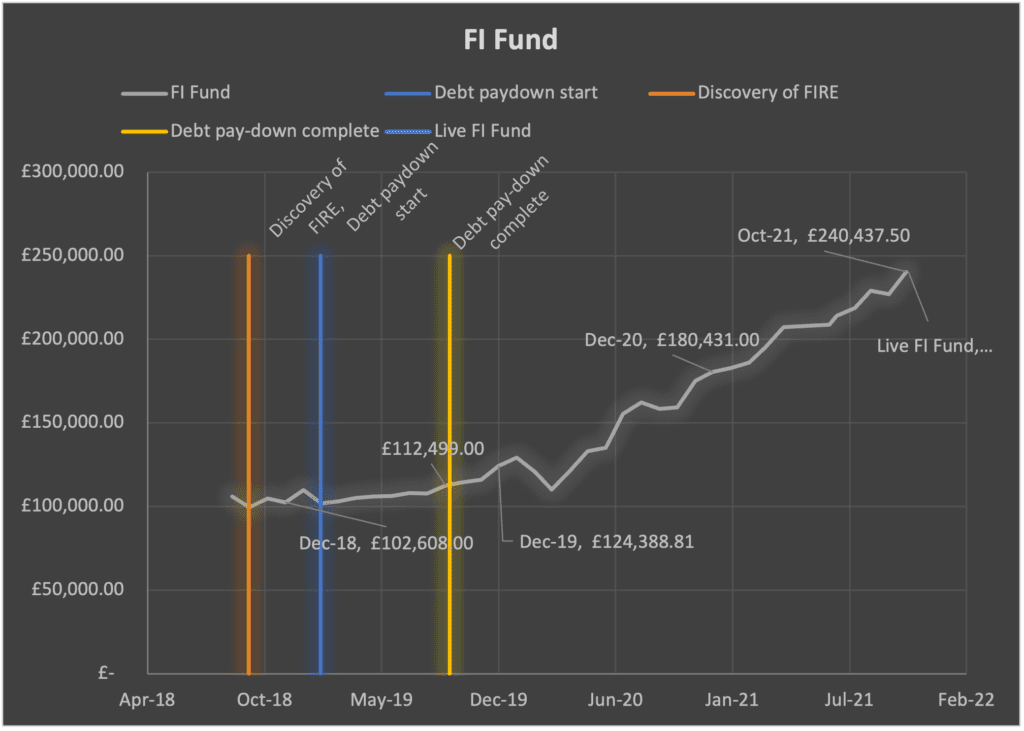

My FI fund has increased from £227,080 to £240,437.

In terms of my 2021 goals, I wanted to reach £230,000 in my FI Fund. This month I exceeded that by £10k. I thought at the time that the £230k goal was a stretch, but better than expected returns have helped me power ahead. It’s all great news for my route to FI. I haven’t worked out how much time that will save me but I really don’t care. It could be wiped out at some point in the future so I’ll not be counting my chickens.

Total Networth by asset type. The black line is when I paid off my consumer debt.

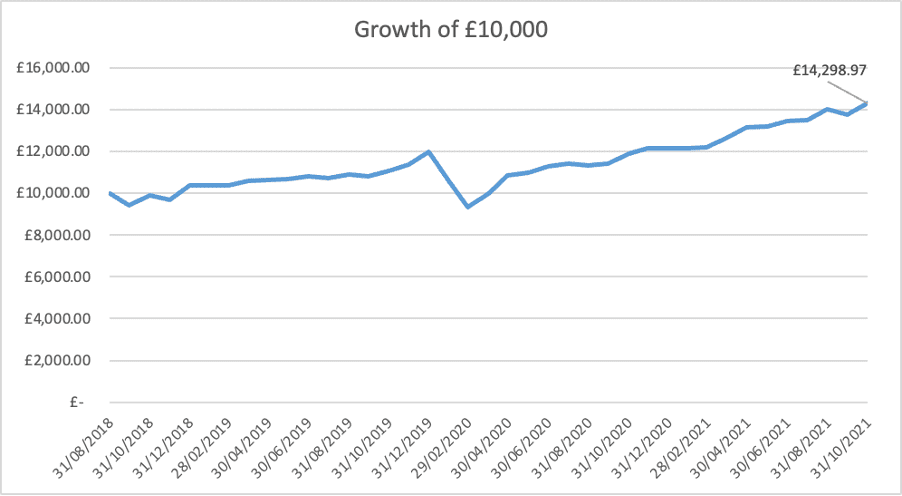

Annual returns.

Year to date returns are 17.7%. That does include cash so that drags the number down. However, accounting for the cash the returns are 18.6%.

Car fund.

I added about £900 to my car fund so it’s now at £6000. That was on top of £1100 that was sitting in a joint account which I reclaimed (it was all contributed by me as the account was redundant but I’d kept paying the month standing order). So I’m making progress. I nearly bought a car this month but it required a lot of finance and i talked myself out of it. I’ll be a bit more patient and save up a bit more.

That’s it for this month. Signing off, The Wealthster.