Remember, remember, the Covid outbreak last November? It now seems such an absurdly long time ago that we were happily approaching Christmas 2021, when out of nowhere, a Covid surge occurred springing another lock down upon us. Yes, not an official lockdown, but a lockdown of my own. It was self-imposed as we were planning to travel to Australia for Christmas and could not risk catching it before trying to enter fortress Australia, but it does it seem a long time ago.

This year will be different though and I am determined to enjoy this time of year, as I’m sure everyone is else, to the max. We will be meeting friends, going to the pub and going to parties as much as possible. Oh, and going on a cheeky trip to California to go skiing. I’ve already done the office party which ended up with me writing off most of Saturday thanks to excessive wine consumption.

As a public service announcement, I dutifully got my flu vaccine for the first time in about 10 years. I had always led myself to believe that I got ill following getting a flu vaccine, but this year nothing happened, which means that was false and I had probably just caught a cold around the same time as the getting the flu vaccine.

We had a visit from my mother who came to stay for 5 days. This was good and also bad at the same time. It was good to have her coming down to visit on her own, but bad to see how much she has physically deteriorated. Thankfully the trip may have been a wake up call for her in terms of her health as she was unable to do many of the things we had planned. She suffers from mental health problems (Bipolar to be precise) and struggles to keep any sort of routine in her life. The lockdowns we’ve had have probably aged her prematurely and she has struggled to get back to a ‘normal’ life, despite never having caught Covid herself.

Her health issues have been a heavy burden on me and Mrs Wealthster this year, so much so that I had to get some counselling to help. Maybe I’ll write a post about it if anyone lets me know that they are interested.

Apart from that, November was an uneventful month and I’m struggling to think of anything interesting to write about it. I did visit Battersea Power Station which was cool. I also visited Bond Street Elizabeth Line station to check it out.

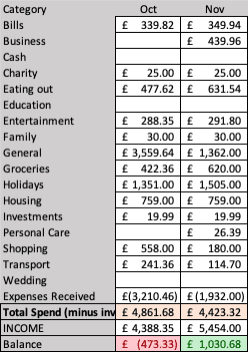

Spending

This month has been a poor show on spending because I have not kept up with my planned investing rate which as a personal finance blogger is not really on. I instead chose to spend some money this month on doing really cool things like flying to California to go skiing (£1500 including accommodation, lift passes, and flights).

I also had some fairly large one off expenses, namely, that my oven broke so I had to buy a new one which cost £379. It could have been worse but the old oven had been there for at least 10 years so I think it served its time. I did a straight swap which did not require any electrician to come and install which I think was smart. The new oven runs off the mains and seems way more efficient that the old one and takes far less time to heat up.

I also received some money from mum as a wedding present which will contribute towards our new sofa. It was very generous of her to do this and I know it was a lot for her. I actually was on the fence about accepting it, but it is her gift to give and I gladly accepted.

Despite my quite spendy month, I seem to still have some money left which means it wasn’t as bad as thought. Thanks to this update, I’m going to dump it into my ISA

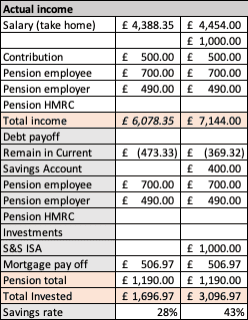

Savings

In addition to not investing, I did manage to save £400 into my savings account. The idea was to replace some money I had ‘borrowed’ from myself to pay for a big purchase/holidays. My savings account is now back to a very healthy amount. It counts as savings but did not go into my ISA. Oddly as a result, and despite feeling like I could do more, I have somehow saved 43% of my income this month. Typical me, beating myself up about nothing.

Investing

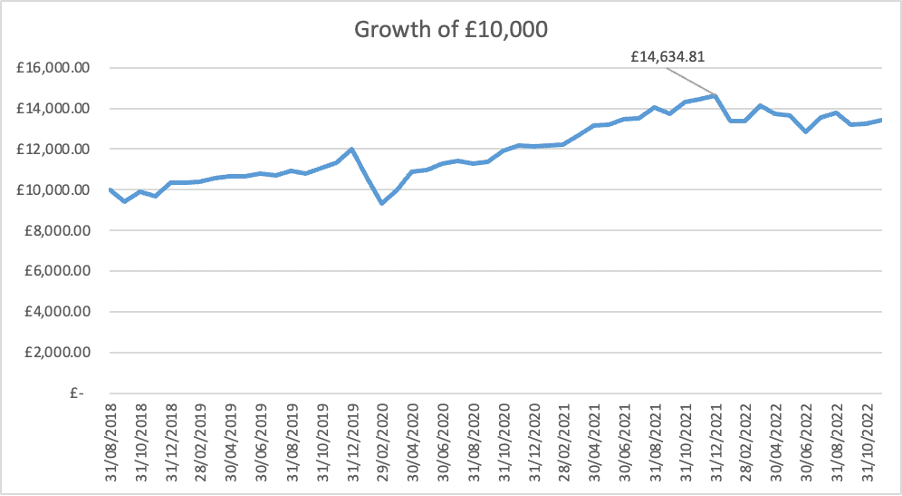

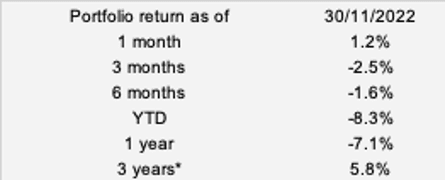

This month has been a poor show really, but the markets have been slowly rising again and with that, so have my investments.

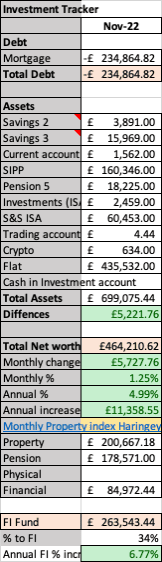

My investments have risen by £5,221, which is great and brings me back to levels not seen since… August 2022. It has been a rollercoaster of a year with the bear market and all.

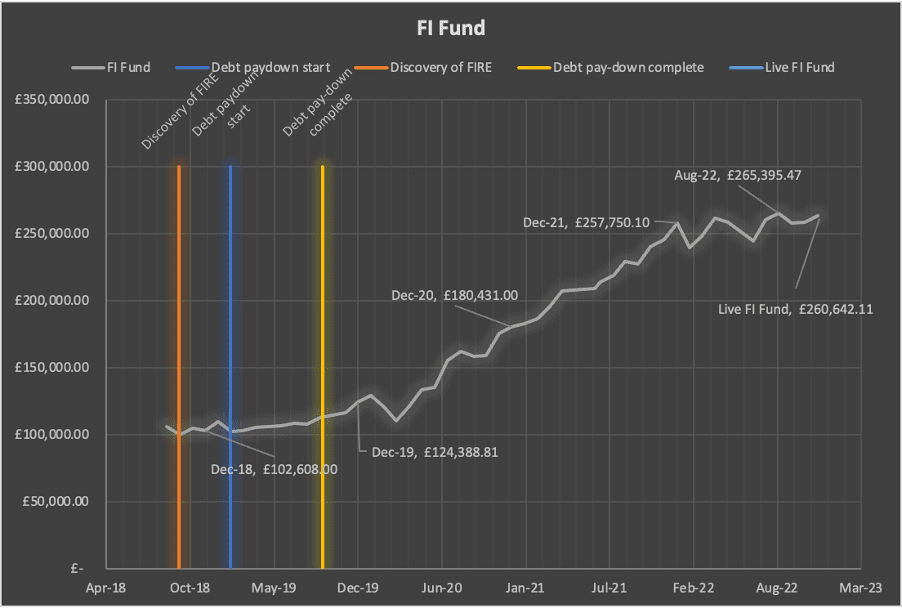

My FI fund is up this month overall, but as we approach the year end, it feels like after investing nearly £24,000 that I should have more to show for it. I’m up only £3000 since December 2021. I have to keep the faith and keep on investing.