It has been said that we are our own worst enemy. There are certain things that we do that are self-destructive or not in our best interests. I’ve done more than my fair share of self-destructive behaviours to that effect. They have ranged from dating toxic people, spending far too much money, and drinking too much. Alarmingly, over the last few months, I’ve noticed another issue popping up. I’ve become obsessed with wanting to own a car.

Those who avidly read this blog will undoubtedly know that I am a petrol head and love cars for the engineering beauty (I’m an engineer) and thrill that a powerful engine can give. I once owned a powerful car but sold it as I had no practical reason to own it. I live in central London and (used to) commute by bike or tube to work so had no ‘work’ need for a car. Now I’m mainly working from home, so that need is still zero. I can do my shopping on foot (parking is a nightmare, so it’s quicker to walk). If I need to drive somewhere, I can hire a car from a car club in the street nearby.

In the earlier stages of FIRE, I wanted to get rid of all my debt and build up my emergency fund and investments. Having a flash car was not helping that process. After much umming and ahhing, I bit the bullet and sold my beloved BMW. As the total cost of the vehicle was about £450 a month, getting rid of the car meant a substantial boost to my savings rate.

The fact is that since selling the car two years ago, my savings and investments have gone from £105k to £230k. I can’t attribute the gain to not owning the car. It is more due to the overall mentality of saving and investing regularly and consistently. Large market gains also greatly assisted. Also, not spending money frivolously has been vital. Not owning a flash car is undoubtedly part of that process. Also, not having a debt to pay and having a decent emergency fund has helped give me a solid financial base to save and invest.

Recently, the pull of the big shiny object has been strong. Whether that is due to the strange semi-lockdown limbo, we are all feeling now (and the accompanying boredom). Or perhaps it is due to a yearning for the freedom (possibly because of the said semi-lockdown limbo) that a car gives to get away from it all. I do not know, but the desire in me is strong.

I have been obsessively looking at cars on Autotrader for weeks now. I have also realised that I can afford any vehicle I would ever desire if I wanted to buy. The affordability of car finance, even on a brand new car, makes all these things tempting.

I got to the point of phoning a car dealership and getting them to give me a finance offer which was well within my spare cash.

The only thing is that the cash isn’t spare cash. It’s money I have allocated to trying to max out my ISA. So, if I bought the car, the entirely possible dream of filling my ISA this year would never be.

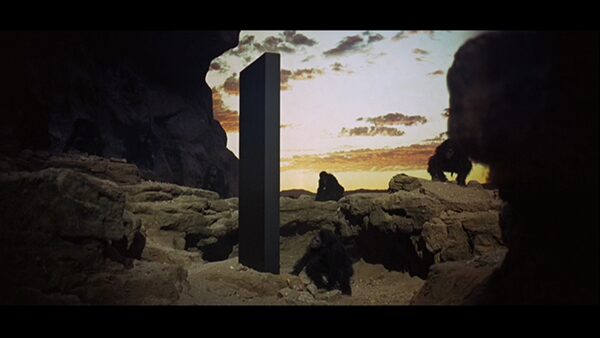

Also, having a more significant proportion of my income allocated to paying debt down instead of investing is self-defeating. See above on the investing success since I paid off my debts. It would be self-defeating to put myself back into a position from which I worked so hard to free myself. However, my chimp brain is not that smart. It only sees the shiny object, and much like the apes in 2001: A Space Odyssey being drawn to the monolith, I am drawn towards the lovely shiny car, even though it is a wrong move.

Let me review some of the arguments I’ve been making to myself to support this poor decision.

First, I’ve got to live a little and enjoy my life. It’s a common argument that I see made as justification for people spending money foolishly. Ultimately it doesn’t make any sense. I already do enjoy my life. If I am not enjoying my life, it is due to things outside of my control, such as the pandemic. That is nearing an end now, so I hope that things will improve. Owning a car will not enhance my life as I can still do anything I need a car for by using a car club. However, chimp brain thinks owning a car will make me enjoy my life by having it sit in the car park for 99% of its existence. Logic says no to car ownership.

Second, I can afford it. True, I can, but doing so will cause me to fail to achieve other goals. The temporary good feeling I will get from buying the car will fade, and the reality that I will have so long to pay off the debt will sink in. I will then not enjoy the car as I have the debt. I have set out to become wealthy, which is hard. It is easy to buy a car. Owning a car will be detrimental to the wealth goal.

Third, because I deserve it. In fairness, I am not making this argument, but it is one I’ve often heard people make to justify splurging money. I like to make this argument when I’m spending £200 on a nice meal out for myself and my Fiancé. It is ridiculous to make this argument for getting £30k into debt and paying £600/month for 48 months. What I don’t deserve is being up to my eyeballs in debt.

In summary, I’ve defeated the most common arguments I am making which were buying a car to enjoy my life more, because I can afford it, and that I deserve it.

The arguments against it are many and convincing. The first is the debt level. I simply don’t want that level of debt against my name again. I feel free-er and better for not having it. Second, the tax, insurance, maintenance expenses, and not to mention petrol. All costs I do not have presently and costs that would eat into my savings. Third, the second-hand car market has gone insane lately due to the pandemic and computer chip shortages. Used car prices are up 15-25% in the past year. This is not a sensible time to buy a car without a trade-in, which would have increased in value.

Now that I have systematically used logic and reason to make my mind up, I need to accept that in some ways that the desire to have this car is never going to go away. I can’t keep bashing it with logic and hope it will not raise its ugly head. Humans are irrational beings and I must accept this. I’m concerned this is verging on mental illness at this point.

I am going to make a plan to save cash and buy an affordable car in cash. Perhaps I could allow myself a small low-interest loan which I would pay off quickly to top up the amount I have saved if my patience runs out.

I will also have to accept that the owning a car desire will have to wait, and topping up my investments will be slower whilst I am saving.

I have already set up a pot in my Monzo bank account for saving for a car. The amount for the car is already at £6000. Proof that saving is effective.

I just need to wait a few more months and not give in to temptation. I think I will get a car for around £15-20k. At a stretch, £25k. But my rule must be to have at least 50% in cash.

I will also add that if I am to own a car, it will be one that I will feel happy owning. I cannot buy an old beater. I’ve owned too many beaters in my time, and I’m too old to put up with the stress of guessing if it will complete the journey or not. I have broken down on the motorway before, and it is not fun, and that was when the UK had hard shoulders on its motorways.

Other than the above reason, not giving in to irrational temptation (getting a car on a huge loan) is critical. I will attempt to balance my wants and needs as I know there will always be a level of temptation which is reasonable. So why not accept that I will always want this and budget for it?

I’d love to hear about your own struggles to control spending in the comments below.

That post struck a chord. I’m fired. I had to buy a car this month, to replace my non-ULEZ one. I narrowed it down between a 2006 Saab 930 convertible, and a 2013 Touran. Big contrast. Aaaand ….ended up getting the Touran as it’s main use is a transport wagon for oldster relatives. But the Saab made my heartstrings throb. So I can empathise with the desire.

That said, I wouldn’t get a car over 10k. Many great old cars now available in good nick due to high road tax on big engines, if you like those and I think you do! No need to get a beater. Best of luck matey.

BTW Saab still available here https://www.hamiltonscarsales.co.uk/used-cars/saab-9-3-2-0-t-linear-2dr-202108045847816 ….

Being sensible is so difficult when it comes to cars! Love the Saab. Such a shame they stopped making them. You’re also right about the cars under £10k. I’m sure if I look hard enough I can find a good one.