It’s June already. We have seen a new King crowned, three bank holiday weekends, and a general feeling of doom and gloom surrounding interest rates in the month of May.

We have had quite a few busy weekends visiting friends, going out for dinner, and enjoying life after my month of work hell. We did a great walk in Abbey Wood, which we accessed on the Elizabeth line in no time. There is a fantastic old woodland there which feels like you are in the countryside (until you pop out in Bexley Heath). Well worth a wander.

I’m still sober and have been drinking alcohol-free beer as a substitute. It’s now over 5 months since I’ve had a proper drink. I occasionally have a craving for a drink but have learned to avoid this. Feeling good and happy to continue the sober life for a while. Apparently my dopamine levels have just about normalised after 5 months. First time in 25 years in my case then.

We had a great meal out at a Gordon Ramsay restaurant to celebrate our anniversary (of our first date rather than our wedding). It was great and made even better, because the AMEX Platinum card dining credit covered it. This is where you can spend up to £150 at a restaurant, which is refunded to your card. As we weren’t drinking alcohol, this was enough, even in an expensive restaurant.

I have also been looking for hobbies to do in my free time. One such hobby has been making a Murphy bed (a fold-away bed). After looking at various YouTube videos of Americans making Murphy beds, I reverse-engineered the design to fit my spare room. This has not been a cheap undertaking. I have spent roughly £650 on wood alone. However, I’d imagine to get a similar product off the shelf I’d be paying £1500. A custom version like mine would cost even more with the day rate of a carpenter being around £350/day.

Mortgage

After the news that the Bank of England raised interest rates again, I decided to lock in my mortgage deal for 2 years pretty quickly. I had waited mainly because I was too busy to sort it out and think about it. Unfortunately, in this climate, that cost me some money. Even that short wait resulted in a slight increase in the rate I originally quoted from 3.94% to 4.1%. With the headlines this morning about banks cranking up their rates over the weekend I’m now glad I didn’t dilly-dally any longer. It means approximately £400/month extra. Not good but could be worse with rates now all above 5%.

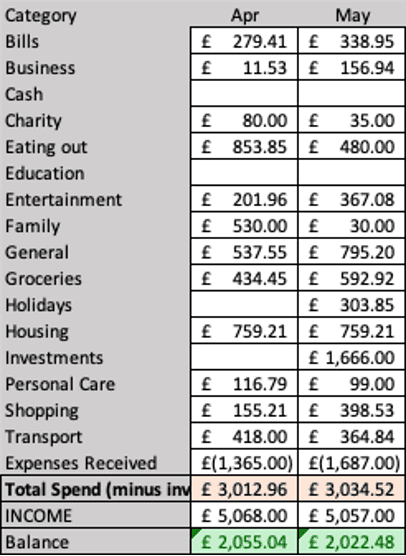

Spending

This month was a little spendy. I bought lots of wood and tools for my Murphy bed construction. I also spent a lot on travel too. This was due to a few train journeys out of London which is always pricey. I have also used Uber quite a lot. This has been a deliberate lifestyle inflation choice simply because I decided I’m too old to get public transport home late at night.

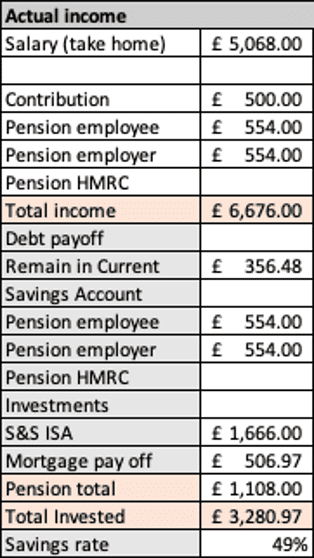

Savings

Another month of nearly 50% savings rate. This is the reason I am deciding to spend more as I think this is more than adequate.

I discovered that my company, without instruction from me, has reset my pension contribution to 7%. It was previously at 10%. I’ve no idea why they did this. I may ask them to increase it again. I had previously limited the amount because my calculations said I was likely to hit the lifetime allowance, but seeing as that has been abolished, there is no problem anymore.

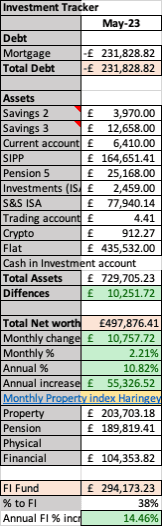

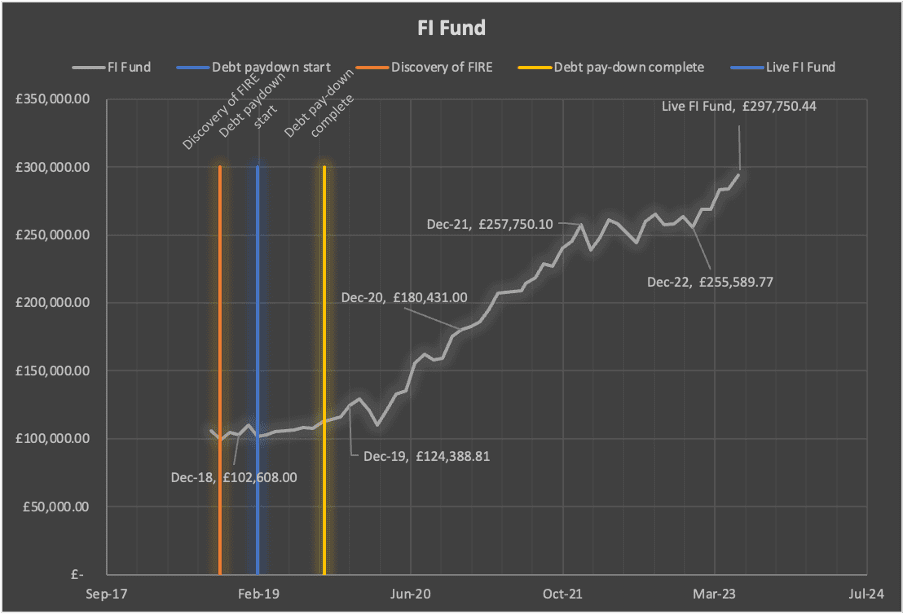

Investing

My FI Fund has taken off this month. It’s up £10,251 in the month up to £294k which means the £300k milestone is within reach. This is due to the excellent market growth in the S&P 500. My stocks have been unstoppable this month. I am still nervous about a pull back, but it is very encouraging to see growth again. Some are saying this may be the start of a bull market. Others are saying it’s a false peak. Let’s hope it’s the bull market. If it is, it will make all those dreary months of investing without joy worth it.

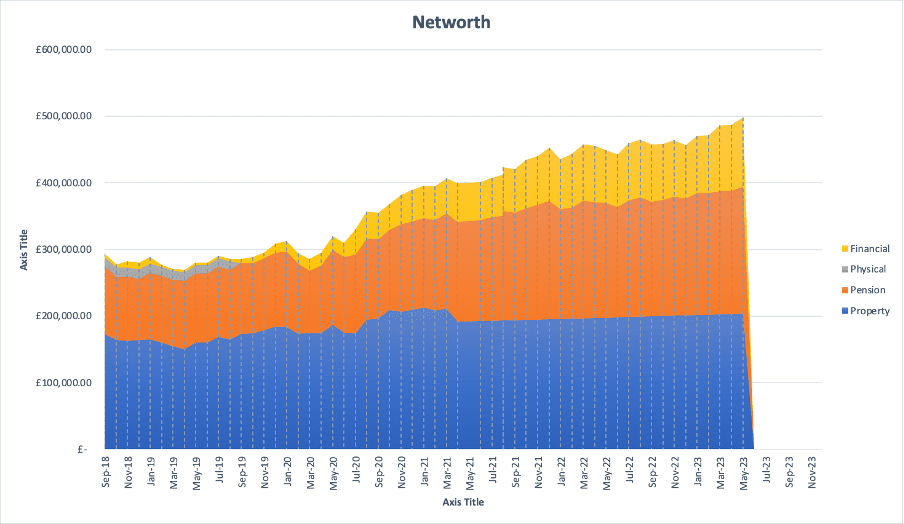

My net worth also broke through the £500k market for the same reason. I must admit this was a surprise after such a long time. It feels good though.

That’s all for now. If you’ve read this far, please leave a comment. I promise I will reply!

Brilliant progress. You seem to be going from strength to strength.

Well done on the 5 months sober free too. I am 7 years sober now. I made the decision before the birth of our daughter and it’s the best decision I ever made. I am completely present everyday.

Do you have a specific FIRE goal or plan? For example: Would you consider contracting once you get to a specific level of wealth which in turn may even increase your earning capabilities?

Always look forward to your posts so keep writing 🙂

Hi Ryan, good to hear from you again and thanks for your kind words. It’s good to finally feel like progress is being made (both in fire and in life).

I don’t have a specific plan. I was super keen on FIRE until I was on furlough in the pandemic and found that I didn’t enjoy being at a loose end as much as I thought!! i also switched into a new field so have been spending time learning that. It helps that I enjoy that work far more than previously which was motivation me to FIRE. Once I start getting my own work in the door I will look to setting up on my own. I suppose I was looking to get to a wealth level where I can comfortably set up my own company.

I think having the option of leaving work is appealing.

Great update. Have you given any thought to moving your savigns and investment approach away from your S&S ISA to over-paying on your mortgage now that interest rates have spiked (and appear to be likely to stay high)?

I fixed at the perfect time on a 5 yr fix at 1.25% until Sept 2026 – by then I’ll have enough in my S&S ISA to pay the mortgage off – and assuming that interest rates are in the >5% region will be really tempted to get it paid off……..

Thanks! Overpaying my mortgage might be a sensible idea if I owned a freehold property… unfortunately I “own” a leasehold property. It’s too big a risk to lock my money into that. We’ve had some serious problems with sales falling through in our block. Luckily no cladding issues. I view my ISA as my alternative strategy and maybe even my future house deposit if I can’t sell my flat. Probably won’t need to do that but I’m enjoying having the liquidity.

Good job on fixing your mortgage. I wish I’d done that 2 years ago!